Secure Energy Services

From Volatile to Durable Earnings

Secure Energy Services (“Secure”) was founded in 2007 by the soon-to-be retired CEO, Rene Amirault. It IPO’d in 2010, and for a period looked like it could do no wrong. It served the energy producers of North Dakota and western Canada. Its best business was its fluid disposal facilities, which included industrial landfills. Although, in its early days, it facilitated the drilling of new oil wells via rail trans loading facilities, the sale of drilling and completion fluids, the rental of fluids and solids equipment, and an oilfield remediation service. About half of the business was tied to ongoing oil production, with the other half supporting new drilling. Secure’s exposure to new drilling worked well when the western Canadian energy market was strong. This exposure propelled the stock to an all-time high of CAD$28.05 per share (a price not seen since then) in August of 2014. Just as with Icarus flying too close to the sun, Secure was humbled in 2015 with the collapse of the energy industry in western Canada. The EBITDA of its new drilling focused businesses was decimated, causing the company’s overall EBITDA to fall 47% in 2015 and another 29% in 2016. Living through this painful time caused management to choose an alternative path for the company.

Management divested or shuttered many of its businesses that were tied to new drilling. If Secure’s future was going to be tied to the western Canadian oil industry, it would seek to be tied to the most secure parts of the industry. Today, the company has two main business units – Waste Management (~70% of EBITDA) and Energy Infrastructure (~30% of EBITDA).

Waste Management (WM): WM has three main business lines:

Wastewater: The largest, by far, earns revenue from processing wastewater, recovering oil from customers’ waste, and disposing of solids in industrial landfills. Secure process ~219 mbbl/day, recover ~1.4 mmbl of oil, and dispose of ~4.5mm tonnes of solid waste.

~15% to 20% is wastewater from drilling and fracking new wells with ~80% to 85% coming from ongoing oil production.

Metals Recycling recovers metals from the tailing ponds of miners (~35%), waste from industrial customers (~45%), and waste from residential customers (~20%).

Oil Field Services provides drilling mud and other chemicals related to the drilling of new wells.

Energy Infrastructure (EI): EI earns revenue by providing transportation, optimization, and storage solutions for energy customers. EI transports ~46 mbb/day of oil, provides terminalling services for ~60 mbb/day, and ships ~140 mbb/day.

Given its current structure, management estimates that only ~15% of its present-day EBITDA is exposed to the drilling of new wells.

Historical Capital Allocation

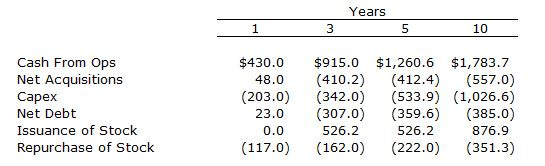

Over the last ten years, the company has generated $1.8B in cash from operations. In deployed just over $1.0B in capital expenditures. In 2021, it bought Tervita, a competitor, for $526M in Secure stock plus the assumption of debt. The deal price was 5.7x ex-synergies (they expected $75M in 12-18 months). The deal seemed to work out well. The combined companies’ pro forma EBITDA for 2022 was estimated, at the time the deal was announced in March of 2021, to be $431M. EBITDA in 2022 and 2023 ended up being $519 and $548, respectively. They ended up paying down $385M of debt over the last 10 years. Stock issuance over that time was $526M, or flat if you take out Tervita.

The Canadian Competition Tribunal objected to Tervita acquisition. It ordered Secure to divest 29 facilities. Secure ended up divesting 30 facilities in a sale to Waste Connections for a price of $1.15B, or 7.0x EBITDA – more on this later.

Future Growth

Future growth is dependent on the following:

Water Volumes: of course, new drilling drives a part of this; however, as discussed, water from ongoing production is the bulk of the water business. Furthermore, management has observed that wells generate more water as they age. Let’s estimate that water from ongoing production grows ~5% per year.

Price: Secure’s long-term contracts have CPI driven price escalators. On solid waste, there seems to be some latent pricing power. You have 10% of the industrial landfills in their market controlled by oil and gas operators, 20% by Waste Connections (through the recent divestiture), and 70% by Secure. WCN always seems to be rational when it comes to price increases.

Greenfield and Brownfield opportunities: Secure should be able to deploy $100M per annum in these opportunities and generate ~$25M in annual EBITDA for each $100M deployed. Note: $25M is ~5.5% of 2024E’s EBITDA.

Acquisitions: As with other waste businesses, large operators can pick up small players at low multiples and extract synergies.

Their metal recycling business seems particularly ripe for acquisitions. It is becoming increasingly harder for smaller players to operate. Secure should be able to pick up tuck-ins in this segment at 4x-5x EBITDA.

When you combine the growth in water volumes and their pricing power, let’s say that generates same-store sales of 5%-8%. Tack on another 5.5% in green and brownfield opportunities, and you are up to 10.5% to 13.5% of internal growth. Acquisitions can put some more growth on top of this; and given the low multiples they will likely pay, acquisitions are akin to organic growth.

Future Capital Allocation

It makes all the sense in the world for Secure to put money to work in green and brownfields expansions, as well as keep some cash available for deals. As of the last quarter, they had gross debt of $966M and cash (including cash from the WCN transaction) of $1.15B. Some of the WCN proceeds will likely go to taxes, so let’s assume their after-tax proceeds are $1B. They should generate $240M of cash in 2024. If they keep $450M of debt on the balance sheet, paying off the balance would still leave them with $100M to deploy internally and spend ~$636M on share repurchases (~19.9% of the current market capitalization). Management has been quite vocal about their stock being undervalued and their willingness to buyback ample amounts of stock.

Valuation

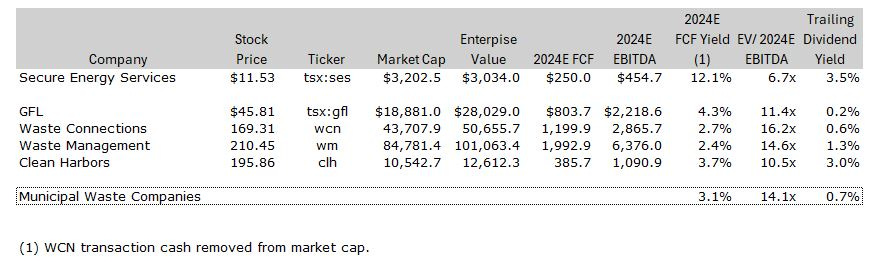

Secure is trading around 6.7x 2024 EBITDA (as of 4/2/2024), which is well below its municipal waste management peers, which average around 14.1x, and industrial waste company Clean Harbors, at 10.5x. Furthermore, Waste Connections purchased assets from Secure, in a forced sale, at 7.0x. It seems to still be trading too cheaply; perhaps it’s a bit hampered by the legacy exposure to new drilling.

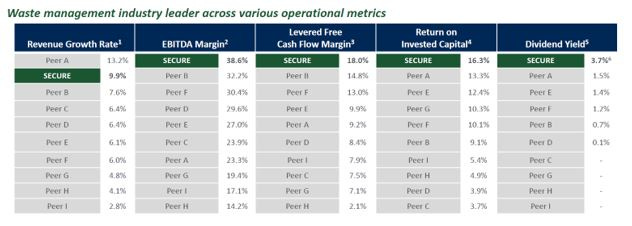

A deeper dive into the comps brings up additional points. Not only is it trading as a discount, but it has the second highest revenue growth rate of its peers, the highest EBITDA margin, the highest FCF margin, the highest ROIC, and the highest dividend yield. Perhaps it should trade at a slight discount to its municipal waste peers, but not the current 7.4 turns.

Catalysts

There are several catalysts which could help propel the stock price.

First, and mentioned earlier, the company is in an ample position to repurchase a large percent of their current market capitalization.

Second, revamping of their investor communications that highlights the durability of its revenue streams.

Third, the recent sale to Waste Connections. The first benefit of the sale is they introduce a competitor into their market who has a history of taking pricing up. Next, it introduced the company to traditional investors in waste management businesses. Finally, it shows that municipal waste companies are interested in the sector. It has come out that the senior leaders of the municipal waste companies participated personally in the diligence trips of the Secure assets. GFL’s CEO said in a breakout session at a recent conference that these are great assets. I can see one of them making a run for all of Secure at some point.

Fourth, the company can take additional steps to solidify their waste industry bona fides such as changing their name or getting coverage by waste industry sell-side analysts.

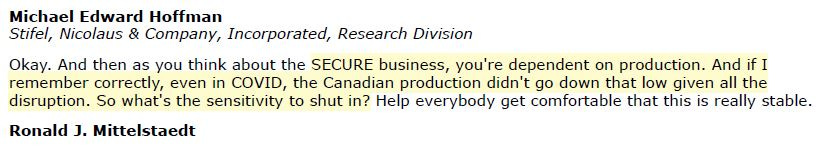

Expanding on the theme of durability, it is worth looking at what Waste Connections said about the business in their Q4 2023 earnings call.

Furthermore, the interest in Secure’s assets by the municipal waste companies may cause some investors to peel the onion back, so to speak. A deeper dive into the financials is warranted in Secure’s case as the pass-through purchase and sales of oil from their pipeline business obfuscates the profitability of Secure. Notice the chart below the reported EBITDA margins vs. the margins with the pass-through oil sales removed.

Conclusion

Secure began its life with a volatile earnings stream. After being hurt by the collapse of oil prices in 2015, management took steps to make the company’s earnings stream more secure. Participation of the municipal waste companies in the recent sale process, which culminated in the asset sale to Waste Connection, proves that they were successful. As time goes on, Secure should begin to trade in line with its waste industry peers. A substantial share repurchase and new attention from legacy waste industry investors should help to close the valuation gap.

Disclaimer: Not a solicitation or an offer to buy or sell any security. This is for entertainment purposes only and is not investment advice. Do your own due diligence.

Perhaps a silly question, but what stops WCN from taking market share from SES? Is it not a risk if WCN would build their future assets closer to the Canadian oil sands (assuming they get all the approvals), thus making them a more attractive alternative than SES, or are the majority of SES's assets already located at optimal locations that would protect them from this ever happening?