Texas Pacific Land Corporation - A Remarkable Company with Abhorrent Governance.

Texas Pacific Corporation Is a 100+ year old company, which started out as a trust, but converted to a C-Corp. in January of 2021, after a long fight between the legacy trustees and a couple of long-time shareholders who went active on the Trust. Note that these long-time shareholders are not activists but were just shareholders tired of the shareholder unfriendly decisions of the legacy trustees. The point of this article is not to give an in-depth history of the legacy trustees’ / current board’s actions, but to look at the recent proxy released on September 16, 2022. I’ll go through each of the items in the proxy; however, for more history on the past actions of the trustees/board, see the great blog on company, https://tpltblog.com/.

The first proposal is the election of directors. Two of the directors were put on the board by the legacy trustees and have probably not pushed the board to be more shareholder friendly during their tenures. I’ll end comments here, but again, the TPL Blog is a good source for further reading.

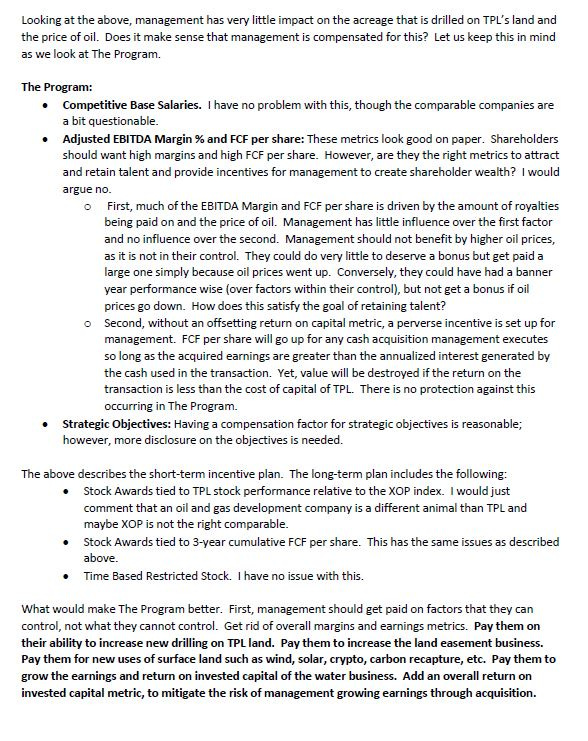

The second proposal is the non-binding advisory vote on executive compensation. Let me start with saying that the current compensation scheme is atrocious. The TPL Blog had an open letter to the board from the shareholder. With permission from the author, I am going to borrow their criticisms of the program and suggestions for improvements. Excerpts from it are below and a link to it is as follows. https://tpltblog.com/2022/03/28/open-letter-to-the-board/

The third proposal is the amendment to the certificate of incorporation providing for the declassification of the board. The board, shockingly, supports this proposal. I am glad they are supporting it and it will likely pass. That said, before we give the board too much credit, it is worth noting that the shareholders voted for this last year via a non-binding proposal. The board took several months studying the issue before deciding to place a binding vote on this year’s ballot. If the board truly wanted to be shareholder friendly, they would have held a special meeting early this year and held a binding vote then.

Proposal 4: It’s a Trap!

The fourth proposal seems great as the current share price is close to $1,800 per share and several investors believe that a stock split would help generate additional interest in the company. The board points out that more shares are needed to execute a split, ergo, please approve more shares. However, where it gets dangerous for shareholders is that they also say that the additional shares could be used as consideration for acquisitions, and as grants to employees. Regarding acquisitions, the long-held investment thesis in TPL is that it was a liquidating trust. No capital was necessary to grow the royalty businesses and all excess cash flow was to be used to pay dividends and / or retire shares. Furthermore, the company has a share buyback program in place, why go the other way? Last comment on acquisitions, management does not have the trust of the shareholders to deploy large amounts of capital via acquisitions. Regarding the stock grants, there are enough issues with management compensation to compound the issue by allowing the company another piggy bank to extract from.

Last comment on this proposal, if the board is interested in a stock split, why submit a shareholder proposal calling for a stock split to the SEC for no action? Listen to Admiral Akbar on this one.

Proposal five is the ratification of the auditor. No issue here.

Proposal six is the right for shareholders to call a special meeting at a 10% threshold. The board urges to vote no on this. This seems like a nice safety net against a bad board. Why would the current board not want this?

Proposal seven calls for the hiring of an investment banker to evaluate a spin of the water business. The board urges to vote against this, and I agree with them.

Proposal eight calls for the release of all remaining obligations of the stockholders’ agreement. So, the two shareholders who went active on the Trust were SoftVest Advisors and Horizon Kinetics. As part of the settlement between them and the trustees, which ushered in the conversion of the Trust to a C-Corp., these two shareholders gained board seats, but are, for the most part, obligated to vote as the Board recommends. This agreement neuters these shareholders, who own sizeable positions. The most shareholder friendly vote, would be to vote for this proposal.

Proposal nine is regarding the shareholders’ right to act by written consent. Of course, the board is taking the shareholder unfriendly view and recommending against this.

The meeting is November 16, 2022. Advice I would give to the board, is that if any of the non-binding proposals pass, do not let another year go by before having a binding vote, such as was done with the proposal to declassify the board. Have a special meeting as soon as possible so the shareholders’ wishes can be implemented.

Such a great newsletter; thanks for writing it!