Secure Waste Infra Corp - Hidden Compounder + A Special Situation

An Update From on My April 2024 Article

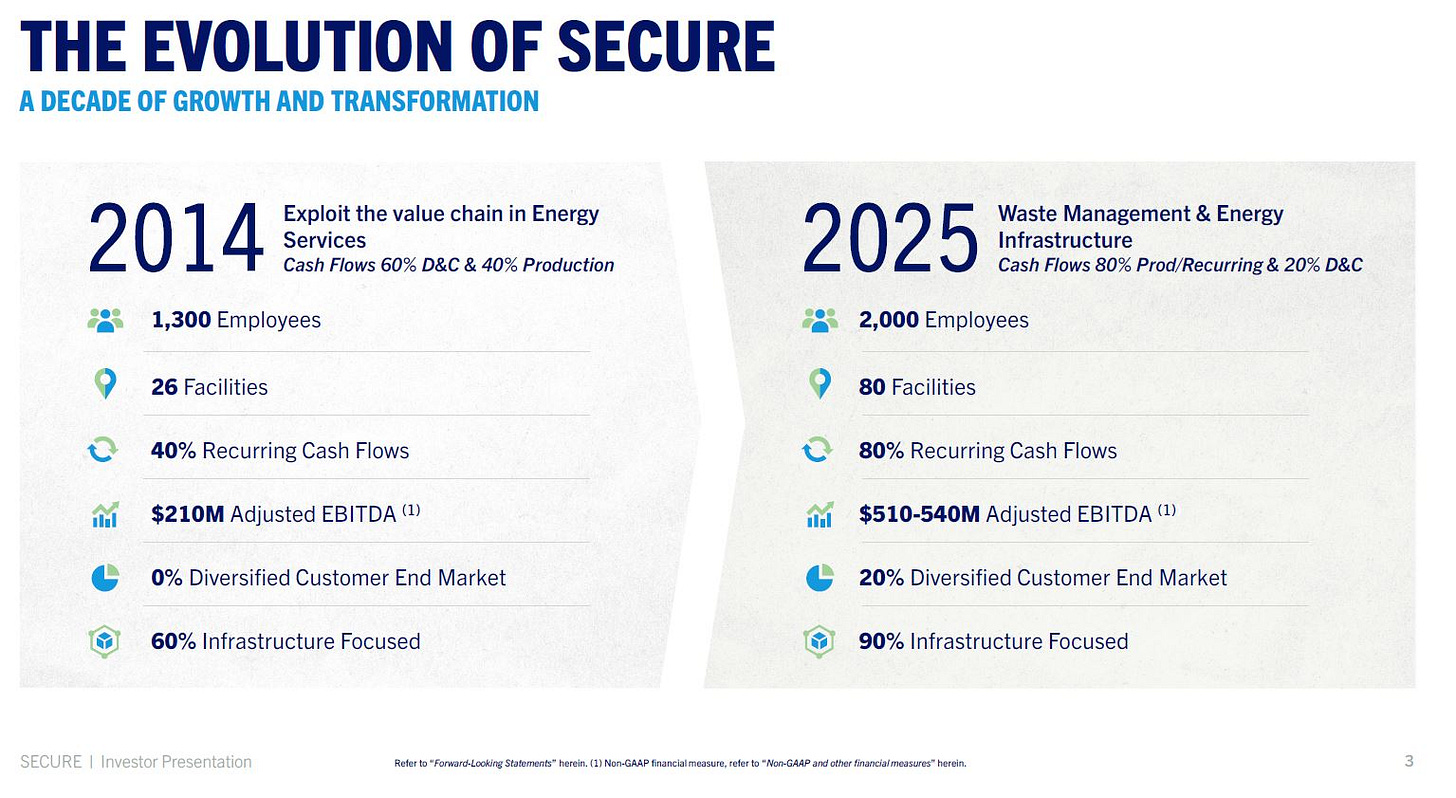

In April of 2024, I wrote the article Secure Energy Services – From Volatile to Durable Earnings (4), which discussed how the then Secure Energy Services (together with Secure Waste Infrastructure Corp. “Secure”) had transitioned from being a company that was highly dependent on new drilling of oil and gas wells to a company that generated highly-stable revenue streams. Canadian Value Stocks on Substack followed my article with one of his own that delved deeper into Secure’s transformation (3). In the summer of 2024, management began including slides in their investor presentations that highlighted this transformation. An example from their May 2025 Investor Presentation is below:

In my original article, I also discussed several catalysts that could help propel the stock price higher. These catalysts included 1) the company repurchasing its own shares 2) revamping investor communications to highlight the durability of Secure’s earnings streams 3) attracting traditional waste investors into Secure 4) changing their name and GICs Code and 5) transitioning sell-side coverage from energy services analysts to waste industry analysts.

So, how has the company done?

Repurchasing their own shares? In 2024, Secure purchased 19% of their stock. Secure foretasted (1) repurchasing an additional 8% of the company’s stock in 2025 through its Normal Course Issuer Bid (“NCIB”). On April 8, 2025, due to a sell off in the stock price because of the Trump Tariff Tirade, Secure suspended its NCIB and announced a Substantial Issuer Bid (“SIB”). The SIB was $200M, to be priced not less than $12.00 and not more than $14.50. Ultimately, $136M was spent to purchase 9.4M shares, or 4% of the shares outstanding. I assume given the company’s liquidity situation and the fact that the stock price was still cheap, that the NCIB was resumed on the completion of the SIB. Also, it is worth noting that the shareholders agree that the stock is cheap, given the unfulfilled SIB. Overall, I would rate this catalysts a success, so far.

Revamping investor communications to highlight the durability of Secure’s earnings streams. The above slide is one example of some changes that occurred in management’s positioning of Secure. Overall, their communications are quite good and worth reviewing. A link to the recent investor presentation is below (2). I would give management high marks for their efforts.

Attracting traditional waste industry investors. Capital Research initiated a sizeable position in Q1 25. RBC, CIBC, AGF all materially increased their respective position sizes. I have heard from some other waste investors who became shareholders during this time, but who are not required to, and do not, file their positions. Additionally, while not a traditional waste industry investor, it is worth noting that the renowned value shop Private Capital Management also became a shareholder. Management has had some success attracting new investors. I think this process takes a lot of time. I would give them a B-, based solely on the results thus far, but this could easily turn into an A+ quickly. For what it’s worth, I hear their presentations at various industry events are starting to be well attended.

Changing their name. Check. Secure Energy Services was changed to Secure Waste Infrastructure Corp. Changing their GICs Code. It is still 1010030, which is Oil & Gas Refining & Marketing. Obviously, it is not up to management, or it would be done. I suspect that the push back they are receiving is due to their ownership of their pipeline business, more on this later.

Transitioning their analyst coverage from energy services analysts to waste industry analysts. This, like transitioning their shareholder base, takes time. That said, since my article was published, Secure gained three waste, or general industrial, analysts – Scotia Bank, 8 Capital, and Stifel. I would imagine that this transition will continue, but good job thus far.

Overall Performance Since April 2024 and Go Forward Strategies

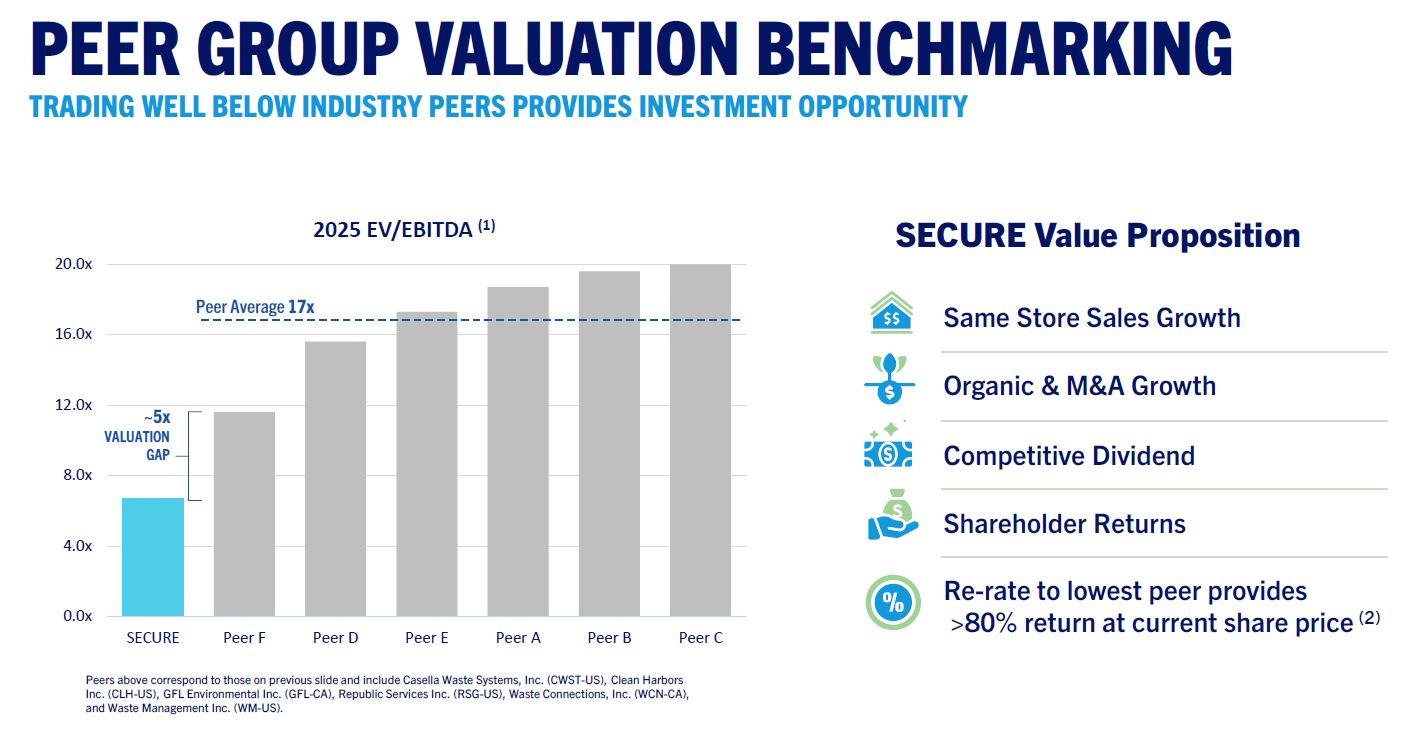

Management has done what was in their control over the last 16 months; namely, they have properly positioned the company’s marketing materials, worked to transition Secure’s covering analysts and attract new shareholders, as wall repurchased a massive amount of undervalued stock. The stock price has been rewarded. Since April 4, 2024, the stock price peaked at $17.13 in November, up 48.1%. Presently (6/5/25), a couple months post Liberation Day, the stock price is $15.02, or up 29.8%. Despite the strong price performance since my first article, Secure is still significantly undervalued – trading at 7.9x 25E EBITDA. What steps can management take to close the gap between the current trading price and intrinsic value?

Aside from normal blocking and tackling, which include continuing to run the operations well, acquiring additional waste industry analysts, and attracting new shareholders, there are two paths that management can take to help close the valuation gap. These actions can be executed separately or in combination.

More Share Repurchases:

After the recent SIB, Secure is still under 1.5x levered. Given the stability of Secure’s revenue streams, it should easily handle two to two and half turns of leverage. Secure could lever up a bit more and execute another SIB.

Selling A Majority Stake of its Pipeline Business:

Selling a controlling interest in the pipeline business would do the following. First, it would allow the company to screen better, as the pipeline business obfuscates the profitability of Secure. Second, it would make them a pure-play waste business, which would likely be a determining factor in changing Secure’s GICs code. Third, it would set a valuation mark significantly higher than where Secure is presently trading and allow Secure to trade more in line with waste peers. Finally, it would provide fresh cash that Secure could use for another SIB.

Simplifying the Financials:

Secure’s pipeline business must take ownership of the oil that passes through it. The revenue and associated cogs for this oil are a complete pass through, so there it has no impact on Secure’s margins. It does, however, make the revenue look unnecessarily volatile and the margins appear lower. A sale of a controlling interest in the pipeline business would simplify the financials and help the company screen better to potential new investors.

Pure-Play Waste Business:

Removing pipelines makes Secure a pure-play waste business. This change should make it easier for them to change their GICs code, attract more waste-focused sell-side analysts, and attract new waste-focused investors.

Valuation:

I have pipeline comps trading ~11-13x 25E EBITDA. Let’s suppose that Secure’s pipeline business is sold at 10-11x. That sets a valuation mark materially higher than Secure’s current multiple of 7.9x. It also makes the valuation spread between Secure’s waste business and its comps more apparent; not that Secure hasn’t been reminding investors of this, as seen in the two slides below (2).

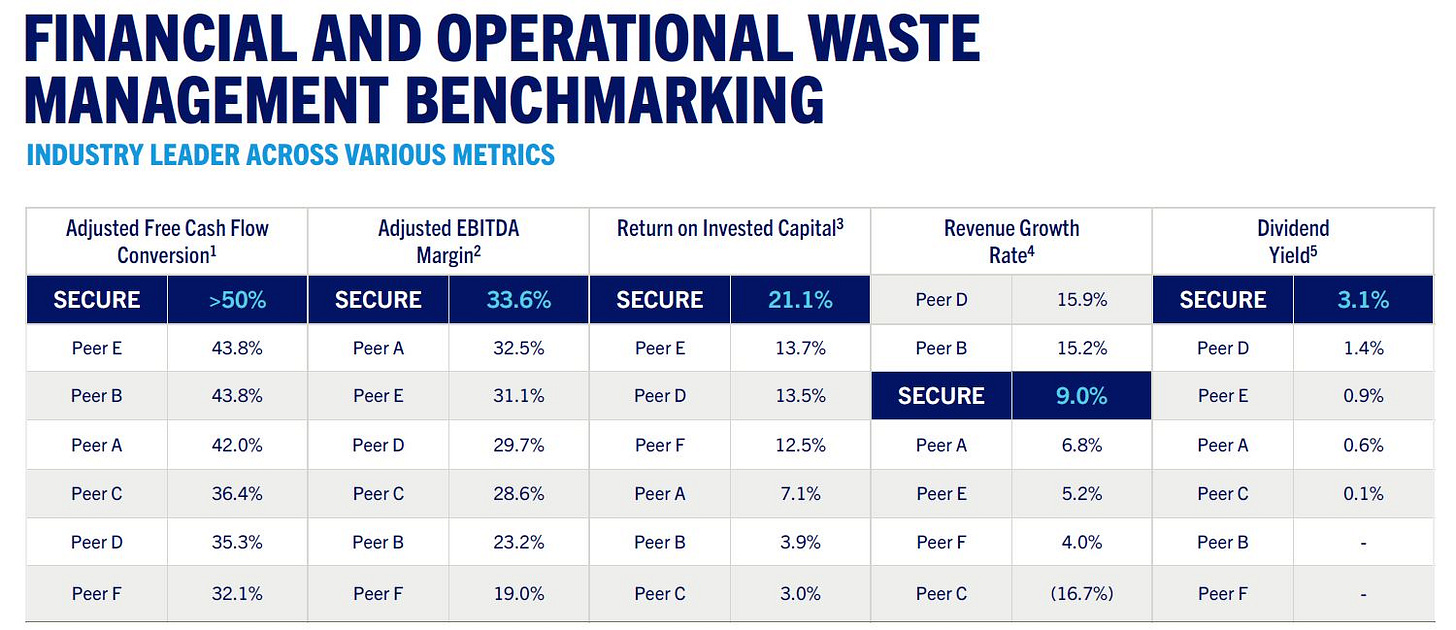

As the valuation slide illustrates, Secure not only trades at a discount to its municipal waste peers, which trade in the high-teens, but also, to its industrial waste peer (Clean Harbors), which trades in the low-teens. Now, the natural push back on the comps is that Secure is energy-related and due to the cyclicality of that industry, it deserves a lower multiple. I think, and a period of low oil prices should prove this out, that given Secure’s exposure to continuing production it is less cyclical than some believe. But let’s suppose it should trade at a slight discount to non-energy exposed peers. The next question one should ask is, what premium should Secure trade at given that it doesn’t have a fleet of trucks as collection assets? The trucks that municipal waste companies have are capital intensive and need to constantly be replaced. See the above metrics chart and compare the ROICs of Secure vs. its municipal peers - Secure’s ROIC is nearly double that of its top performing peers!

Cash for SIB:

I made some simple assumptions that the overhead of Secure is split 70/30 between waste and pipelines (not that this assumption is overly material to the results). I also assume in a pipeline sale that Secure sells 2/3rds of the pipeline business – there is a strategic rationale for Secure retaining a large minority position. I also assume that 20% of the sale proceeds go to pay taxes, which is conservative in my opinion. Given my estimates, if the pipeline business sold at a 10x multiple, Secure would have $779M in net proceeds. The RemainCo would still be under 2x levered, so there would be no need to pay down debt. So, that excess cash could be used in a Substantial Issuer Bid. The chart below shows various implied stock prices at various SIB prices and trading levels of Secure waste business. Note, the SIB purchase prices make a minimal impact, most of the stock price uplift comes from Secure being valued as a waste company.

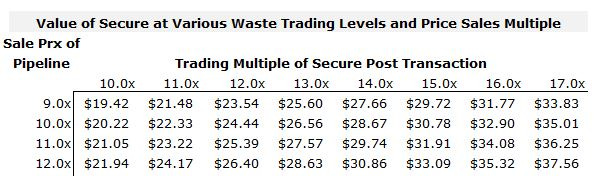

For fun, I created the below table that sensitized the trading levels of Secure post transaction as well as the transaction multiple paid for the pipeline business. In this scenario, I asusmed the SIB price was $16.50.

The midpoint in both these data tables is $26.00 to $28.00 per share. Let take a look at selling the pipeline buisness for 10x. If secure trade up to 13x, then its implied price would be $26.56, that’s a 76.8% premium to today’s price.

Conclusion:

Since my original article in 2024, Secure has come a long way. It has retired a quarter of its stock; it has changed its name; it has attracted new sellside analysts and new shareholders. The company’s stock price has increased materially, but it is still undervalued. That said, there are plenty of levers to pull to close the valuation gap. Namely, the share repurchases and the sale of a controlling stake in the pipeline business. Mangaement should be commended for the job they’ve done thus far and the value they created. However, management should move quickly to close the valuation gap, less the company become a target for an acquiror. Being acquired may be an attractive outcome at some point, but given the company’s bright future and its low price, it is way too soon for that option.

3) https://substack.com/home/post/p-148041075

4) https://310value.substack.com/p/secure-energy-services

Other Resources:

Manana Investing Newsletter 6/3/2025 (See this one for links to 10X Radar’s article on Secure and a video interview with the CEO)

https://substack.com/home/post/p-165043013

Yet Another Value Podcast 11/5/2024

Disclaimer: Not an offer or a solicitation to buy or sell any security. For entertainment and informational purposes only. Do your own due diligence.

has management indicated the possibility of selling their pipeline business?

Thank you for your thoughtful observations. As a shareholder myself, I would invite you to discuss these proposals directly with the management. I totally agree with you that it would be a pity to receive an offer when the stock is so lowly valued.