Unpacking eDreams' Capital Markets Day

Business Transformed, Plenty of Growth Ahead, Now Let's Fix That Share Price

eDreams held a Capital Markets Day (“CMD”) on January 31, 2025. I’d like to unpack it. I’ll approach this article a bit differently than my previous articles. eDreams did an excellent job going through the business at their CMD, so I’ll mostly utilize their slides, and provide some commentary on them. Before getting into the slides, I’ll start by saying that management and the company should be congratulated for the remarkable transformation of the business since the last CMD. The transformation has been a success in every sense, with the exception of eDreams share price, which will get into later in the article. When they held their last CMD just over three years ago in November of 2021, the company laid out three-year projections. I don’t think that it can be understated how aggressive it was for an online travel agency (“OTA”) to do this in the early days coming out of COVID, but they did it. How did it hold up? Well, despite the subsequent emergence of the COVID Omicron variant, the invasion of Ukraine, a period of high global inflation (that was particularly bad in Europe), and war in the Middle East, eDreams is on the cusp of hitting their projections of having greater than 7.25M Prime Members (2.0M at the 2021 CMD) and €180M of Cash EBITDA (€2.9M LTM at the 2021 CMD). Hitting these aggressive targets speaks both to management’s ability to execute and the predictability of the Prime Subscription Business Model. Now, let’s get into the CMD.

Management’s Victory Lap

Being two months from the end of FY25, Management is confident in hitting their long-term projections.

Delivering despite a challenging macro backdrop.

The key to the success was transitioning to the Prime Subscription Model, which grew steadily.

The steadiness of the Prime Membership growth is impressive when considering it in light of passenger traffic figures.

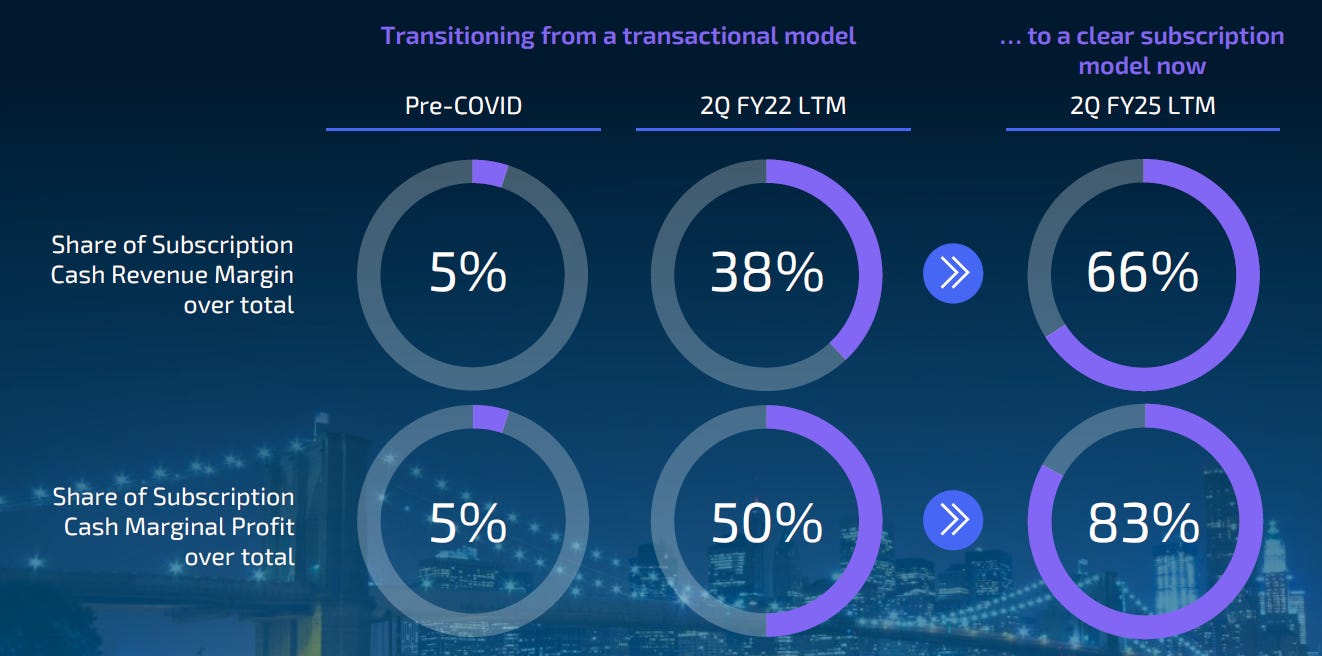

Looking at the below, the company is fairly transformed as Prime currently contributes 83% of Cash Marginal Profit.

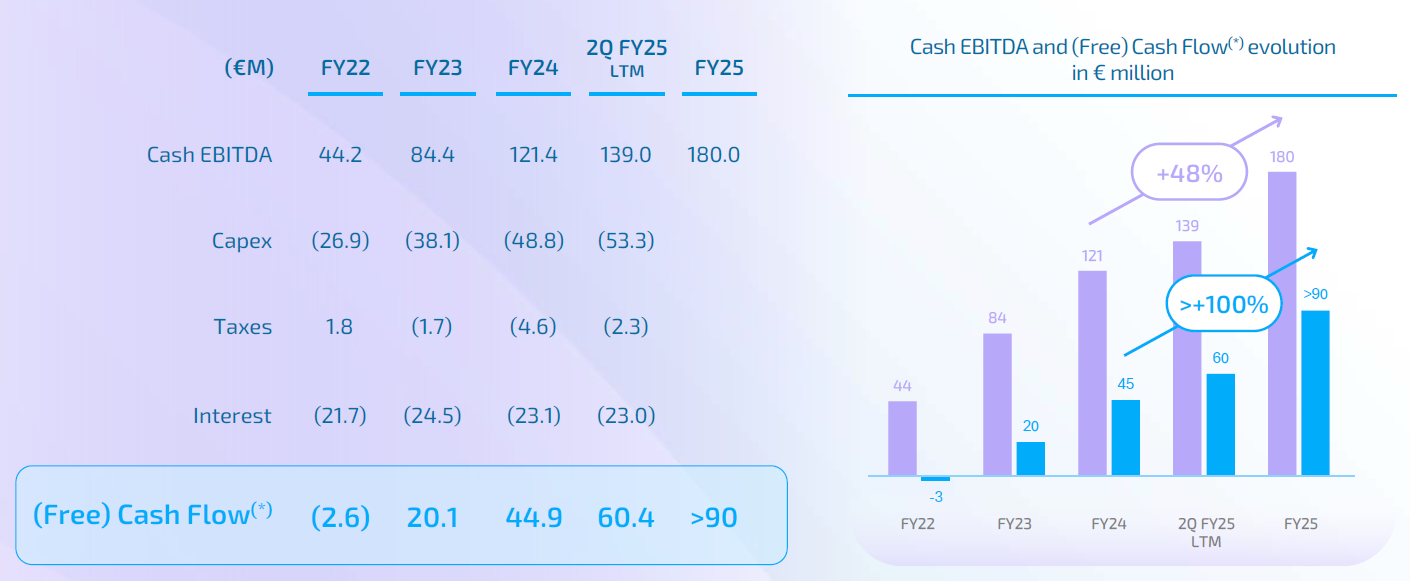

The transformation is reflected in their strong earnings growth. Although, its worth pointing out that subscription business models run much of their long-term investments through the income statement. So, this EBITDA is burdened with ample growth expenses that will generate earnings for several quarters if not years.

The business model generates strong FCF as well, with its growth ramping up as the higher Member numbers get leverage on initial investments.

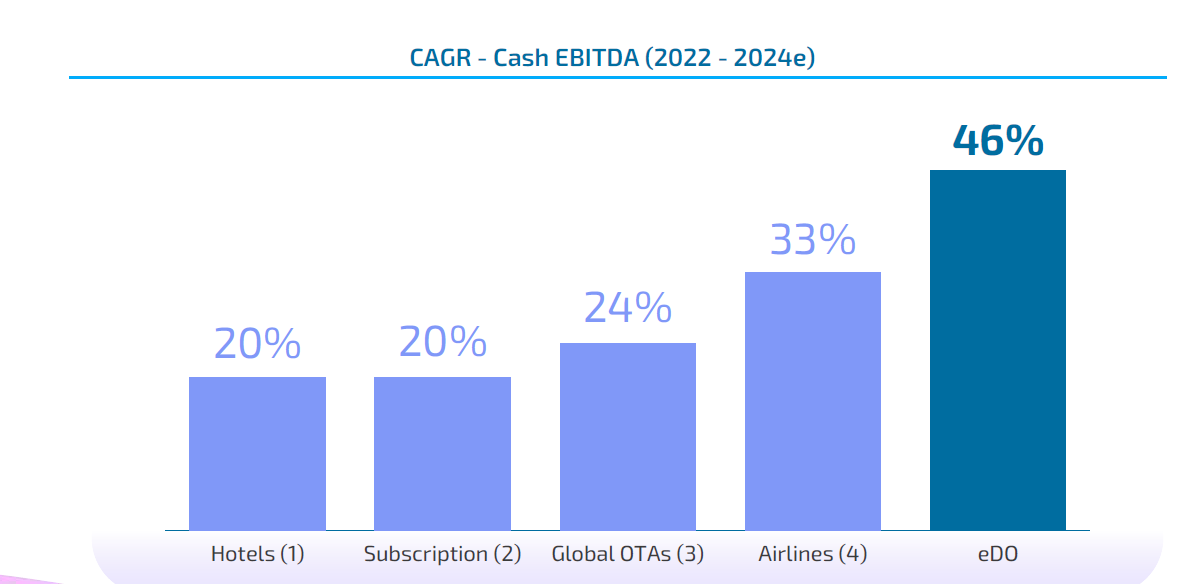

The durability of the Prime Subscription Model allowed eDreams to outperform its peers during the same period.

To further illustrate the durability of the Prime Model, its worth noting that eDreams never changed their 3.5 year guidance, something that few travel companies can claim.

Why create a subscription model in travel?

To start, we highlighted the durability of the earnings stream above, but comparing subscriptions programs in general to travel-related companies, subscription models seem to have financial benefits via higher margins and premium valuations.

Getting into OTAs specifically, the Prime Program solves the Google problem that plagues the industry, gives higher revenue predictability, allows for greater customer personanlization, and increases both customer loyalty and their lifetime value (“LTV”).

The Prime Program is now one of the top-10 subscription program in Europe and is the youngest program on the list.

Prime provides a one-stop shop for customers by providing unique customer itineraries.

The Prime offering continues to expand. A couple new offerings that particularly add value is the ability to freeze the price of any flight for €1.00 and the ability to cancel 2 flight bookings made in the app for free - the latter is a feature of Prime Plus. The insurance value of this probably covers a good portion of the Prime Plus Subscription Fee.

Here’s the price freeze for a Euro case study….

Which results in higher Prime Renewal Rates.

Price Freeze is nice, but the two key benfits of Prime to Members are price savings and customer service……

There are ample cost savings (I recently booked a flight hotel combo and my savings exceeded the cost of the Prime subsription), but don’t discount customer service. In an industry where the customer is often forgotten immediately after making a booking, eDreams prides itself on its customer service. They’ll even pick up the phone when customers call - usually within 60 seconds. The calls will be recorded, transcribed, translated into English, and fed into their AI model, but that’s another story…..

The Prime Value Offering of Cost Savings + Increased Customer Service yields the highest Trustpilot scores in the industry…..

Which leads to lower churn, higher LTVs, and expanding earnings and margins…..

What Value does Prime Bring To Airlines and Hoteliers?

Airlines and hotels are well known within their home markets, but less known outside of it. There is little existing overlap within eDreams’ customers and that of an airline’s or hotel’s existing customer base. This incremental demand helps airlines and hoteliers improve their utilization and yield.

Can Prime be Replicated at Other OTAs?

The answer is maybe, but not easily. First, eDreams’ OTA competitors live and die by their take rate. Transforming into a subscription business would require destroying the current business model, running massive investments through the income statement, resulting in the destruction of reported earnings. I don’t know how many management teams would have the stomach to do this. eDreams started Prime in 2017, but they materially ramped it up during and post-COVID, when the expectations for reported earnings were already low. Second, eDreams’ leadership position in flights is likely partially the reason why it was able to make the transition. Performance marketing for flights is much cheaper than that of hotels. eDreams likely spends a large part of the first-year Prime subscription fee if acquired via a paid search. If a hotel-focused OTA tried to replicate this given the higher performance marketing costs for hotels, the price for their subscription program would likely have to be much higher if not multiples higher. It’s likely easier to get someone to sign up for a subscription if the price is €60 to €100 than if it is €200 to €300. eDreams building Prime on the back of flights and easing into hotels was quite savvy. It will be interesting to see how they market their hotel offering to hotel-first, or hotel-only customers who are not presently Prime Members, as performance marketing may not be the avenue. At the very least, this example illustrates the value Prime brings to its customers in hotels.

Artificial Intelligence

eDreams has been on this for long time.

eDreams getting some good recognition from Google.

AI is another way eDreams is leveraging Scale Economics Shared…..Also, one tidbit I picked up is that every movement on their website is tracked as well as every interaction with them. All customer service calls are recorded, transcribed, translated into English, and fed into their AI system, which helps them not only better serve their customers but also make >6B online AI predictions daily.

How Big Can Prime Get?

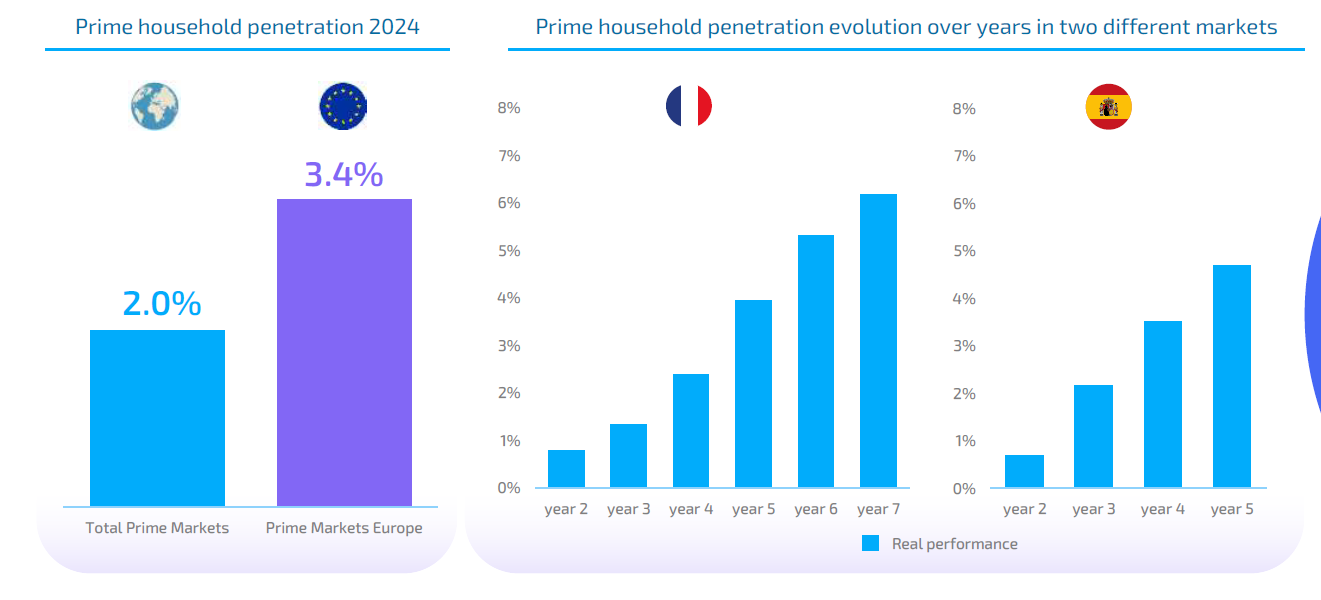

Prime is 3.4% penetrated in Europe, and France at 6.2% is its most penetrated market.

Prime could grow to 19M Members if the rest of the markets got to France’s level of 6.2%. If all markets got to 10%, then Prime could grow to 30M Members. Slicing it another way, if their European markets only got to 10%, then it could get to 16.5M members. Any way you look at it, Prime should grow for a long time.

Prime Member Retention

eDreams has increased its offerings for Prime. First it added hotels and car offerings. Later, other offerings came into play such as Advanced Refunds, Price Freeze, Cancel 2 Flights no questions asked, exclusive vouchers, and the ability to share it with friends and family. Some of the new products come at a cost to eDreams, which is why ARPU seems to have plateaued. That said, the new offerings likely increase the LTV.

The increassed LTV is expressed in rates of repeat business.

Financial Projections

Let’s start with financials which have been strong post COVID.

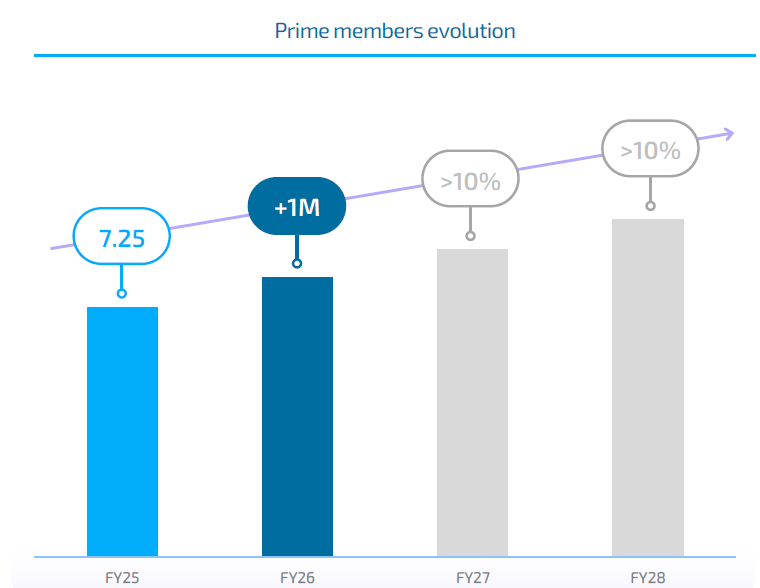

Prime Growth Projections of +1M in FY26 and >10% for FY27 and FY28 seem light to me. Perhaps the company is sandbagging a bit. They gave strong long-term projections at the last CMD and their stock price wasn’t rewarded for it, so I don’t blame them for setting up a beat and raise cycle.

Cash EBITDA for FY26 seems light, but at ~20% growth over FY25 is perfectly acceptable…

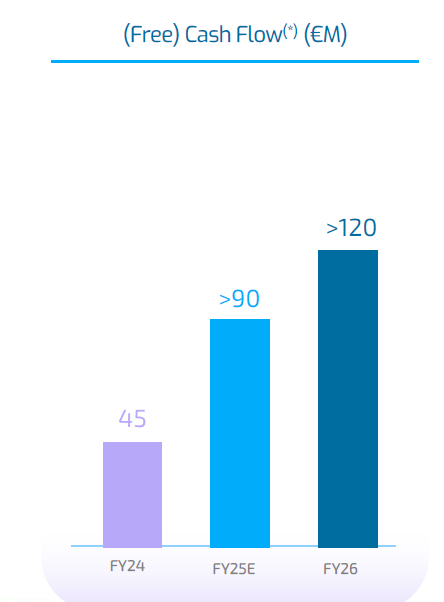

Free Cash Flow looks especially light, despite being ~33% higher than FY25’s. €220M of EBITDA less €60M is €160M. Take out €28M for taxes and interest and you are at €132M. Not a big deal, just another example of their conservatism.

Based on their, likely conservative, projections, they trade at an 11% FCF Yield. Below are some uses of cash. I’ll start with stating that debt will naturally de-lever as they grow. Given where they are trading at, one might up size their debt when they refinance it and use the extra cash to buyback shares. M&A probably makes very little sense given their transition to Prime. The last thing you want to do is double down on transactions. With respect to dividends, for a company that is growing and priced as cheaply as eDreams is, the only dividend that makes sense is one that is de minimis in size but growing. It makes much more sense to deploy capital into share repurchases, but I could see deploying a small amount into dividends and allowing that to grow if doing so would increase the possible shareholder base - some firms require their holdings to pay a dividend, while others mandate that the dividend grows. Some examples of companies that do this well are HEICO, Chemed, and Roper.

eDreams’ peers trade at a much lower FCF Yields with much lower FCF growth rates. If eDreams traded at its comps’ FCF Yields the resulting share price would be: Airlines 4.8% (€20.49), Global OTAs 3.9% (€25.22), Hotels 3.5% (€28.10), B2C Subscription 2.8% (€35.12).

Just to reiterate this point, I expect eDreams FY25 EBITDA margin to be 24%, topping both the Global Subscription and OTA comp sets. Additionally, its trading at an EV to CY24 EBITDA multiple of 8.5x, below the OTA comp set and far below the Global Subscription comp set. If eDreams (likely with faster growth) traded at the Global B2C comp set, it would be priced at €29.67 per share.

The Ugly Duckling

Looking at the above two slides, it’s clear that eDreams’ stock price should at least begin with a “2”. If you comp it to Global Subscription Businesses’ FCF Yield, you get in the mid-thirties per share. The discrepancy between trading value and intrinsic value is remarkable and reminds me a bit about the story of The Ugly Duckling. By transforming from a transaction business into a subscription business, eDreams looked differently than its peers. It probably looked ugly for a period of time as the investments made into the Prime transition lowered its earnings and FCF. But looking at it today, with ~7M+ Prime Members, margins that likely exceed that of both Global OTAs and B2C Subscription Businesses it is easier to recognize eDreams as a beautiful swan. Of course, this situation is not unique to eDreams. There were several examples of this about a decade ago when licensing businesses such as Adobe and Autodesk transitioned to the cloud. They looked like Ugly Ducklings at first, but where ultimately rewarded by the market (at least in the US). If I remember correctly, the Tiger Cubs were all over these opportunities….if any of you are reading, do you want another bite at the apple?

So, how does eDreams get valued like a swan? I would start out by saying that the stock price appreciation will likely need to be driven by Management. I read a few analysts’ reports coming out of the CMD. All of them raised their price targets (which is nice), but none of them valued it as a subscription business. To date, Management has transformed the business and instituted a share repurchase program. Neither of these efforts have materially closed the valuation gap yet. That said, they are data driven. They were also quiet on this topic at the CMD. My gut is that they are formulating a plan. There are plenty of options for closing the valuation gap. The first option is continue the current path. eDreams’ FCF is growing. The FCF next year is expected to be in excess of ten percent of the market capitalization. If dedicated to share repurchases, that is quite a perpetual bid to support the stock price. This option could also lead to eDreams being included in the IBEX 35, the premier index in Spain. The second option would be to sell the company. Given the growth prospects of the company, I am not in favor of this option, as I want exposure to it as a shareholder for a long time. That said, eDreams’ Prime Program likely has strategic value to some companies, as mentioned in a previous article of mine. Additionally, the growing FCF would be attractive to financial sponsors. Lastly, a re-listing on the NASDAQ would bring the company into a market that likes travel assets, understands subscription businesses, and has less restrictive rules with respect to executing share repurchases. Management has been focused on transforming the business during a challenging time. Now that its transformed, I believe they’ll divert attention to closing the valuation gap. Given the success they had in transforming the business to date, it’s worth giving Management some latitude in forming a new plan. I am eager to see what they come up with.

Disclaimer: For informational and entertainment purposes only. Not a solicitation or offer to buy or sell any security. Due your own due diligence.

Thank you for highlighting!

Thanks for his, helpful. Can you explain the middle bar on the demographics barchart on slide 32? It is the only bit I don't understand.