Unpacking DigitalBridge's Fourth Quarter

If you want complicated, you’ve got it.

There were two major areas in DigitalBridge’s (“DBRG’s”) fourth quarter earnings release – fourth quarter results, and future projections. So, I’ll start with each category below with the results followed by the projections. That said, DBRG is a highly complicated story, but not complex. Complicated like a chronograph watch, or the engine of a Ferrari, it has a lot of moving parts. An engine or a watch you can take apart and put back together and it will work the same way every time. Point is that while it takes time to pull the numbers apart and analyze them, you can do it and figure out what is going on. As opposed to something complex like the weather or the daily movements of the stock market. The industry that DBRG operates in is especially complicated, as you have funds that hold several investments. Those investments do well or not, which determines a firm’s ability to raise subsequent funds and generate carried interest. In the meantime, those funds earn a steady and predictable stream of management fees. What makes DBRG especially complicated is that it started as a REIT, meaning it made investments on balance sheet. As a result of the abuses of Enron, DBRG is forced to consolidate into their financials their investments in DataBank and Vantage SDC (“Vantage”), despite owning only 11% and 13% of these businesses, respectively. The good news is that these two businesses will soon be sold below the threshold for consolidating them, so will mostly go away from a reporting standpoint. The bad news is that it has not occurred yet, and DBRG made changes to their guidance methodology to set the business up to simplify its reporting and get it ready for a post de-consolidation reporting regime. However, the new methodology may not be fully understood yet by investors. Accordingly, I’ll spend some time at the end to highlight where investors may be looking at the projections incorrectly and the ramifications on valuation.

Q4 Results

Fundraising:

DBRG raised $1.4B of FEEUM in the quarter, ending the year $4.8B raised (+52% YoY if you include AMP, and +21% without it). Of the $1.4B raised, $400M was for their liquid fund offering (which does not get talked about too much despite having excellent performance in 2022), $100M each in their nascent Credit and Core Funds, and $900M in co-investments. Investors may have been a bit disappointed, as many were expecting to see more progress made on the Core and Credit Funds, and perhaps some indication of the size of DBPIII. That said, the company closed sizeable transactions in Q4 and Q1 23, so it makes sense that co-investments were the focus in Q4. Going forward, the company expects to raise at least $8B of FEEUM in 2023, on its way to raising $50B+ by the end of FY25 (this is a slight reduction to past guidance, but let’s look closer at that below). I admit, I was disappointed not to see some projections articulated on the sizes of Core, Credit, and DBPIII, but that should come in the next couple of quarters. With regards fundraising, CEO Marc Ganzi (“Ganzi”) noted that January and February were good months for their fundraising efforts, and with regards to DBPIII, they have 80 investors in DBPII. In the last 4 months they have spoken to 79 of the DBPII investors. Not one has said no to investing in DBPIII. They are anticipating getting 80% of their DBII investors into DBIII, and because allocators’ funds are now smaller, they expect commitments to be 20% to 30% smaller than what it was for DBII. If that projection holds, that puts them near $5B for DBPIII from DBII limited partners. Plus, they have been in dialogue with 200 new allocators and received verbal interest in around $30B of capital. I think this will get DBPIII to end up being between $6B and $9B, but we will see in the coming quarters.

Capital Deployment:

DBRG closed the $11B take private of Switch and the $19B take private of GD Towers. While I don’t want these two deals to be the focus of the article, I’ll say that Ganzi gave an excellent talk on DBRG’s plan for Switch at the Pacific Telecommunications Council’s Keynote Presentation. I believe he eviscerates the heart of the shorts’ thesis that DBRG deployed capital into Switch at a high multiple in a frothy market, but you can decide for yourself.

Now that GD Towers closed in Q1 23, I hope that they do a similar presentation on that investment.

Portfolio Performance:

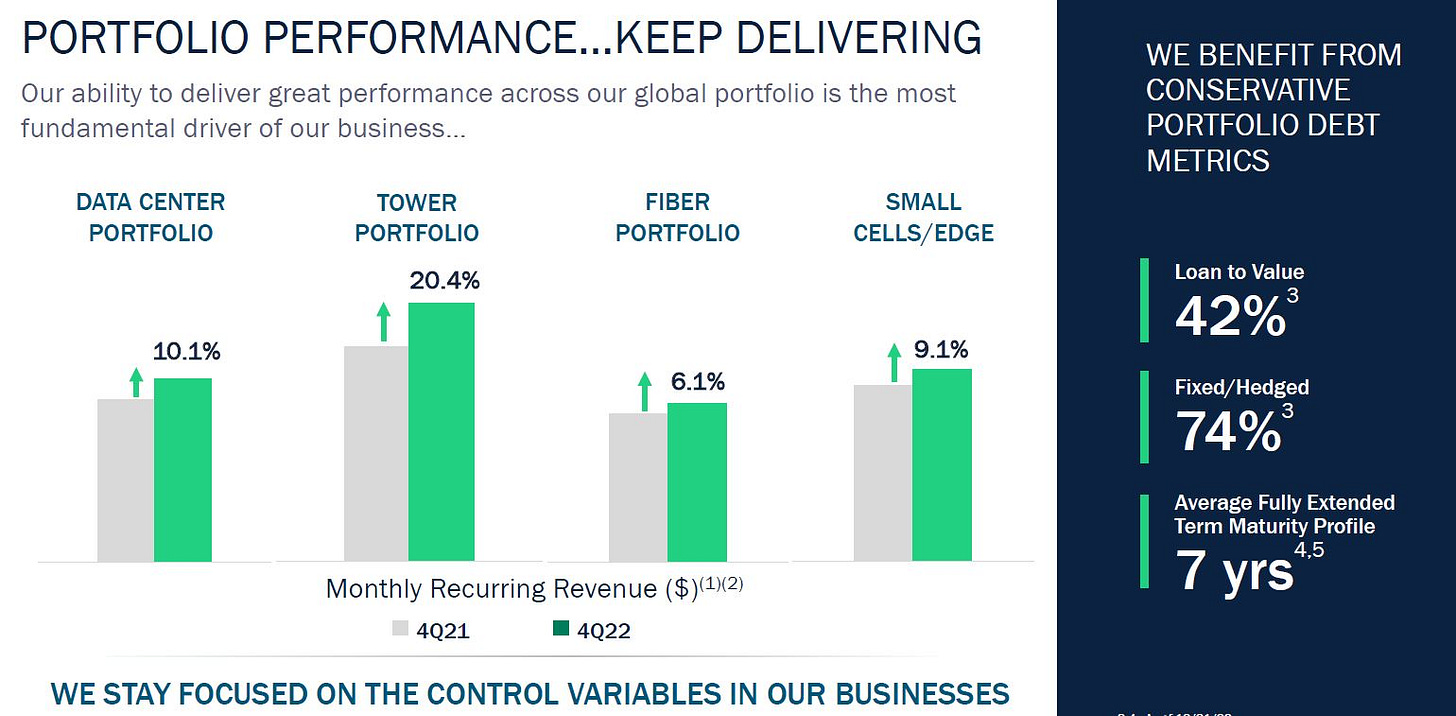

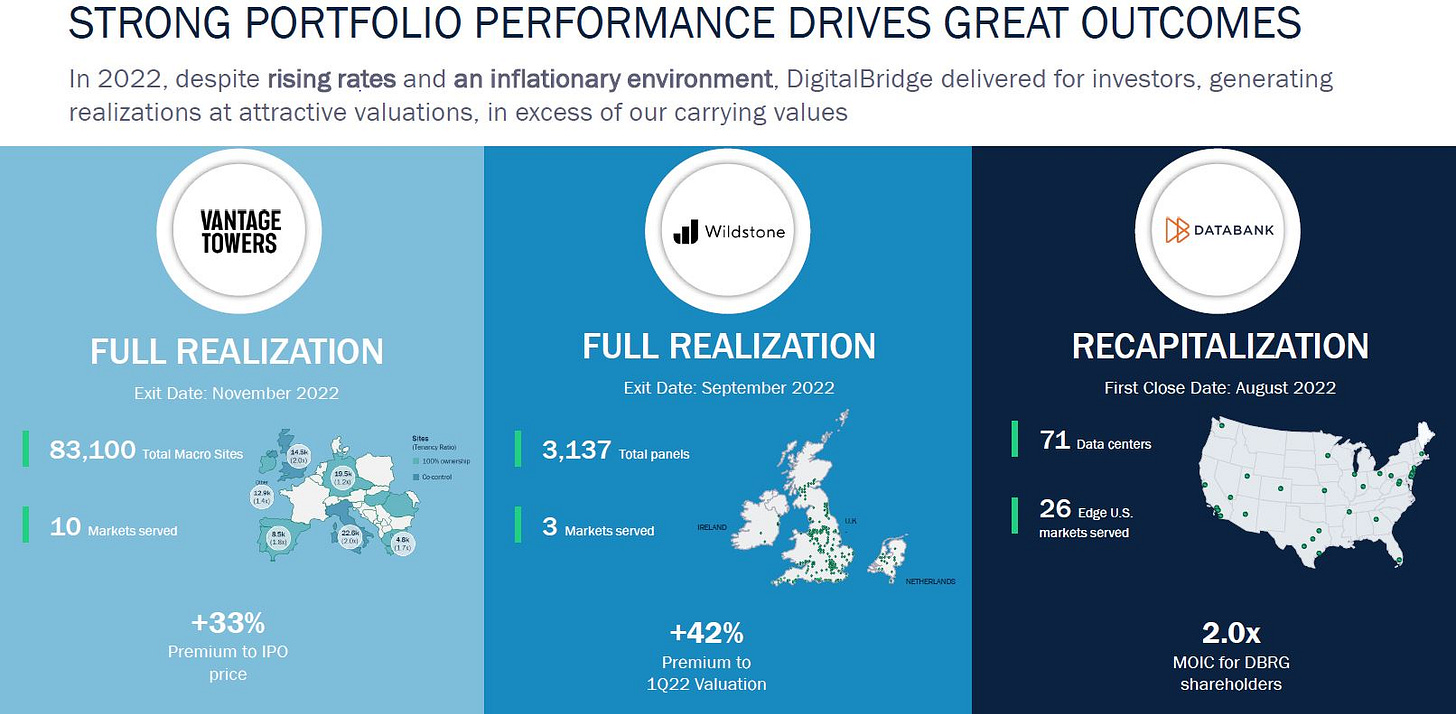

Portfolio Performance seems strong, but given that most investments are in funds, this is somewhat opaque. Below are a couple interesting chart from their Q4 slide deck. Despite the opaqueness inherent in this industry, we do see some indication of results with their recent monetizations.

Revenue and Earnings Performance:

Let’s start with the Investment Management Segment’s historical results. Q4 results looked decent, the FEEUM was up 22%. Revenue was up 18% with FRE up 2%. $12.4M of carried interest was generated. The issue is that headline revenue and FRE results were down 21% and 30%, respectively. The headline numbers had non-recurring catch-up fees and incentive fees in the Q4 21 figures. This made the results look negative, but the catch-up fees should be removed from the calculation to adequately asses the health of the business. Catch-up fees are generated when a fund is launched, capital is raised, capital is deployed, fees are earned, and subsequently, new capital is raised, which then pays catch-up fees to get them level with the existing shareholders. Basically, it's revenue and earnings, that should be retroactively applied to a previous period. With respect to the Operating Segment, consolidated revenue and EBITDA were up 21% and 17%, respectively, which shows strong combined results of DataBank and Vantage. That said, DBRG’s share of this revenue and EBITDA went down 14% and 15%, respectively. That is because DBRG’s ownership of DataBank went down in the recap. The negative number are not indicative of an issue, just a natural consequence of the recapitalization.

De-consolidation:

Analyzing the business will get much easier once the operating assets are de-consolidated. I expect this to happen in the next two quarters. Aside from getting easier to analyze, the business will screen better with respect to its GAAP earnings and leverage ratios. It looks highly levered today, but it really is not – this will be apparent after the de-consolidation. Note, the company could have already de-consolidated without selling down additional amounts of DataBank and Vantage. All they had to do was give up some board seats, and lesson their controls of these companies. However, would you want them to do that? I wouldn’t. They made the right decision to de-consolidate by selling down, even though doing so takes longer than they would like.

Guidance:

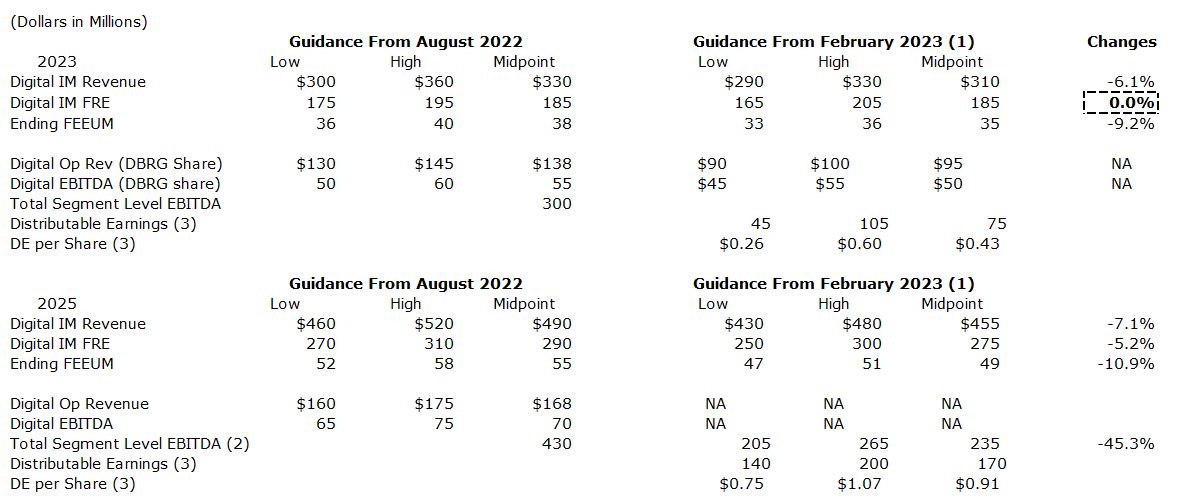

Next, we have the company’s guidance update. Yes, they provided an update to guidance. Yes, it went down in some cases. Yes, they added some new metrics, and the new metrics were lower than what the street thought they would present. The company’s FY 25 FEEUM estimate dropped ~11%, and the stock price dropped ~11% the day of the earnings release, so this seems to be what investors quickly focused on. I think it is worth looking closing at each piece of the guidance and changes to see what exactly changed. I created a chart that shows the latest guidance versus the last update.

Let’s start with FY 23 Guidance before moving on to FY 25.

FY 23 Guidance:

Note: (1) Guidance assumes no M&A deployment into complementary asset management platforms (private equity is likely the next offering for them).

Digital IM Revenue: Revenue guidance went down 6.1% for the fiscal year. On the surface, this looks bad, but the FRE gives us a clue to what is going on.

Digital FRE: Revenue is going down, so FRE should be going down too, but it is flat. What is happening here is that InfraBridge (formerly AMP) comes with $5.6B of FEEUM. However, $1B of that is low margin business. That $1B is getting kicked out, so InfraBridge is really $4.6B of FEEUM. After kicking out that business, revenue goes down, but margins stay the same. So, the revenue guide down was not really a fundamental change, as it was a business decision regarding InfraBridge.

Ending FEEUM: This was guided down from $38B to $35B. It is worth mentioning that with M&A, this category exceeds the previous guidance, and M&A was probably baked into the previous guidance. Setting that aside, $1B of the reduction is the change at InfraBridge. Another $1B is conservatism on the company’s part. They are not uncomfortable with the state of the fundraising market; however, to generate fees, you need to raise capital and deploy it. FEEUM gets turned on once deployed. They gave themselves some breathing room here, which is fine. I much rather them take their time in deploying capital than setup a false deadline to deploy it.

Digital Operating Revenue and EBITDA: This went down, but this is only related to the Q4 and future recapitalizations of DataBank and Vantage.

Total Segment Level EBITDA: This went down, but again, FRE was flat. EBITDA from the operating assets is going down, as DBRG is owning less of them.

Distributable Earnings (“DE”): This is a new metric, that is a result of the transformation from a REIT to an Asset Manager. Clearly, this disappointed the analysts. That said, the are some issues in how some of the analysts were setting up their own estimates and how DBRG presented their DE guidance.

First the Street, many of the analysts that cover DBRG are telecom analysts and are unfamiliar with the intricacies of asset manager metrics. As of Q4, DBRG corporate has GP contributions in their private and public securities funds of over $500M. I suspect that the analysts included in their DE calculations, the compounding of DBRG’s invested capital. This would get picked up in EPS, but in DE, only realizations get picked up. DBRG is not forecasting realizations, so their DE estimate is artificially light (they will have realizations).

Furthermore, DBRG is not projecting carried interest in their DE, which is part of the standard DE calculation.

Also, it was not readily apparent that they were assuming the existing capital structure to calculate the DE estimates. The existing capital structure burdens their DE estimates with $59.1M per year in annual preferred dividends payments, which will likely be reduced through repurchases of the preferred shares. More on this issue below.

FY 25 Guidance:

FEEUM: FEEUM is moving to $50B+ down from a range of $52B to $58B. As with FY 23 projections, there is the InfraBridge change of $1B, the lack of M&A in guidance, and some company conservatism. Again, I don’t think there are any apprehensions regarding the fundraising environment; they just want to be conservative around timing. Would it matter to you if raised capital came in January of 26, as opposed to December of 25? In the long run, such distinctions are meaningless.

The FEEUM changes, flow through to Revenue and FRE guidance, which are slightly lowered from the previous guidance.

Segment Level EBITDA guidance is going down 45%, but again, this is mostly related to the de-consolidation of DataBank and Vantage.

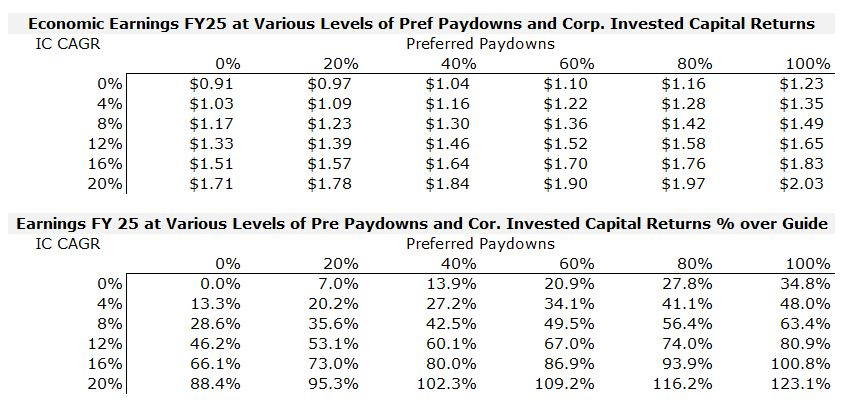

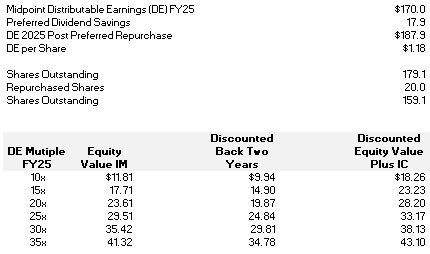

DE guidance was given and it likely disappointed analysts for the same issues as above (lack of realized gains assumed, no carry assumed, burdened by the prefs.). I created a couple of charts, which show the per share economic earnings - basically DBRG’s DE guidance plus the gains on DBRG’s invested capital (assuming various return levels) and paying down various levels of the preferred stock. This is a more realistic example of the company’s economic earnings – and note, carry is still excluded! So, if they paid down 40% of their preferreds, and generated a 16% on their invested capital, then the economic earnings (excluding carried interest), would be $1.64, or 80% higher than their FY 25 DE guidance.

Valuation:

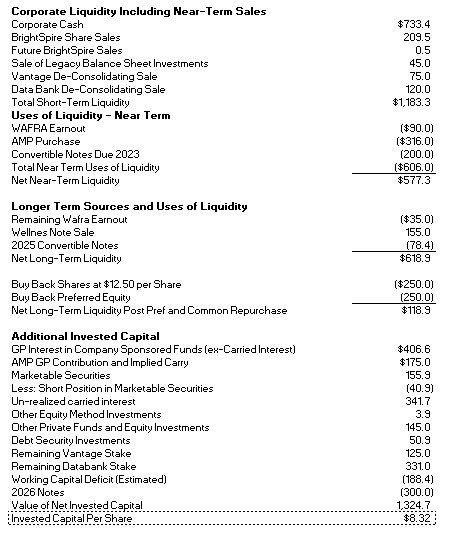

Brookfield Corporation has similar valuation dynamics where you value separately a fee stream from the an asset management business and assets on the balance sheet. I’ll use that approach for DBRG. Let’s start with the balance sheet. Note that in the valuation, I assume that they spend $250M to buy back common equity and $250M to buyback preferred equity. This leaves them with ~$119M of liquidity in which to deploy into digital M&A (that I am not assuming they do). The only additional major assumption was assuming they have a $500M working capital deficit. End the end, I estimate their invested capital is worth $8.32 per share.

Now for the Asset Manager business. I am valuing it off of FY25 DE, and discounting it back to today using a 9% cost of equity. Additionally, I am using the $250M common equity and $250M preferred equity buyback assumption noted above. Lastly, I am assuming that there is no carry in DE, so we carry, in excess of what is accrued, for free. Worth noting that Blackstone currently trades at 21.8x DE. Blackstone has both realized invested capital gains and carried interest in its DE estimate, so it is not exactly an apples-to-apples comparison. Blackstone has a fantastic reputation and a long history; that said, I don’t think their earnings growth will match DBRG’s over the intermediate future. Given this, I think that it is fair for DBRG to trade in the 20s to 30s; certainly not the 3.5x FY25 DE (assuming no carry in DE) or 7.0x FY23 DE implied by today’s price.

What Could Go Wrong?

As complicated as the business is, the drivers for realizing value are simple. What do they do? They raise capital, they deploy capital, they steward their portfolio companies, and they harvest their investments. During this time, they earn management fees on their raised capital. If the investments are successful, they generate carried interest (most of this goes to the investment teams, but some comes back to the c-corp.), they have the ability to raise new funds, and do it all over again. There are two obvious risks. First, their portfolio companies fail generate adequate returns. Second, they never raise another dime of investor capital. Let’s suppose this happens. These are long-lived funds. They will have several years of management fees coming in. If they are capped at their current $26B of FEEUM, at 90 bps their revenue would be $234M. At 65% margins, their FRE would be $150M. Let’s apply $40M of overhead, though in rundown mode, this could be a lot lower, and that gets us to $110M in free cash flow. In a draconian situation, they wouldn’t spend the $500M I assumed they would for preferred and common share repurchases. Adding that back to the balance sheet get the balance sheet value to $11.47per share. If the runoff took 8 years, the present value of that cash flow stream would be ~$608M, or $3.40 per share. Adding the NPV of the fee stream and the working capital together, and subtracting out the preferred shares leave common with $10.24 of value. Today’s price (3/9/2023) closed at $12.10 per share. Not too far from runoff value.

What Catalysts Could Help the Stock to Work?

De-consolidating the operating assets.

Holding an analyst day once the operating assets are de-consolidated.

Have substantial closes on Core and Credit as well as provide credible target sizes for the funds.

Have a first-close of DBPIII and provide credible guidance on the fund’s target size.

Realizations of mature assets in the current funds, which generate carried interest.

Doing a Pacific Telecommunications Counsel Switch-style presentation for GD Towers.

Speculation regarding a sale of the business. I want to own this for a long time, but Ganzi has $100M reasons to get the stock to $40 per share by late February 2024, the closer we get to that date, the more likely sale rumors are to come out.

Executing more preferred and common equity buybacks ; couple this with a larger than expected sale of DataBank or Vantage and use of that cash for more repurchases, and that could be quite a kick starter to get the stock moving up.

Raise FEEUM at a faster pace the guidance.

M&A: buying a complimentary investment management platform (private equity).

Ganzi and CIO Ben Jenkins (“Jenkins”) invested off their personal balance sheets into deals they led prior to merging their business with Colony Capital and forming the now DigitalBridge. They still have significant investments in these deals and are eligible to earn carried interest. Significant fees were earned in the last year, and I anticipate more to be earned by them given the up-coming de-consolidation of DataBank and Vantage. Ganzi and Jenkins using their proceeds generated from DBH, DataBank, and Vantage to buy stock in the egregiously cheap DBRG C-Corp. would be a strong vote of confidence that would likely be noticed by the market.

Disclaimer: For entertainment purposes only. Not a solicitation to buy or sell a security. Due your own due diligence.

Great write up! I have two questions on the B/S.

1) On valuation for Vantage and DataBank, assuming 20x LTM EBITDA (which is low given DataBank recap is at more than 30x) * LTM EBITDA number which is $380m in 2022 * ownership of 12%. I get a total valaution of $912m. In your calculation, you have $651m (75+120+125+331). Is it becauase you are assuming a lower multiple?

2) On GP interest / warehouse investments, the company reported $449m (I got it from supplemental>>tab Other), but your number is much higher than this. May I know if I missed anything here?

Thanks!

Excellent write up thank you. Perennially a little disappointed with the presentation of data in the supplements. FEEUM is so crucial to understanding the company and yet their presentation of it obscures more than clarifies. Also, why start showing DE if you are not going to calculate it in a way that allows comps to other alt managers? Continue to believe DBRG is an incredibly easy hire (career risk-wise) for any institutional allocator.