eDreams is Transforming into The Leading Subscription Business in Travel

Summary

eDreams; transformation from a transaction model to a subscription model is underway with ~3MM paying subscribers.

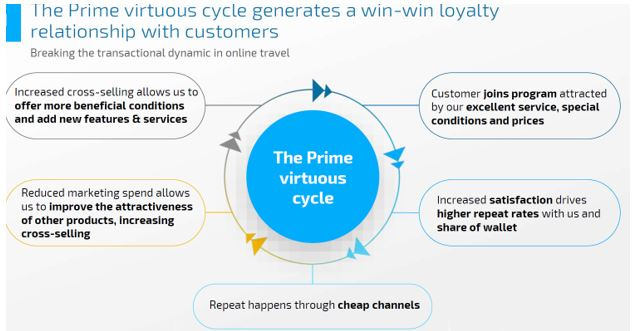

Subscription program (“Prime”) lowers the customer acquisition cost for customers, makes customer relationships sticky, and creates a moat around their business.

Financial benefits of Prime members accrue to eDreams after the first year of membership, so investors looking at trailing financials are missing the value creation.

eDreams’ is trading a substantial discount to intrinsic value.

eDreams benefitting from the return of leisure travel.

Overview

eDreams is the leading online travel agency (“OTA”) for flights in Europe. In addition to flights, it allows customers to book other travel services, such as hotels, and rental cars. For most of its history, eDreams operated using a transaction business model, getting paid for each booking a customer made. eDreams launched their Prime subscription program in 2017, which is currently available in 9 of the 44 countries in which they operate. With Prime, customers pay a fee of ~€55.00 per year. The benefits to the Prime member are discounts on each booking – the Prime Fee is “amortized” within the first or second booking; an exclusive 24x7 customer service hotline; and access to special deals and promotions (Prime Day sales). The benefits to eDreams are higher customer return rate (1.4x non-Prime over a 12-month period); a highly engaged customer base, as Prime customers repeat bookings 2.7x the amount of non-Prime customers; and little-to-no customer acquisition costs after the first booking, as Prime customers usually book through eDreams’ App or through an eDreams exclusive channel.

eDreams is focused on leisure travel, which recovered quickly from COVID. The below chart shows eDreams bookings growth vs. pre-COVID levels. Bookings vs. pre-COVID levels turned positive in June of 2021. There was a brief pullback due to Omicron. However, not even the Ukraine invasion could damper leisure travel demand with April and the first half of May bookings both up over 50% vs pre-COVID levels.

The strong leisure travel, combined with the savings that Prime allows, propelled Prime membership to nearly 3M members as of May 17, 2022 – up 3x over the last year.

Prime Membership Economics – Building the Moat

eDreams’ CEO, Dana Dunne, focused the business, and the culture of eDreams on building the Prime Program. There is good reason for this. eDreams calculates that the lifetime value (“LTV”) of a Prime Customer is worth 2.5x that of a Non-Prime Customer. Note that this calculation assumes a 24-month customer relationship, although the actual lifetime of a Prime customer’s relationship should be more than 24 months. Intuitively, it makes sense that the Prime Program is a good idea, but how does that translate to building a moat or making money?

The unit economics of the Prime Program are closely guarded by the company for competitive reasons. That said, we can make some assumptions that 1) should get us close to replicating the unit economics; 2) show the profitability of the Prime Program; 3) and show how the Prime Program is building a moat around eDreams’ business.

We can classify eDreams revenue types into three categories. First, there is a booking fee. This is the transaction revenue that eDreams gets paid for making a booking. Second, there is the first-year Prime Fee. Third, there are post-first-year Prime Fees. Let’s look at how this translates to money for the company and a moat around its business.

When eDreams acquires a new Prime customer, that customer books a transaction (let’s use a flight in this examples) and signs up for Prime. eDreams receives a booking fee and the first-year Prime Fee. Let’s assume the first-year Prime fees goes to google or a metasearch provider as a customer acquisition cost. That leaves the booking fee. eDreams can give a portion or all of the booking fee back to the customer in the form of a Prime discount. The customer should love this, as they are receiving a discounted price for their ticket. This discounted price should keep the customer coming back for future bookings. In this example, eDreams would not make any money off a first-year Prime customer as the booking fee is given to the customer and the Prime Fee pays for the customer acquisition cost.

The second year and beyond is when it gets interesting for eDreams. The customer returns, usually via a direct method, which removes any customer acquisition cost. The customer books a ticket, at a discounted rate, which makes them happy. eDreams collects the Prime Fee, for which there is usually not any customer acquisition cost tied to it. The retention rate of Prime customers is high, as customers continue to anniversary, their Prime Fees drop right to the bottom line. This business model is akin to Costco’s where margin is not made on individual transactions, but on the membership fee; although, in eDreams’ case, they get the benefit of that fee starting in the second year of membership.

The Prime virtuous cycle keeps customers in the program, which provides a moat to eDreams. Interestingly, the Prime program not only directly benefits eDreams, but the program also harms eDreams’ competitors. By not having to collect transaction fees, recall eDreams gives these back to the customers in the form of discounts, they can bid aggressively on metasearch sites to acquire new customers. If eDreams wins the bid, then they have a good chance to gain a new Prime customer and are set to realize the lifetime value of that customer. If they lose the bid to the competition, the competition is taking business at little to no margin, as the competition does not have a comparable subscription program and the associated subscription fees.

Financial Projections

Assumptions:

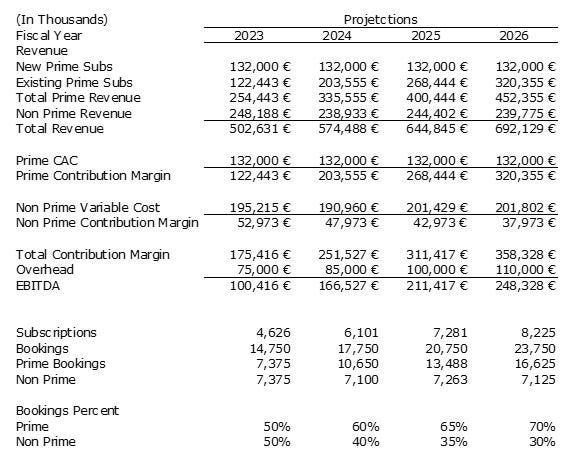

eDreams grows subscriptions to 7.25mm buy FY25.

eDreams gives Prime Transaction Revenue away to Prime customers. Note, for simplicity’s sake, I am excluding Prime Transaction Revenue from the below table, given it is 100% netted out of earnings.

eDreams pays the first year Prime Fee to acquire a new customer but keeps all Prime Fees thereafter.

Prime transactions represent 50% of total transactions in FY23 and grows to 70% by FY26.

No change in the travel basket size (note the basket size and consequently transaction fee margins are depressed due to the shorter duration, and distance of trips post COVID).

No additional services are added to Prime (Prime should become a one-stop travel shop in the next few years).

Cost of Equity equals 10%.

eDreams is currently trading at 11.7x and 7.6x my estimated FY23 and FY24 EBITDA, respectively. Booking Holdings is trading 17.6x and 13.9x, respectively. Given eDreams’ stickier revenue base with its Prime program and its rapid revenue growth, what should it trade at? I’d argue at a premium to Booking Holdings. That said, if management hits their goal of 7.25mm+ in FY25, then eDreams is likely cheap. The below is a data table showing eDreams’ price at various Prime subscription levels in FY25 and various terminal value multiples.

The current price is €7.07. How does it get from its current price to its intrinsic value? First, I believe that the European investors are slow to recognize the value of eDreams as they are focused on trailing financials and not the value of existing Prime subscribers who will have anniversaries this fiscal year. As the year progresses, the value of these Prime members will be apparent, especially in the back half of the fiscal year, where a large amount of them will anniversary. That said, the word is getting out. The company has conducted one road show to the US this month, and they will conduct another one before the month is over. Additionally, the company is attending two sell-side conferences in Europe this month. The investment bank hosting one of the conferences does not presently cover eDreams. Perhaps eDreams will pick up another analyst. As the word gets out, I expect eDreams to eclipse recent highs of €10.14 per share. Once they get into the double digit range, they get very close to being large enough to be included in the Ibex 35, Spain’s leading equity index. Spain has a limited amount of large publicly traded companies, and Spain has investors who want access to their home market. This could lead to a premium multiple for companies in the index.

Concerns of the Bears

Revenue margin per booking is low post-COVID.

Three reasons for this. First, the basket size is small as travelers are traveling closer to home and taking shorter trips, as they are afraid of getting stuck far from home if they contract COVID. This should normalize as restrictions continue to ease.

Revenue per booking has in the numerator both transaction revenue and the annual Prime fee. In the denominator is the number of bookings. If a Prime subscriber books more than one booking per year, the annual Prime fee gets diluted in this metric, which makes it look lower relative to past years. Note, that eDreams earnings will not change based on the number of bookings a Prime customer makes, so this impact on this metric is not concerning.

Revenue per booking includes first-year Prime customers. eDreams may be bidding aggressively to capture that customer, which pushes down the revenue per booking metric. However, the LTV of a Prime customer is 2.5x that of a non-Prime customer, so you should want them to bid aggressively to gain a new Prime subscriber.

Macro environment in concerning given European inflation.

European consumers have ample savings - €907B of pandemic-related savings.

Europeans want to travel and will prioritize it over other discretionary expenses.

Airline capacity increases will likely absorb some of the increase in fuel prices.

eDreams’ Prime program saves customers money (that is why it is popular and has a strong repeat rate).

The market share is in the low-single digits, so there may be a pull back in the broader leisure travel market and eDreams could still grow by taking market share.

Competitors can replicate their own subscription program.

Easier said than done. Tripadvisor tried to launch a subscription program, and ultimately transitioned it to an industry-typical rebate program.

To create Prime, eDreams’ CEO changed the culture of his company to focus on LTV. Competitors have a metasearch, transaction-focused model. Switching their business model would be difficult and take a long time.

Booking Holdings has been in flights and dynamic packages for years, and therefore had the opportunity to launch a subscription program. Thus far, they have not.

Disclaimer: Not investment advice. For entertainment purposes only. Not a solicitation to buy or sell securities. Do your own due diligence.

Awesome analysis. Any idea what cohort based churn rate looks like? I noticed report only shows how much they decreased churn by but I’m curious what the starting point is. Thank you!