Brookfield Corp.’s SOTP Valuation

Getting Read for Their Upcoming Analyst Day

I have long been an admirer of Brookfield Corp. (“Brookfield” or “BN or BNRE”), its management team, and how they manage their business. That said, I found it a bit entertaining how promotional they can be at their Analyst Day (next one on September 12th), where management has a history telling investors exactly what they think the business is worth. This has continued into their quarterly reports, specifically their Supplemental Report, where they provide a sum-of-the-parts ("SOTP”) valuation on Brookfield Corp. Despite the promotional nature in providing the valuation, looking closely at the analysis appears to reveal a substantially undervalued business, even if you remove some of management’s possibly aggressive assumptions.

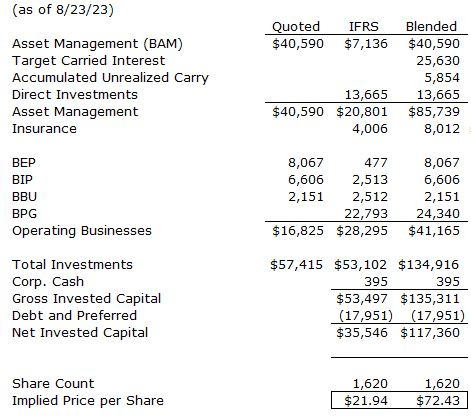

Sum-of-The-Parts Analysis:

The above chart is an updated version of the valuation provided in their Supplement. The current share price value that it implies is $72.43, which is a cool 122% premium over the current price (as of 8/23/23). Let’s go through each line item.

Brookfield Asset Management (“BAM” or “Asset Management”): This is the value of Brookfield Corp.’s position in Brookfield Asset Management. Recall a portion of Asset Management was spun out to the shareholders less than a year ago. This value is derived from the quoted price, so it is reasonable to me to use this value in the SOTP analysis. I’ll make the same reasonableness assumption for the various other publicly listed entities. Before moving on, a quick aside, distributing Asset Management to shareholders allows Brookfield Corp. to do two things. First, it allows them to set a value for a large portion of their business. Second, it provides another lever to pull to maximize shareholder wealth. Asset Management generates ample free cash flow, which it distributes to its shareholders via dividends. As Brookfield Corp. is the largest shareholder, it receives a large amount of those dividends. If Asset Management is trading cheaply, then Brookfield Corp. can take that the cash it receives from the BAM dividend and use it to buy Asset Managment’s shares on the open market, increasing Brookfield Corp.’s ownership stake. If Asset Management is trading dearly, then Brookfield Corp. can sell BAM shares or use them as acquisition currency, as in the case of the recent American Equity Life (AEL) acquisition. Additionally, in such a case, it could use the cash form Asset Management’s dividend to fund buybacks of other listed securities that are cheap, as is likely happening with the repurchase of Brookfield Corp.’s shares today.

Target Carried Interest: This is the value of carried interest that Brookfield Corp. expects to receive, in addition to what it has already accrued but not realized. This is an aggressive assumption. That said, while we don’t know what the value of this will ultimately be, I would bet that it will not be zero. It is easy to sensitize this assumption and see how it changes the SOTP analysis. I’ll do this below.

Direct Investments: While they could have come up with a better name for this category, this represents their GP investments in the private funds that they manage. While they have some discretion in valuing the assets in their funds, in the end, if you Brookfield doesn’t generate acceptable returns, it doesn’t raise more money. Given their recent fundraising success, I am comfortable with this valuation assumption.

Insurance: This is the value of their insurance business. I am fine with the $8B assumption, which is ~12x trailing earnings. In fact, this may prove to be cheap. If you use $2B for earnings, which they think they can get to not long after closing the AEL deal and add the value of the AEL deal to Insurance’s enterprise value, then you get to ~6.2x earnings. Another aside, it seems like in the early days of its insurance business, Brookfield wanted to give its shareholders exposure to its insurance business through BNRE shares. As its insurance business has grown, all the exposure now seems to be in BN shares, and BNRE is used as a tool to give investors exposure to BN, but in a more tax efficient manner (return of capital vs. dividend taxation), and as a way to provide small and mid-cap focused funds exposre to BN.

BEP, BIP, BBU: These are the values for Brookfield’s investments in its listed partnerships. Given they are publicly listed, I am fine with these valuations.

BPG: This is the value of Brookfield’s investment in Brookfield Property Group (BPG), which was a publicly listed partnership that Brookfield took private. BPG is filled with some high-quality office and retail properties. That said, some of the properties in the portfolio are stressed and undergoing financial difficulties. Each of the properties is individually financed, so there is no portfolio contagion risk if some of the individual investments turn out to be zeros. This is one of the hardest line items of the SOTP analysis to value. I know that some of the investments are troubled, but the whole portfolio is not likely a zero. As with the Target Carried Interest line item, it is easiest just to sensitize the assumption and see where that leads us.

We end up with a Total Investments value of ~$135B, of which 43% of that value is derived from publicly listed securities. There is some net debt, which brings the Net Invested capital down to ~$117B or $72.43 per share.

Scenario Analysis:

As discussed, 57% of the value of Brookfield’s total investments are in un-traded categories. However, 72% of the un-traded values are comprised of Target Carried Interest and BPG. Sensitizing those two assumptions yields some interesting observations.

The first observation that jumped out to me is that if you assume that their Target Carry and value of the BPG portfolio are both zero (a highly unlikely scenario in my opinion), then the implied sum-of-the-parts value for Brookfield is $41.59 per share, or a 27.2% premium to the current price. How about the case where the Target Carry and BPG are both worth 50% of the assumed value? That yields a price of $57.01 per share, or a 74.4% premium to the current price. Feel free to use the below charts to create your own assumptions.

Conclusion:

Brookfield’s realized value of its Target Carry and its BPG portfolio are not likely to come in exactly at where the company has them valued. However, even if one assumes they are both zero, then the stock is still cheaply valued. I think that the values of both will be much higher than zero. Valued at zero or much higher, either way, if you own the stock at today’s price, the question is likely not if you will be a winner or not, but likely by how much you will win.

Disclaimer: For entertainment purposes only. Long BN/BNRE (as of 8/23/23). Do your own due diligence. Not a solicitation to buy or sell any security.

Great article. Thank you for the details and I love that you provided a range. At current prices $29 and change I’m trying to figure out how I lose money on an investment in $BN

In the body of the article you use the old conglomerate symbol of BAM through the whole article