2022 was an interesting year for DigitalBridge (“Digital” or the “Company”) with strong performance of their portfolio companies (for the most part), a double digit percentage increase in FEEUM in the first nine months of 2022, monetization of a few investments which returned capital (and nice IRRs) to investors, announcement of two large investments (one closed), the repurchase of the fee streams owned by WAFRA, the announced acquisition of AMP at attractive terms, and the launch of fundraising for new strategies. Despite the good news and accomplishments, the stock was pummeled in 2022. Before diving into 2023, let’s look at some of the issues that caused the collapse in the stock price in 2022.

Issues in 2022

Interest Rates Rising: Obviously the cost of capital is going up across the board. That said, I believe investment managers that manage funds that have long lives, that invest in real assets can do well in rising rate environments.

Conversion From a REIT to a C-Corp.: Digital is switching to an asset-lite business model and has ample existing NOLs. Ergo, it made sense to transition to a C-Corp. That said, the conversion created forced sellers as REIT investors had to exit their positions, and by the way, they were forced to exit during a time in which there were extensive macro challenges and a horrendous market sentiment.

Complicated Financial Statements: The company has complicated financial statements, which causes the company to screen poorly, and deters potential new investors from spending time on the company.

Recent Deal Headlines Allow for the “Digital Overpays” Narrative to Flourish: The Switch and GD Towers headline valuations were high. Now the headline numbers could be wrong once you peel the onions back, but perception can be reality until the perception is changed.

Zayo Turnaround Taking Longer Than Expected: This, along with the overpaying narrative above, is leading some investors to question if Digital will ever raise another penny. The stock is certainly trading as if they will not.

Tax Loss Selling: The above issues help to beat down the price of the stock, which was likely further beat down by tax loss selling near the end of the year.

What’s on the Agenda 2023?

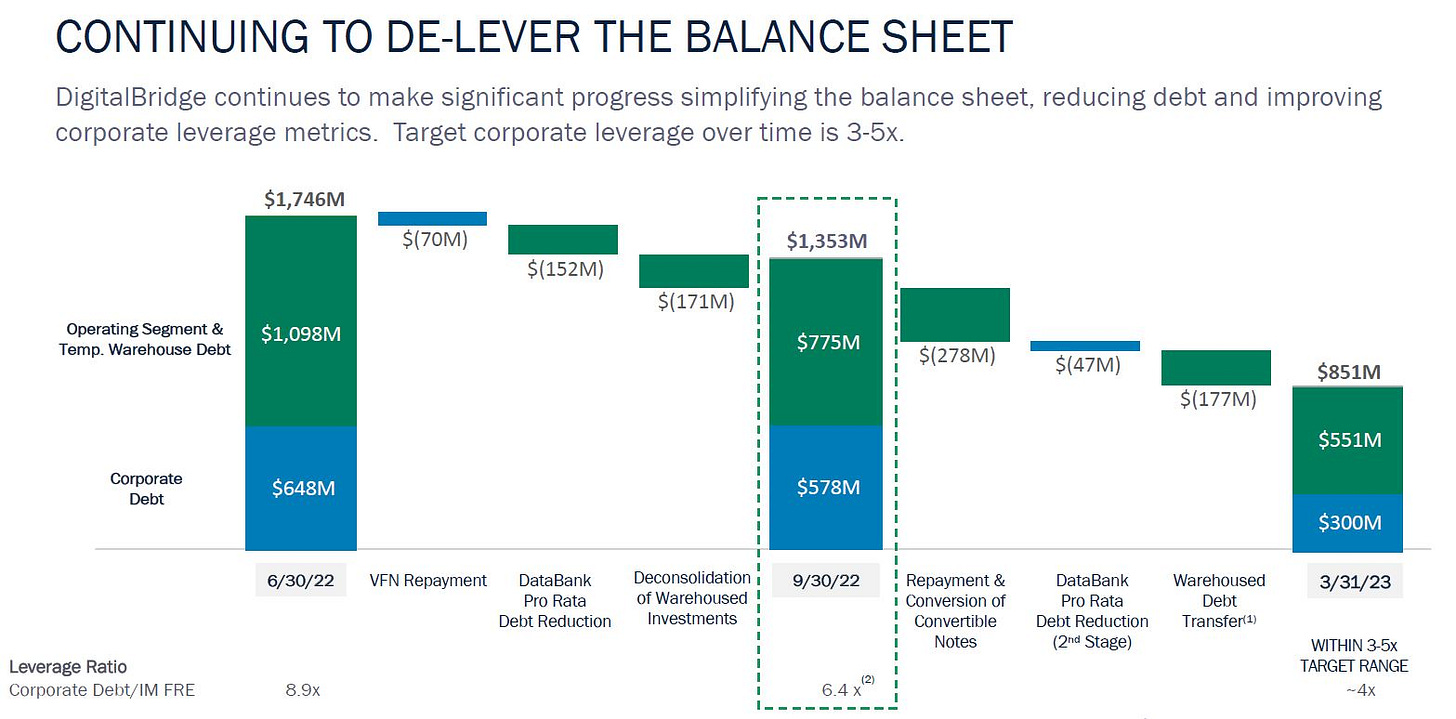

Accounting Clean Up: The biggest issue with Digital’s accounting is the consolidation of their balance sheet investments. Typically, a company consolidates a subsidiary into their financials when the subsidiary is at least 50% owned by the consolidating company. Below 50% ownership, a subsidiary is called an unconsolidated subsidiary and is recognized in the financials of the parent via the equity method. So, this means Digital owns at least 50% of its balance sheet investments? Well, no. It owns just over 10% of Databank and Vantage SDC. So why does Digital consolidate them? After the Enron debacle, The Financial Accounting Standards Board (FASB) paid close attention to the various entities used by Enron to avoid financial reporting obligations. This produced a FASB Bulletin and later a FASB Interpretation which reduced the ownership percentage trigger for consolidating Variable Interest Entities. Digital (perhaps stemming from legacy Colony practices) deemed that they were required to consolidate Databank and Vantage SDC. There are two major implications to consolidating these two companies. First, Digital’s leverage ratio looks higher than it is. Looking at Capital IQ today (1/6/23), they have them at 10.5x debt to LTM EBITDA (Bloomberg has no current leverage ratio, but their 1-year trailing is 15.9x). Digital is nowhere close to this, as the debt of the operating companies is non-recourse to Digital. Second, there is a similar issue with respect to the reported earnings. Consolidating these data centers, with their high depreciation and resulting net income/AFFO mismatch, causes Digital’s GAAP net income to appear negative. They can solve this issue two ways. First, they can get their ownership below 10%, which is the trigger for the FASB guidance. Ganzi basically said this should happen within the next six months at the Citi Conference on 1/5/23 (see below). Additionally, there is another way for them to fix this issue, and that could come sooner. Digital can go to their auditor and make the case that the FASB guidance does not cover Databank and Vantage SDC. If the auditor agrees, they can immediately recognize these two investments as unconsolidated equity investments. See below on the leverage implications of just doing this for Databank.

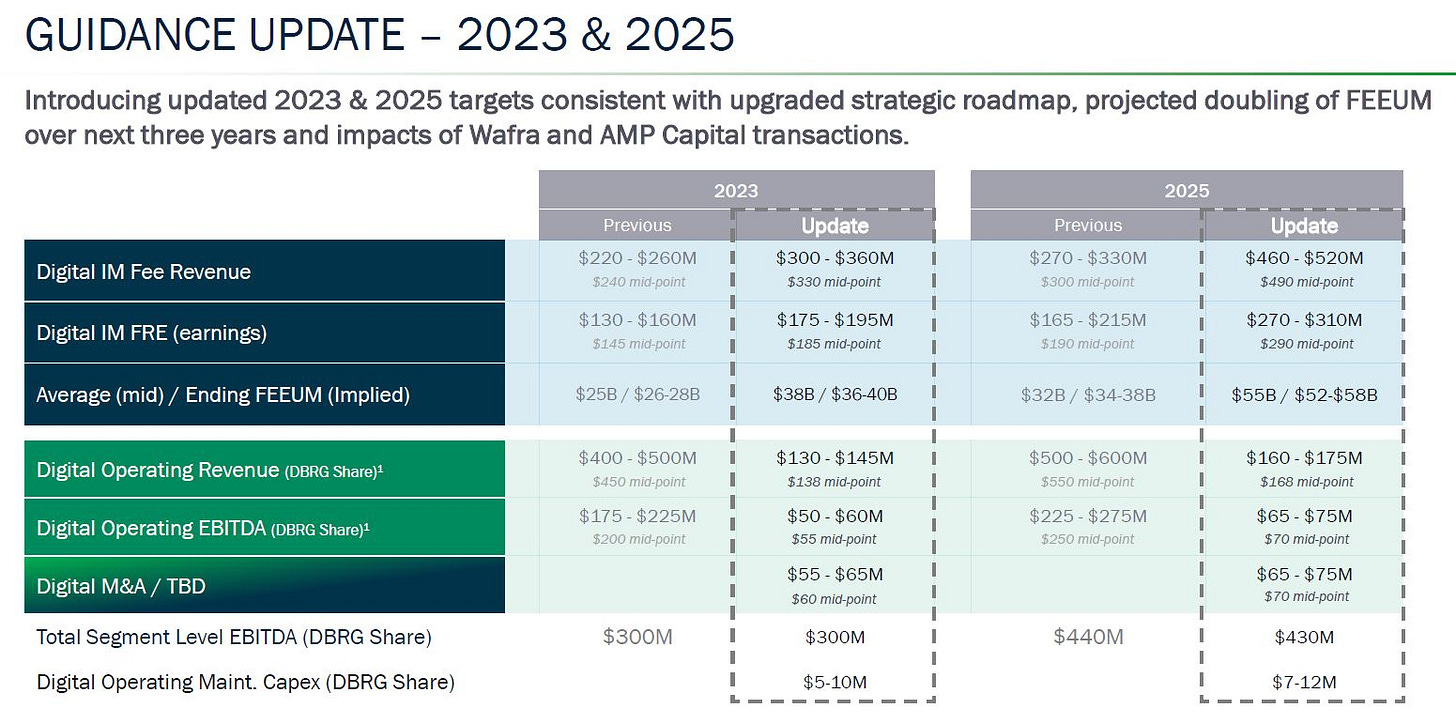

Fundraising: The most important announcements in 2023 are updates on fundraising. The first updates should center around first closings and target sizes of their Debt and Core Funds. We should also expect an update on the timing and size expectations of DBPIII, their third flagship fund, given that DBII is more than 90% deployed.

I don’t know what the targets will be for the Credit and Core Funds will be, but I bet we will likely see first closes in the first half of 2023. Additionally, we should get guidance on the size of the third flagship fund. Interesting that the 2023 fundraising and earnings guidance remains unchanged as per Ganzi’s above comments from the Citi Conference. The implications are that between 9/30/21 when the company had $26B (pro forma for AMP) of FEEUM, among Debt, Core, DBPIII, and co-investments, they will need to raise an additional $10B to $14B in those 15 months to fall within their 2023 FEEUM guidance.

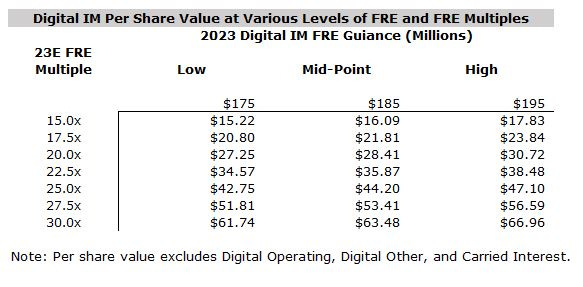

So, if they hit their guidance, then the Digital IM business is worth a lot more than the current $10.83 per share price. The low end of their guidance at a 15x multiple implies the shares are worth $15.22 per share (a 40.5% premium over today’s price), and that is without factoring in the value of their operating assets, proceeds from other legacy assets that will be exited, or the value of carried interest.

The above discusses credit, core, flagship, and co-invests. Don’t forget that AMP is closing soon. They will likely top off AMP II, before gearing up for a formal AMP III fund raise in 2024. They will be in market for their venture capital vehicle, more capital for the Databank and Vantage SDC permanent vehicles. Also, their liquid strategies performed quite well in 2022 and ended Q3 22 with just over a billion dollars of FEEUM. I would not be surprised if the liquid strategies attracted new capital.

More Disclosure on Portfolio Companies: Maybe not more disclosure, but the thesis, and/or strategies around the three companies that have been the driving the narrative as of late. Those would be Zayo and existing company that is having some issues, and newer holdings GD Towers and Switch, which have high headline multiples.

Let’s start with Switch. A certain short seller has been saying that Digital paid 41x for Switch. He gets there by taking the $11B purchase price divided by EBITDA of $270M. However, the math needs to get cleaned up a bit. The EBITDA he uses is burdened by a fair amount of non-cash litigation expenses, as well as a small amount other nonrecurring items. Also, the EBITDA he uses is trailing. Valuations are done off one-year forward earnings, and by the time the deal closed, that means that the forward EBITDA was expected to be ~$396M. Take the $10.6B transaction value divided by 23E EBITDA, and you are at 26.8x. Now let’s look at what else the company has told us – the below is from the Switch proxy. Digital raised an additional $1B of debt that they can pull down withing two years of closing. Let’s assume that the debt is backed with an additional $1B of equity. This would nearly double the footprint of the business – by the way, Switch has the four things you need to grow a data center business, demand, power, permits, and land. Let’s suppose the $2B investment gets you an incremental $315M of EBITDA. By the time the new facilities are built, their existing facilities will likely be doing $450M of EBITDA; adding EBITDAs from the new and existing facilities gets you $765M of total EBITDA. $12.6B of investments - $10.6B purchase price plus the $2.0B incremental investment – divided by $765M is just under 17.0x. I think this is their game plan with Switch, so hopefully we will see it discussed a little more explicitly. Now it took me a paragraph to explain it, which is certainly more words than taking sloppy math and forming a narrative around it, but investing often requires a little deeper than the headlines.

Now GD Towers. The deal was announced July of 2022 with a headline price of 27X LTM EV, though 2021 EBITDA was used as a proxy for LTM. 23E EBITDA would be more appropriate, similar to Switch above. So, what is Brookfield and Digital getting for their investment? First, they are getting a high-quality tower portfolio, with the best telecom provider in Germany as the anchor tenant. Second, they are getting European exposure to one of the better economies in the region. Third, they are getting an investment in a region with geographic characteristics that necessitates having a high tower to population ratio. Finally, they are getting an asset that is primed to grow organically, as well as will serve as a platform for acquisitions. Back to organic growth, telecom companies typically manage to enhance the quality of their networks. They don’t manage their towers for the optimal number of tenants. A similar situation happens in data centers. When Equinix takes over a data center from a telco and manages it in a carrier-neutral fashion, it enhances the value of the data center. Deutsche Telekom ended FY21 with its towers having a tenancy ratio of ~1.4x, with an FY22 outlook of the ratio being stable. There is certainly room to increase the tenancy ratio of the portfolio, and with each tenant a tower adds, the more cash rains in. I would not expect them to talk about this until the deal is closed, but I would hope they give us an update once the deal closes. Additionally, a good amount of Digital’s investment will be from the nascent Core fund, with some growth capital coming out of the flagship fund. The fact that they are already committing capital from the Core fund, should provide some comfort in their ability to raise one.

Now for Zayo. Zayo has been giving some investors concern, as they believe that the performance of it, may inhibit Digital’s ability to raise capital. Two thoughts on this. First, going back to the Citi Conference, Ganzi addressed Zayo by acknowledging that they invested in a turnaround, and turnarounds take time. He followed up by claiming that ample work was put into Zayo in the back half of 2022, and that the work should start to payoff this year. Furthermore, he pointed out that Zayo is benefitting from relationships with other Digital portfolio companies. I hope he is correct that the turnaround is starting to be realized. My second thought is, even if Zayo is not a success, Digital’s equity exposure to it in DBPI is relatively small given the investments in it by their partner EQT and co-investors. The performance of one portfolio company in their first flagship fund, should not, by itself, determine digital’s ability to raise subsequent capital.

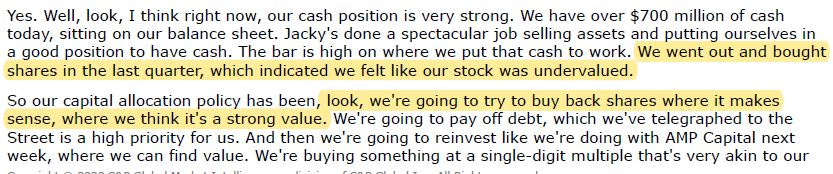

Share Repurchases: Digital has ample liquidity, that said, there will be a lot of funds coming and going over the first couple of quarters in 2023. They have showed a willingness to buyback shares. I expect them to step in with a large buyback if the stock price doesn’t materially improve. These should come, in size, this summer, once all of the big movements of capital have been completed.

DigitalBridge is trading at a point of peak pessimism. Management is quite optimistic about their ability to raise capital, to the point that they reiterated their fundraising goals. If they are able to hit their 2023 fund raising targets, then this business is materially mis-priced, as just the asset manager is would likely be worth at least $15.00 per share, and that is without the value of the carried interest, or Digital’s operating assets. That said, even if they missed their fundraising targets, and they raised half of their 2023 FEEUM goal, then it is still likely a value at today’s price. 2023 should be an interesting year.

Excellent overview. Any thoughts on when they might exit BSRP and why they are being so bullheaded about that postion. In terms of multiple 15x feels right to me for IM, JPM has 24x in their model which clearly seems rich.