Drilling Down on Disposal: Parallels Between Produced Water and Municipal Waste Disposal

WaterBridge and Secure Waste Infrastructure Corp.

The recent IPO of WaterBridge is shedding light on the produced water industry, an industry that I wrote about in my previous articles on Secure Waste Infrastructure Corp. (“Secure”) (1, 2). One theme in these articles is that the attributes of Secure, and now WaterBridge, are akin to that of municipal waste companies, which trade at higher multiples. Secure and WaterBridge are trading at ~10x and ~11x 25E EBITDA, while the leaders in the municipal waste industry are trading in the mid-to-high teens. Given the lower amount of maintenance capex required for produced water companies relative to municipal waste companies (no garbage trucks in produced water!), the trading discount is even more pronounced on a FCF Yield basis. Secure is trading at ~6.9% 26E FCF Yield with the waste companies trading in the mid-to-high threes; WaterBridge will be burdened by a lot of growth capex over the next couple of years, so this metric is a bit less relevant for them. It is not surprising that produced water companies trade at a discount to their municipal waste peers. Secure is viewed as an energy services firm and WaterBridge is viewed as a midstream business. However, the attributes of produced water businesses are quite similar to that of municipal waste companies; frankly, produced water companies have better economics, but we will get to that later. I am not the only one that has noticed these similarities. The management of Secure has changed the company’s name from Secure Energy Services to Secure Waste Infrastructure Corp. to highlight this point. More telling is that the management of Waste Connections (“Connections”), who obviously see the same parallels, has made several acquisitions in the produced water space. Let’s explore the produced water space and why waste multiple makes sense for them. Before we do, note that I’ve written extensively on Secure in the past, so while Secure will often come up, there will be more discussion of WaterBridge in this article.

Produced Water, What is It?

When an oil and/or gas well is fracked, the fracking fluid (injected source water) that returns to the surface is known as flow back water. This will need to be handled, transported, cleaned, and disposed of. The volumes of flow back water is driven by new drilling activity, which is correlated to oil prices. Once a well is fracked it enters the continuous production stage of its life, where it produces oil and gas, water, and sand (www.scuttleblurb.com has an excellent description of this in his write up on Secure). The water in this state, while it may contain a small amount of flow back, is mostly formation water that was seawater buried with the organic materials that produced the hydrocarbons. The water-to-oil ratio that is produced by a well is called the “water cut”. The water cut of the Delaware Basin is ~80% (4 barrels of water for 1 barrel of oil). In the Midland Basin it is ~74%. It’s worth noting that water cuts can be localized, with some areas in the Delaware Basin being as high to 10:1. Also, anecdotally, it has been observed that the water cut increases as a well ages and declines set in. This latter point gives the industry natural organic growth, even if oil production stays flat, the amount of water increases. When water flows from a well, the oil and solids are separated from it. The recovered oil is sold, and the solids are taken to an industrial landfill (note Secure and WaterBridge own industrial landfills). The remaining water can be re-used in the fracking process, though more water is produced than can be used in this manner, and the excess water is transported to and put into a saltwater disposal (“SWD”) well.

Pore Space and Flow Assurance

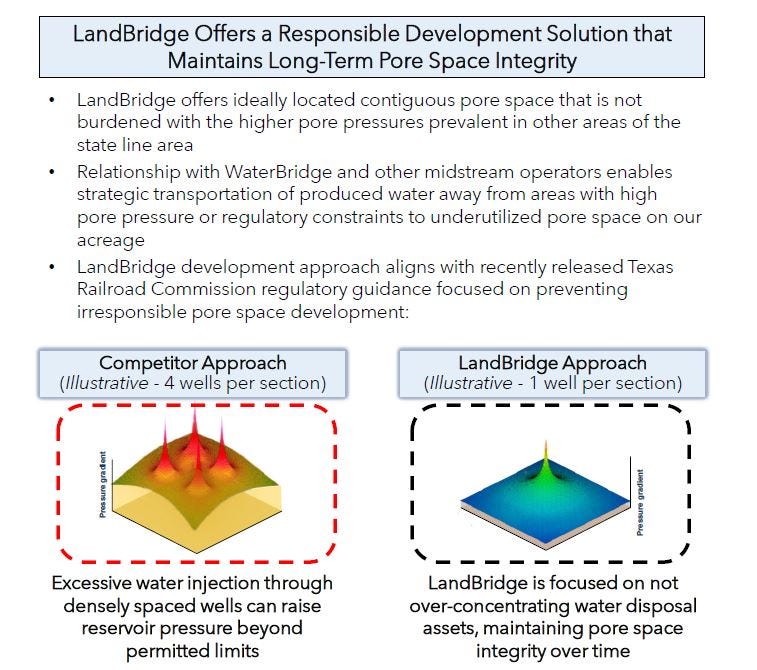

Initially, the industry disposed of produced water in deep wells located below the hydrocarbon bearing shales. Although, deep injections contributed to seismic events and the industry shifted to shallower disposal wells (above the shales). In order to have a shallow SWD wells you need suitable geology, meaning suitable permeability and porosity. WaterBridge management believes that if you under pressurize (compared to industry practices) your shallow SWD wells, the pore space can last a longtime. You are also less likely to experience a surface blow out or interfere in the oil and gas drilling of neighboring properties. The rest of the industry seems to have over-pressurized their shallow SWD wells, which has led to both environmental issues and legal claims over interference with oil and gas activities, as noted in two recent Bloomberg articles (3, 4). Fast forward to today, having incremental pore space is important, but it needs to be in the right location. Transporting water is expensive and the farther it travels, the more likely that it crosses someone’s property. Each new property the water crosses is an opportunity for a property owner to extract a toll fee (“easement”). Cross enough properties, and the toll fees could be prohibitively expensive to transport water to incremental pore space. Ergo, having pore space in the right location is important.

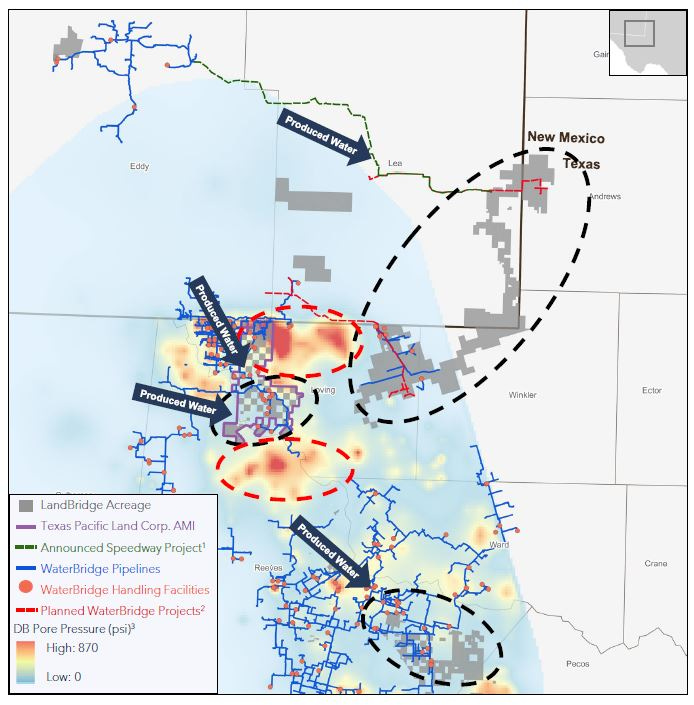

The below pictures are from LandBridge’s (5) Q2 25 earnings slides that illustrate this point. The first one explains the WaterBridge low-pressure approach and transportation abilities. Note: LandBridge is a publicly-traded sister company to WaterBridge. They own the land that has the pore space. Think as WaterBridge as the garbage collection assets (trucks and routes in the municipal waste space) while LandBridge owns the landfills, which WaterBridge pays a royalty to utilize.

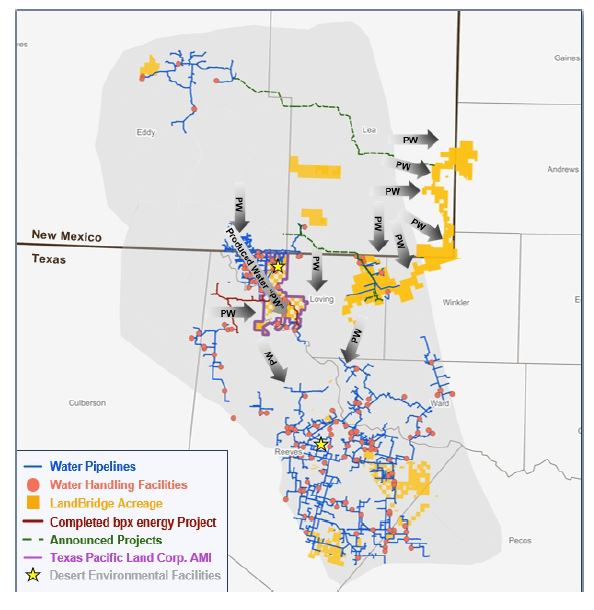

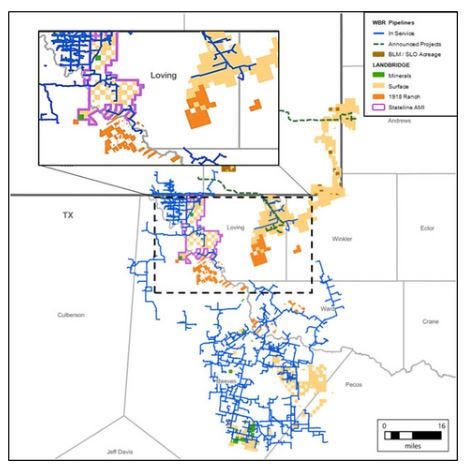

The second picture (map) is more interesting. First, notice how the water flows. It flows to the east and to the south. It also flows out of New Mexico, a state that has an onerous SWD well permitting process that often exceeds 2 years, if the approval is received at all. Second, notice the areas shaded in red. These areas are areas with excessive pore pressure, which, consequently, have limited to no incremental pore space (6). Third, notice the path water would have to take in order to reach incremental pore space (pore space that would be south or east of existing state-line pore space). Starting on the right side of the map, the area west of the Texas Pacific Land Corp. (“TPL”) AMI is burdened with seismic activity, so there is likely not a path that direction. Moving to the TPL AMI, that’s controlled by WaterBridge, so you are not getting a path through there – not for free any way. Continuing west, you have the over pressurized area (11), that is mainly one large ranch. While there is limited incremental pore space on the ranch, one could cross the ranch, but not for free. Next you have an area with low pressure. This is a ranch that has no SWD wells on it. I don’t see that ranch opening incremental pore space any time soon, but one could presumably cross it for a price. Next, you have Landbridge property that extends from Loving County, into Wrinkler, then north into Lea, and Andrews counties. Operators seeking passage through LandBridge property would be required to pay a toll. Furthermore, should LandBridge/WaterBridge need to purchase incremental pore space to the south or to the east of existing properties, it should be easy for them to tack on additional space, space that their existing land blocks access to for other operators. In fact, LandBridge did just that on October 7th in their 1918 Ranch and Royalty acquisition (8), by purchasing pore space that was near, and in some places contiguous to, their existing pore space. Notice in the second map below, how easy it is for WaterBridge to access the newly acquired pore space (shaded in orange) and how hard, meaning expensive, it would be for competitors to access this pore space.

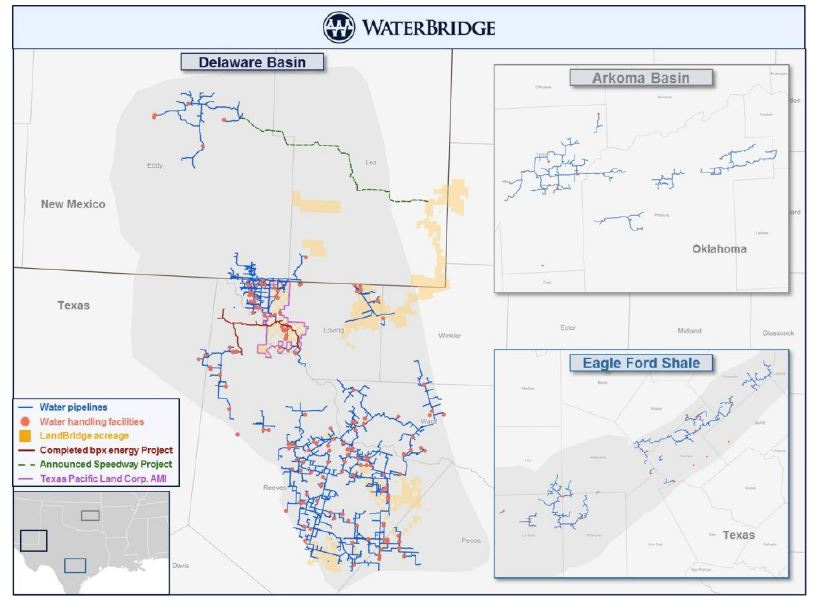

The next map is a more granular look at WaterBridge’s network. What is key to grasp both the scale of the pipeline network as well as the ease of connecting various parts of the network such that water has multiple pore space sites available to it. Having the combination of pore space (through LandBridge) and a network that gives multiple pore space options to producers provides producers with flow assurance. Producers have a waste stream (produced water) to get rid of. If they cannot get rid of the water, then production stops. Flow assurance is their comfort level that a counter party can dispose of the produced water for a long time. Flow assurance comes from having the combination of incremental pore space and redundancy in your network. In their recent BPX and Speedway projects, WaterBridge received 10 year contracts at premium prices (BPX around $0.90/bbl and Speedway around $1.00, where competitors were offering contracts in the mid-sixties). They were able to do this because of their ability to provide flow assurance.

It is worth noting that in the Permian, large E&P companies initially handled their own water. But, as seen in the above picture, of WaterBridge’s network, this is an industry that lends itself to scale. Furthermore, if not having a solution for your wastewater causes a shutdown, a water business owned by a major E&P company could provide minimal flow assurance to small operators that are their neighbors, as if pore space became limited, you know who would get production curtailed.

Parallels to Waste

I have owned positions in either Waste Connections and GFL for several years before initiating a position in Secure and now WaterBridge. It was my experience with GFL and Connections that helped me to recognize that municipal waste and produced water companies have similar attributes. Below are their similarities:

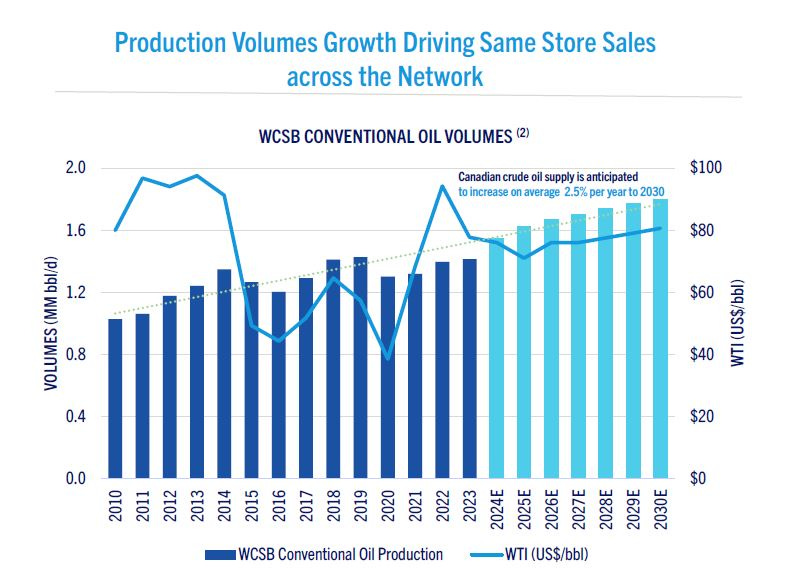

Recurring Revenue Nature: Municipal waste’s contracts are typically one to five years and feature CPI escalators. Municipal waste’s volume are stable in nature. If you look at WaterBridge, the majority of their contracts are 10 – 15 years with escalators. WaterBridge’s newer contracts are minimum volume contracts (“MVCs”), which further enhance the recurring revenue nature of this business. Contracts underpinning Secure’s recent growth initiatives have similar downside protections. Because the oil price question always comes up, I would point out the following. First, declines in new well drilling activity lowers the ability to dispose of produce water by recycling it as frac water. Second, ongoing production will still occur, and water cuts grow over time. Third, WaterBridge operates in the Delaware Basin, which has the lowest break-even producer economics in the Lower 48 states. The perception is that the revenue stream is overly tied to new oil and gas development, but the revenue is likely to be much more recurring than the street is giving it credit for. Secure has a nice chart that illustrates this point (see their July 25 investor slides). Lower oil prices, for a short while, are probably good, as it should help to prove the above points.

Landfills and Pore Space: Go back to what these companies do. They separate oil, then solids from produced water. The solids are put into landfills. The parallels do not get any clearer than that. Landfills are highly regulated and suffer from nimbyism. Usually, you have one in a given geography. Pore space seems to have some similar attributes as landfills. If you look at Secure, where the industry is consolidated, the geographic dominance of players is evident – just look at the findings of the Canadian Competition Tribunal (7). Much, but not all, of the liquids that Secure processes are transported to Secure via trucks as opposed to pipelines, so proximity to oil production is paramount. The liquids WaterBridge processes, on the other hand, are mostly transported via pipeline. Proximity is less of an issue, per se, but what is important is the route the water takes from oil well to disposal well and the amount of toll charges it incurs between the two wells. Every time you cross a property line, there is an opportunity for a landowner to charge a toll. A small number of tolls are fine, but too many would make transporting water prohibitively expensive. Furthermore, both Secure’s and WaterBridge’s SWD wells are highly regulated. The combination of high regulations and logistical constraints make SWD wells look like municipal waste landfills when it comes to being advantaged from both their geographies and regulations.

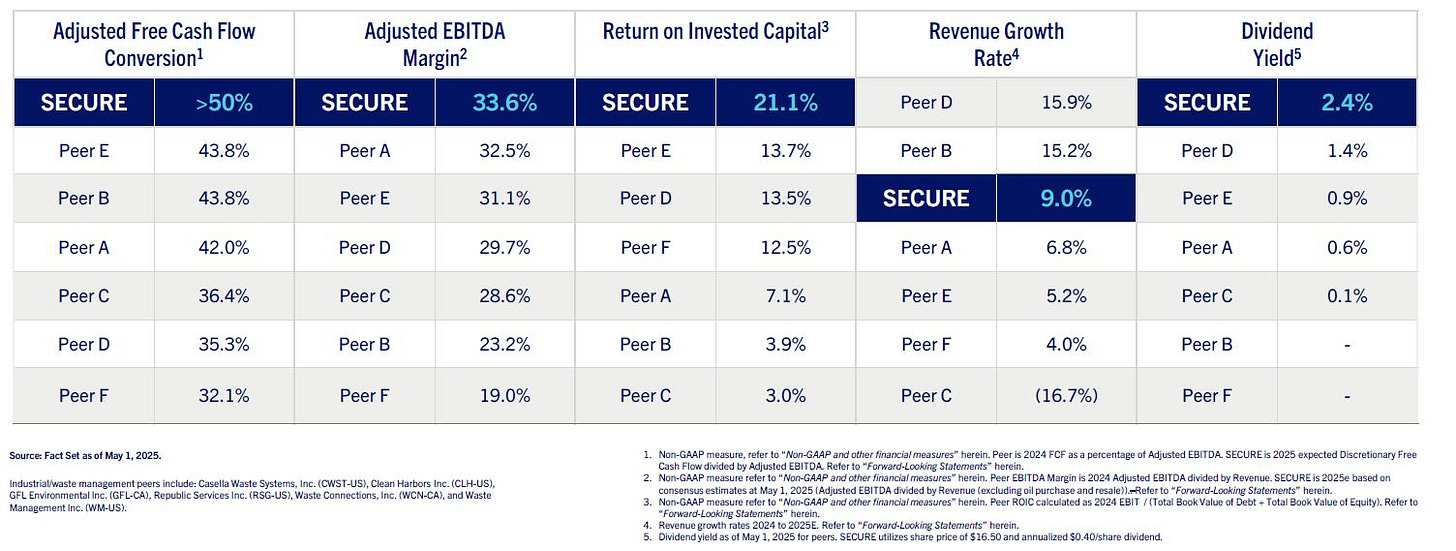

Margins: WaterBridge (S1) has EBITDA margins in the low 50s. These include some younger and under utilized businesses. Steady state, these margins are probably in the low 60s. Also, its worth noting that, unlike Secure, WaterBridge pays a royalty to its sister company LandBridge for use of LandBridge’s pore space. The margins would likely be even higher if these businesses were consolidated (as a LandBridge shareholder I am happy they are not!). In the chart below from Secure’s July ’25 investor presentation, Secure provides their EBITDA margins as being 33.6%. Alone, that is impressive and better than their waste peers. However, it’s worth noting that this is a consolidated number for Secure, which includes its infrastructure, transfer stations, metals recycling, and chemicals businesses, all of which have EBITDA margins far lower than that of its waste processing and landfill businesses and is dragging lower the consolidated 33.6%.

Returns: The ROIC for Secure in the above chart show the ROIC at 21.1%, on top of its waste comp set. That said, my diligence indicates that Secure is deploying new capital in the 20s, with the ability to scale up the projects and increase the returns. My diligence on WaterBridge indicates that it is deploying incremental capital north of a 30% return (EBITDA to Gross Investment) on new projects with additions to those projects generating much higher returns. It makes sense that the returns for produced water companies are superior to that of pipelines. Pipelines can have other pipelines to compete against, so the ROICs can be driven down to the cost of capital. Produced water businesses can get themselves in regional oligopoly and local monopoly positions given their landfills and pore space. This leads to higher ROICs and growth opportunities. It also makes sense that they companies have higher ROICs than municipal waste companies, as they have no garbage trucks to constantly maintain and replace.

Why Do These Opportunities Exist?

Let’s set aside concerns about falling oil prices, as I spoke about those in the recurring revenue attribute section above. Also, WaterBridge’s IPO has been :successful in the current oil price market and Secure has been undervalued for a long time, including when oil prices were much higher. It’s helpful to look at the two businesses separately.

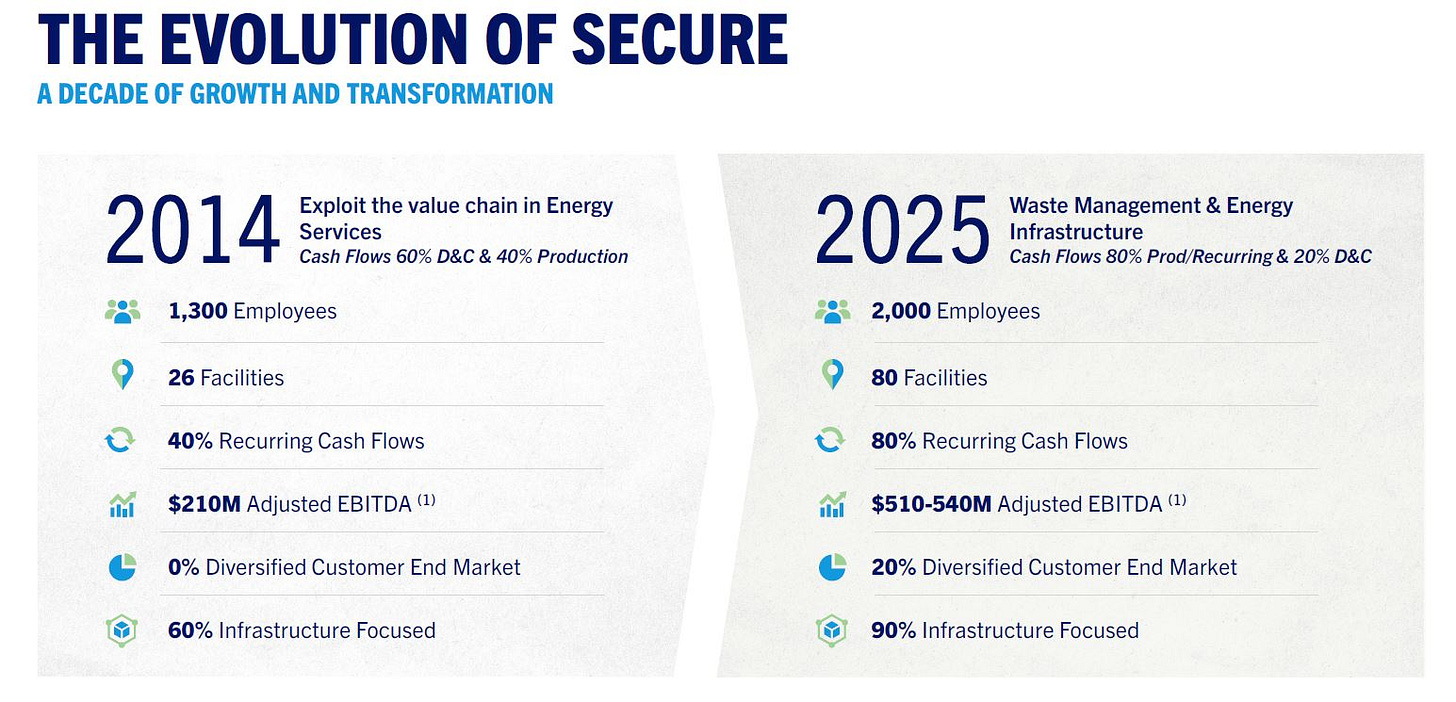

Secure

Secure was originally called Secure Energy Services, it only recently changed its name to Secure Waste Infrastructure Corp. (See my two previous articles on for more color 1, 2). Prior to the oil price collapse of 2015, around half of Secure’s revenue was tied to new drilling activity. Additionally, the sellside analysts who covered Secure were all energy services analysts. These sellside analysts comped Secure to energy services firms. Post 2015, the company greatly reduced its exposure to energy services activities and increased its exposure to its waste activities, as evidenced in the below slide which shows recurring cash flows from those to periods increasing from 40% to 80%. Additionally, Secure changed its name and is in the middle of transitioning its research coverage from energy services analysts to waste analysts, or at least general industrial analysts. Secure was early in recognizing the parallels between produced water and waste businesses. While its trading multiple has expanded greatly in the last couple of years, it is still well below that of municipal waste companies.

WaterBridge

As noted earlier, WaterBridge recently became public. The are some other public companies in the US that focus on produced water; they are lesser quality in my opinion due to their inability to provide flow assurance to customers, as they have less incremental pore space available and may be held captive to the surface easement procurement process. These companies have been historically covered by midstream sell side analysts and comped to gathering and transportation assets. US investors are used to viewing these companies as midstream assets, but with better growth and returns. Consequently, when WaterBridge’s management hired bankers to manage its IPO process, they hired the energy team, and their IPO documents were drafted with that view. That said, WaterBridge’s management is savvy, and they certainly understand the parallels between waste businesses and WaterBridge. I expected, maybe hoped is a better word, that the sellside analysts would discuss this in their initiation reports, given the success Secure has had with transitioning its sellside coverage to waste analysts. As of October 15th, eleven banks initiated coverage on WaterBridge. I have read eight of the eleven reports so far, and not one of the reports I read mentioned WaterBridge’s waste parallels. The reports that I read were all fine and did excellent jobs of telling the story, but they just did it from a midstream perspective, and they comped WaterBridge to midstream companies. I suppose this is not surprising given the analysts are midstream analysts and probably look at the company under that lens. There could also be institutional pressures at the analysts’ banks. I can see how if they focus too much on the waste parallels in their reports, they could be seen as stepping on the toes of their waste analysts or be at risk of losing coverage to their waste analysts. The fact that Secure is transferring their coverage from energy services analysts to waste analysts is likely in the back of the minds of WaterBridge’s new analysts. Also, midstream analysts may view their customers not as investors in general, but as midstream/energy investors.

Outside Validation of the Waste Thesis

So far, you have the management team of Secure talking about the waste parallels and the management WaterBridge likely poised to do the same thing, but they want the juicy waste multiples, so you could argue that they are conflicted. You have a handful of Substack authors making the same argument; I would say they are smart, but I am obviously biased. I think the best validation comes from within the municipal waste industry itself, as Waste Connections spent real money across multiple transactions over a long period of time in this space. The first acquisition that Connections made in the sector, to my knowledge, was its $1.3B acquisition of R360 Environmental Solutions in 2012. Connections paid 6.5x EBITDA (9) while their stock was trading at ~7.1x NTM EBITDA. Since 2012, the multiples for municipal waste expanded, while that of produced water companies did not. In 2024, Connections bought assets from Secure for 7.0x EBITDA (GFL was also a bidder but had its own leverage issues to deal with, which inhibited their ability to be a serious player in the process). Granted this was a sale forced by the Canadian Competition Tribunal, so probably not a true market price. Lastly, private equity firm Golden Gate Capital sold Stonehill Environmental Partners (10) in March of 2024. While Connections name is not in the press release, two of my contacts have told me that Connections was the buyer. Municipal waste companies obviously have an interest in the produced water space. Likely, because they see a business with similar moats, but with better margins and returns. As it gets harder to roll up the municipal waste sector, I would imagine that increasing exposure to produced water will become more attractive to municipal waste players. As the percentage of produced water revenue grows as a part of the municipal players total revenue, either the produced water companies’ multiple will be drug up, or the municipal players’ multiples will be drug down, or a combination of both - I am obviously betting that produced water multiples will go up.

Opportunity Going Forward

The way I look at both Secure and WaterBridge is that there is ample growth at each company. Each of them should be able to grow their per share FCF at least at a 15% CAGR. So, there’s money to be made on the FCF growth alone. Where it gets interesting is if these companies re-rate to a municipal waste multiple. Secure has been beating the municipal waste drum for a while. Their message is starting to get out as evidenced by several Substack articles on it and the transition of their sellside coverage. But it is a Canadian company, and perhaps not yet looked at by the broader US market. It will be helpful to have WaterBridge’s management beating this same drum, and my gut tells me they will.

Upcoming Catalysts

Secure bought back 19% in 2024 and will likely buyback north of 10% this year. Furthermore, Angelo Gordon recently sold a large block of stock, which reduces the sponsor overhang at Secure. Perhaps some well known investors where buyers of the Angelo Gordon block, and that brings attention to the company once they buyers become known. Additionally, Secure does not screen well as it is forced to recognize the pass through oil revenue and cogs in its pipeline business. I made the case that they should sell a controlling stake in the pipeline business in my second article as a way to address this, but the company could also address this issue by challenging this accounting practice with their auditors. Given that Secure was the first mover of the waste thesis in the space, and the transformation the company has undergone, it would be appropriate for management to have an investor day to take credit for their success and to teach investors about their business.

WaterBridge has 6MBbls per day of incremental pore space, without factoring in the additional pore space LandBridge acquired via the 1918 Ranch transaction. At $1.05 per barrel, that equates to ~$1.4B to WaterBridge in annual EBITDA and ~$360M to LandBridge in annual EBITDA (for each, this assumes no LB royalty rate changes). It will not surprise me over the next couple of years to see a steady stream of large projects/contract announcements from WaterBridge. With each one, the consensus estimates should be ratcheted up. Additionally, the concepts of pore space and flow assurance, which are relevant to both the valuations of WaterBridge and LandBridge, take time to understand. Now that LandBridge and WaterBridge are both public, it would not surprise me if a joint investor day were held. This would be a good development, as I am sure the WaterBridge/LandBridge management could make the waste case much better than I. Lastly, Five Point Energy, WaterBridge’s sponsor, also has a Midland Basin asset (Deep Blue) that is anchored by the legacy Diamondback Energy system (Rattler Midstream). Combining Deep Blue with WaterBridge should create a pro forma business with greater than $1B of EBITDA. Having WaterBridge being that size should increase the number of potential shareholders.

Summing it up, I believe with both companies, an investor should make money based on their earnings growth alone. It gets real interesting if their is a waste-multiple re-rate.

Footnotes:

1)

2)

3)

https://www.bloomberg.com/news/articles/2025-07-21/toxic-water-leaks-from-top-us-oil-field-ensnare-devon-dvn-in-texas-court-fight

4)

https://www.bloomberg.com/graphics/2025-permian-basin-geyser/

5)

LandBridge (LB) is the sister company of WaterBridge. It has common management, but separate ownership structures. LB owns the pore space (land), while WaterBridge handles the transportation and operations.

6)

The Texas Rail Road Commission provides permits for SWD wells, the permits cover the amount of water volume a well can take and, as of recently, cover the amount of pressure of a SWD well.

7)

Summary of the Canadian Competition Tribunal Findings (h/t: bizalmanac)

Removal of Competition. “The tribunal finds that the merger eliminated a vigorous competitor, Tervita, which was Secure’s closest rival….in the absence of the Merger, Secure and have continued to vigorously compete in Relevant Markets for the foreseeable future”. This refers to the one area where they had overlapping operations.

Barriers to entry. “The tribunal finds that there are significant barriers to entry into the…supply of Landfill, TRD (Treatment, Recovery, and Disposal facilities), and SWD services…new entry into, and expansion within, those markets is not likely to sufficient to ensure that the Merger will lessen competition.

Countervailing power. “…the Tribunal finds that customers are not likely to be able to rely on geographic leverage to prevent Secure from exercising materially greater market power than it was able to exercise prior to the merger…customer are not likely to be able to credibly threaten to switch sufficient volumes away from Secure to prevent Secure from increasing prices for waste services or reducing service levels.”

Self-supply. “…the Tribunal finds that the threat of self-supply is very limited and is not likely to prevent Secure from exercising the increased market power that it will have to raise the price of waste services, as a result of the merger. The evidence is that even for a large customer such as Canadian Natural Resources, the threat of self-supply has not actually led Secure to modify its pricing behavior.”

Price discrimination. “The tribunal considers that the evidentiary record in this case demonstrates that Secure has the ability to price discriminate based on the distance between its facilities and its customers’ locations, and that it exercises that ability when it is in its interest to do so.”

8)

https://www.landbridgeco.com/investor-relations/news/news-details/2025/LandBridge-Announces-Agreement-to-Acquire-37500-Total-Acres-in-the-Delaware-Basin/default.aspx

9)

https://www.reuters.com/article/markets/sp-cuts-waste-connections-rating-to-bbb--idUSWNA8037/

10)

https://goldengatecap.com/golden-gate-capital-completes-sale-of-stonehill-environmental-partners/

11) Red Shading Represents Over Pressurized Areas.

Helpful Podcasts:

The Business Brew

James Davolos - Liquid Assets: Water's Role in Oil's Future

Business Breakdowns

Yet Another Value Podcast

Misreading Waste-Focused $SES.TO as Energy Services

Disclaimer: Not an offer or a solicitation to buy or sell any security. For entertainment and informational purposes only. Do your own due diligence. Under no obligation to update on positions.

High quality research 10/10.

This is a really insightful framework for thinking about these businesses. The pore space angle is fascinating becuase it creates genuine scarcity value over time, especially as the more attractive disposal zones get filled up. Your point about the structural difference between WBI and SES is spot on. WBI has that Deep Blue merger optionality which could really enhance scale in the Midland Basin, while SES seems more levered to operational improvements and multiple expansion given the higher current FCF yield. What's interesting to me is how the whole Delaware Basin concentration risk might actualy be a feature not a bug. If you believe the basin stays tier one for drilling economics, having concentrated infrastructure there with high switching costs creates a real competitive moat. The waste management comp is clever too because it highlights how the market hasn't fully appreciated the recurring revnue and ROIC profile here yet.