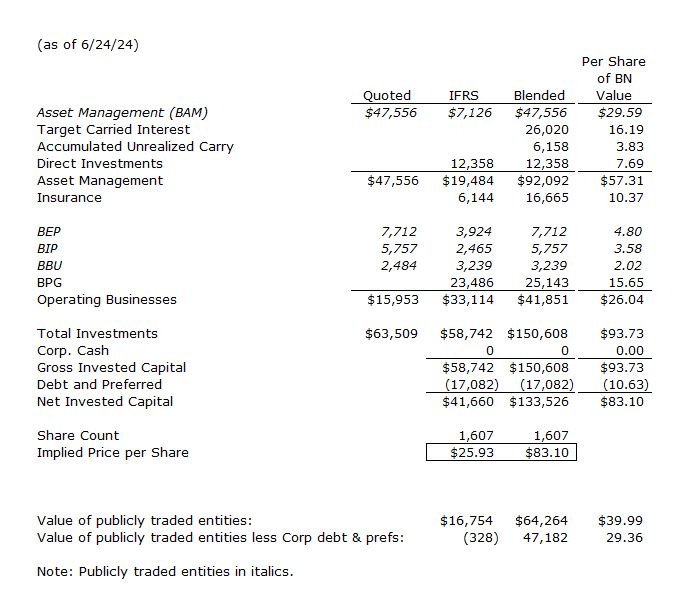

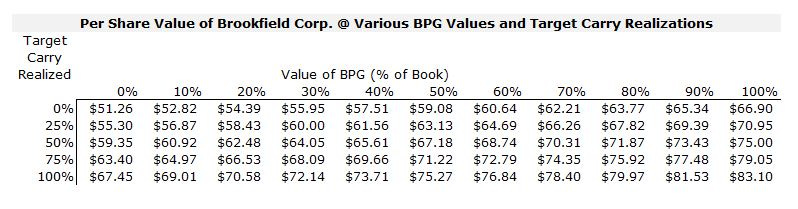

On August 23, 2023, I wrote an article on Brookfield Corp.’s (“Brookfield”, “BN” or “BNRE”) sum-of-the-parts (“SOTP”) valuation (https://310value.substack.com/p/brookfields-sotp-valuation). At the time, the SOTP analysis yielded a per share value of $72.43 for Brookfield, which was a 122% premium to its trading price of $32.63. While the current trading price of $41.42 is higher than the August price, the current SOTP valuation of $83.10 is still a gargantuan 101% premium to its trading price. This raises the question, why is there such a discrepancy?

SOTP Valuation vs. Trading Price

What is interesting about the discrepancy is that 43% of the value of the analysis, before the deduction for the value of the debt and preferred equity, comes from the value of the publicly traded entities. Since those values come from liquid and traded securities, the discrepancy must come from elsewhere. Brookfield is perhaps a tad aggressive in including Target Carried Interest in the SOTP valuation, but Brookfield has been successfully investing and generating carried interest for a long time. Let’s set that aside. The other obvious candidate for the discrepancy is the value of Brookfield Property Group (BPG). Let’s dive into this.

Brookfield Property Group (“BPG”)

Brookfield formed BPG when it took Brookfield Property Partners private by buying the 40% that it did not own for $5.9B. BPG are assets that are owned directly by Brookfield on its balance sheet as well as their LP interest in the funds that Brookfield Asset Management manages. The direct investments of BPG consists of two groups of assets.

Core: Core is Brookfield’s collection of 35 premier office complexes and retail properties.

Core Office: Their 16 office properties are located in the world’s leading commercial markets and cover 35 million square feet of leasable space.

Core Retail: Their 19 retail centers cover 19 million square feet of leasable space. The retail assets are further classified as Market Dominant Retail (examples: Ala Moana Center in Hawaii, Fashion Show and Grand Canal Shoppes in Las Vegas, and Woodlands Mall in Texas), Urban Retail Centers (examples: 730 Fifth Avenue and 685 Fifth Avenue in New York, and the Miami Design District), and hotel properties.

Transitional and Development: is Brookfield’s collection of assets that are undergoing significant value added activities through development and leasing. They are typically held for a shorter time period than Core assets before being monetized for attractive returns. Included in the category is their North American residential business, which represents about 20% of the value of the category.

Of the above categories, investors may be most skeptical of the value of the Core portfolio. These properties can only raise rents materially as rental contracts expire and are exposed to the work-from-home trend.

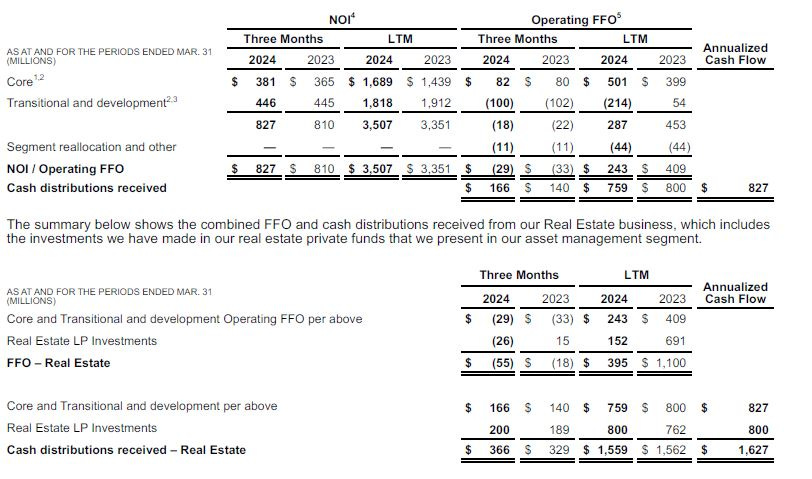

(Note: Left column is Q1 ’24, while right column is Q1 ’23)

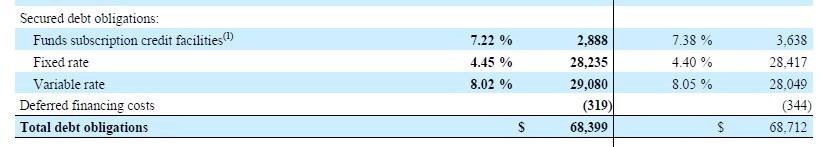

To compound their problems within Core, BPG’s assets are about 50% financed (at the individual property level) with floating rate debt. Looking at the below chart, Core’s FFO is holding up well, as are their cash distributions. You can look deeper into this by pulling the filings for the preferred equity for Brookfield Property Partners, which is still traded. Core Office and Retail are being hit with rising interest charges, but it seems like rising rents are absorbing some of the blow from interest rates.

Transitional and Development numbers look worse than historical, but this is likely just noise. These properties don’t generate revenue until the transformation is completed, so it is not helpful to look at steady-state metrics such as NOI and FFO for this group.

The FFO from their LP investments looks bad, going from $691M LTM last year to $152M this year, but I think this is mostly accounting noise. Distributions are probably a better metric, and these are holding up strongly.

Lastly, there is North American Residential, and while I won’t drop a chart (see on Q1 ’24 supplemental page 22), these numbers seem to be holding up nicely.

If historical earnings for Brookfield’s property assets are strong, what aside from real estate market sentiment is giving investors concern. It could possibly be upcoming refinancings.

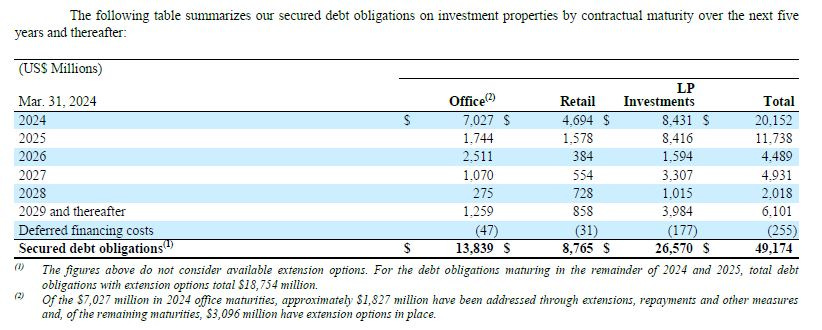

Upcoming Debt Obligations

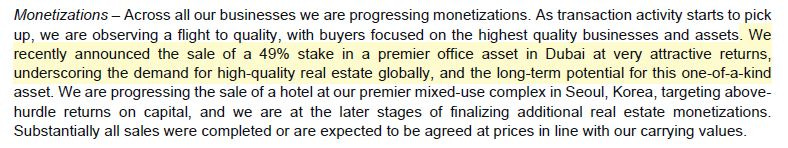

Forty one percent of Brookfield Property Group’s secured debt is due in 2024; 65 percent is due in both 2024 and 2025. Of the $32B in debt coming due in 2024 and 2025, ~59% have extension options in place. Now most of this debt is inside of the funds. Looking at directly owned office, they have $7B in maturities in 2024. Twenty-six percent of these have already been addressed, with extension options in place for another 44%. Furthermore, they note that they have suspended interest and principal payments on two percent of the portfolio. I would make two comments on this footnote. First, having two percent of your portfolio with problems seems good to me. Second, just because you are suspending payments, doesn’t mean the equity is gone. It seems like a first step in the negotiations.

IFRS complicates this a bit, as it requires Brookfield Property Group to consolidate all the debt from their funds. That said, I think we can ignore the LP column based on the performance indicators. Looking at office and retail, if all the debt from 2024 and 2025 were refinanced at a rate 357 basis points higher than their current average rate for fixed rate debt, the annual hit to FFO would be $537M. That would make a hit to their current $759M in distributions, but it shows that the portfolio can withstand the hit and allow them to slowly monetize the portfolio.

Other Ways to Look for the Value of Their Property Portfolio

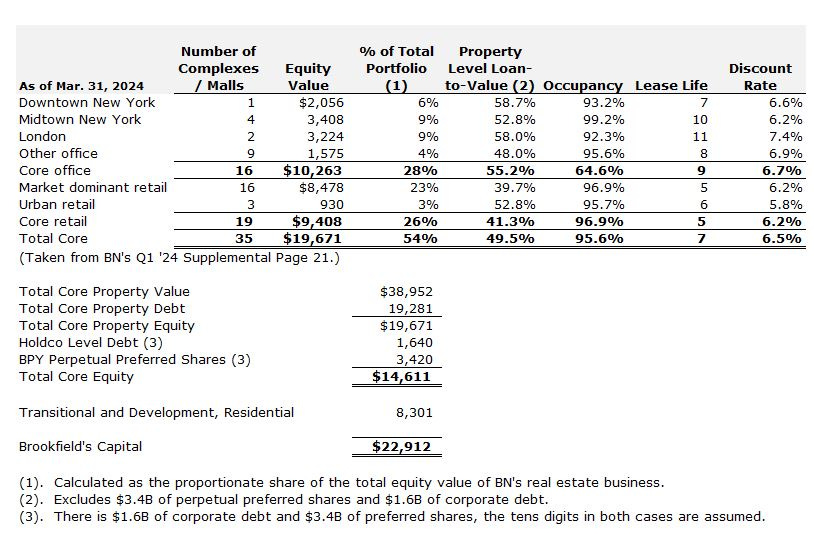

Brookfield is essentially trading as if the value of its owned real estate is worth nothing. I know two things. First, I don’t know the value of the portfolio and second, the value is not zero. Another way to get comfortable that it is not worthless is to look at the equity values and debt levels of the Core portfolio by real estate type and location. The below chart is taken from Brookfield’s Q1 ’24 supplement. It shows the equity value of Core at $19B after property-level (nonrecourse) debt. After that, you take out the hold-co level debt and preferred and you are left with $14.6B in the equity of the Core portfolio. Add the Transitional and Development value to that and Brookfield Corp has $22.9B of equity in their real estate.

Personally, I start picking apart each of the locations to see if I can get comfortable with it.

Downtown New York: This is Brookfield Place. I can’t see how this isn’t money good.

Midtown New York: This includes One Manhattan West, 300 Madison, The Grace Buildings, again, money good in my mind.

London: This includes Canary Wharf. Maybe a little bit of problems here.

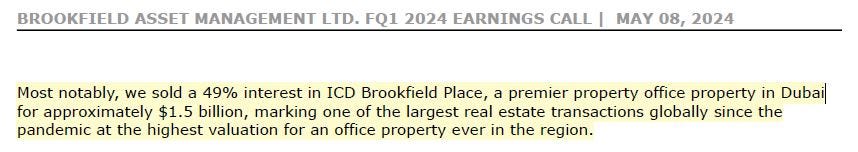

Other: Other includes everything else, probably some nice buildings in Canada and some others around the world. One building in this category that made some recent news is a building in Dubai. They sold 49% of the equity. The transaction value was $1.5B. Using the category average of 48.0% LTV, the value of the sold equity to Brookfield was $382M. That is 24% of the equity value of the “Other office” category.

Conclusion:

Brookfield Property Group’s assets seem to be handling the increase in interest rates well. Monetization of certain assets also illustrates the value of the portfolio. While I don’t know if their full SOTP value will be realized, I feel more confident that the % of book for BPG is close to 100% but make your own assumptions. Assuming there is no value in their anticipated carry (probably another overly conservative assumption), at 100% of book value for BPG, Brookfield’s SOTP valuation is $66.90. At no value for BPG, the SOTP valuation is $51.26. Both scenarios are higher than today’s price of $40.41.

The equity value of BPG is certainly higher than the $14.75B implied value at the time Brookfield took private BPY – recall the book value is $22.3B. Rate increases will impact the FFO from BPG over the next couple of years, but the portfolio will be able to withstand the rate increases. Furthermore, continued monetizations will illustrate the value as assets are sold off and cash is brought into Brookfield. Recall, one avenue for monetization is moving from Brookfield’s balance sheet to that of its insurance portfolio (highly scrutinized by regulators). This avenue will give its insurance clients exposure to some of the best office and retail real estate in the world, while turning assets that the street is marking at zero into cash of Brookfield’s balance sheet. Cash that it can further use to grow its business or return to shareholders via share repurchases.

Disclaimer: For entertainment purposes only. Not a solicitation to buy or sell any security. Due your own due diligence.

It depends. If you mean that their LP position in the BAM managed funds are zero, then that would be bad for BAM as it would hit management fees, carry and impair their ability to raise future funds. If you mean the direct holdings that BN owns on balance sheet, there would be no impact on BAM.

Interesting article. On the hypothetical scenario that BPG is worth $0, do you know what would be the hit to BAM?