SigmaRoc’s Capital Markets Day

Local Monopolies + Irreplaceable Products + Low Cost to End Customer + Savvy Capital Allocation = Shareholder Wealth Creation

SigmaRoc (aim:src), the leading lime and limestone provider in Europe, held their Capital Markets Day on May 6th. The business is interesting. Its products, lime and limestone, are necessities to modern life. While the video of the entire day is worth watching, if you only have a few minutes, watch the introduction, which explains what life is like without their products (you can watch here: https://www.sigmaroc.com/cmd). Aside from diverse end markets, the industry is similar to that of the aggregates space, it is comprised of local monopolies. Regulations and nimby sentiments inhibit the development of new limestone mines. Additionally, these products are expensive and sometimes dangerous to ship. Lime and limestone are often irreplaceable in their customers’ manufacturing processes. Despite this irreplaceability, lime and limestone are often, for the most part, a de minimis part of their customers’ overall cost of goods sold. This allows for the industry, and SigmaRoc, to be in a position to generate stable earnings throughout various cycles and generate strong returns for investors. With that introduction, let’s dig into some of their slides from the Capital Markets Day

Geographic Footprint

To start, let’s take a look at their footprint. SigmaRoc has 117 sites and is either number 1 or 2 in the United Kingdom, Northern Europe, and Central Europe.

End Markets and Applications

Lime and limestone serve a diverse set of end markets.

Lime and limestone applications are endless.

Lime specifically usually plays one of three roles.

No Substitutes Combined with a Low Cost

Below are applications for which there are no or, at least, less ideal substitutes.

Lime and limestones costs as a percentage of customers’ procurement bills are often small. Let this sink in. Lime and limestone are used in steel production. They represent ~1.6% of the cost of goods sold of steel, yet if a steel plant manager runs out of these inputs, the steel plant shuts down. Do you think the manager really cares if the cost of these inputs rise 10%, 20%,….50%?

Logistics Issues

I would imagine that most of the delivered cost of lime and limestone is in the shipping costs. It doesn’t ship well - particularly lime, which is a hazardous material. The challenges with shipping it, gives each quarry a local moat within a certain geographic area.

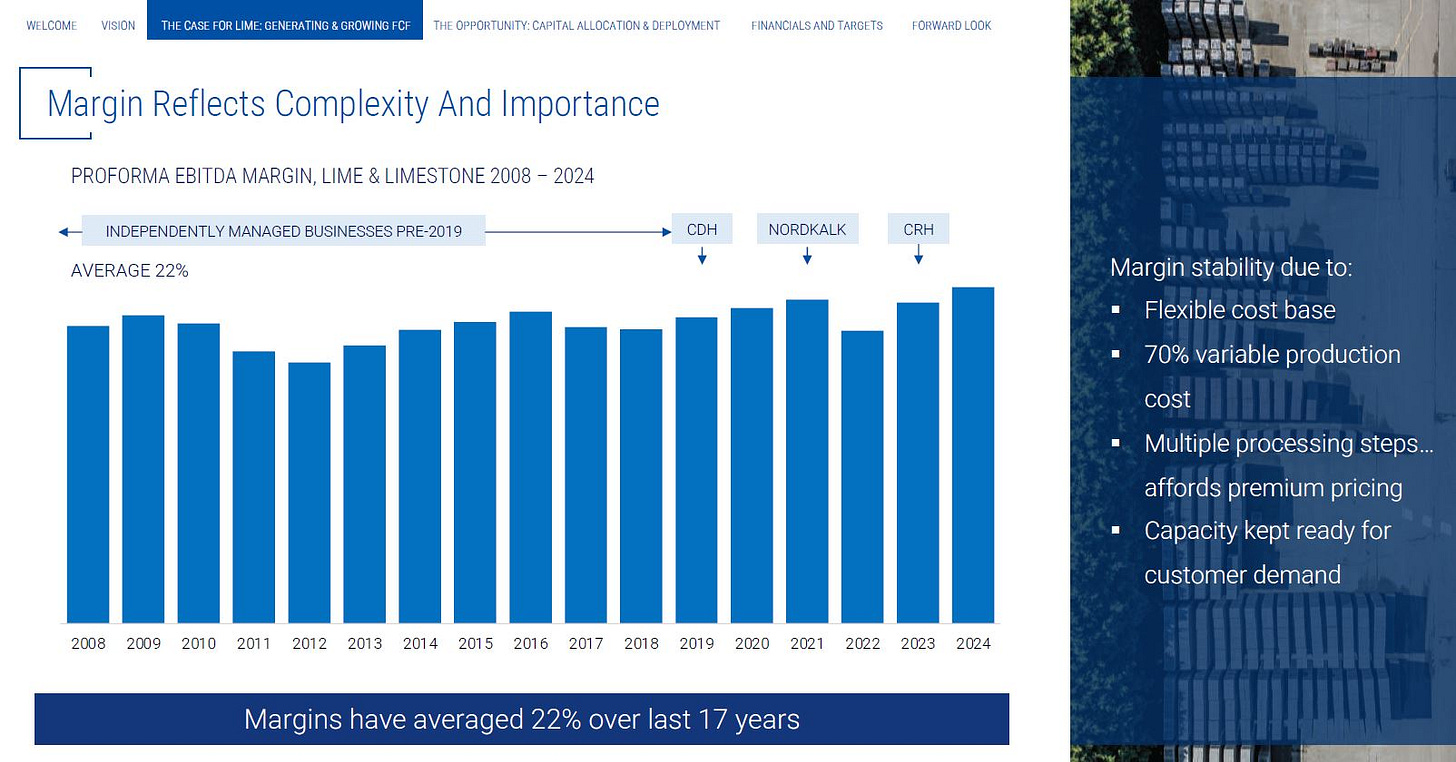

Local Monopolies - Irreplaceable Products - Low % of COGS = Stable Margins

The above characteristics, plus having a 70% variable production costs leads to having stable margins throughout various cycles.

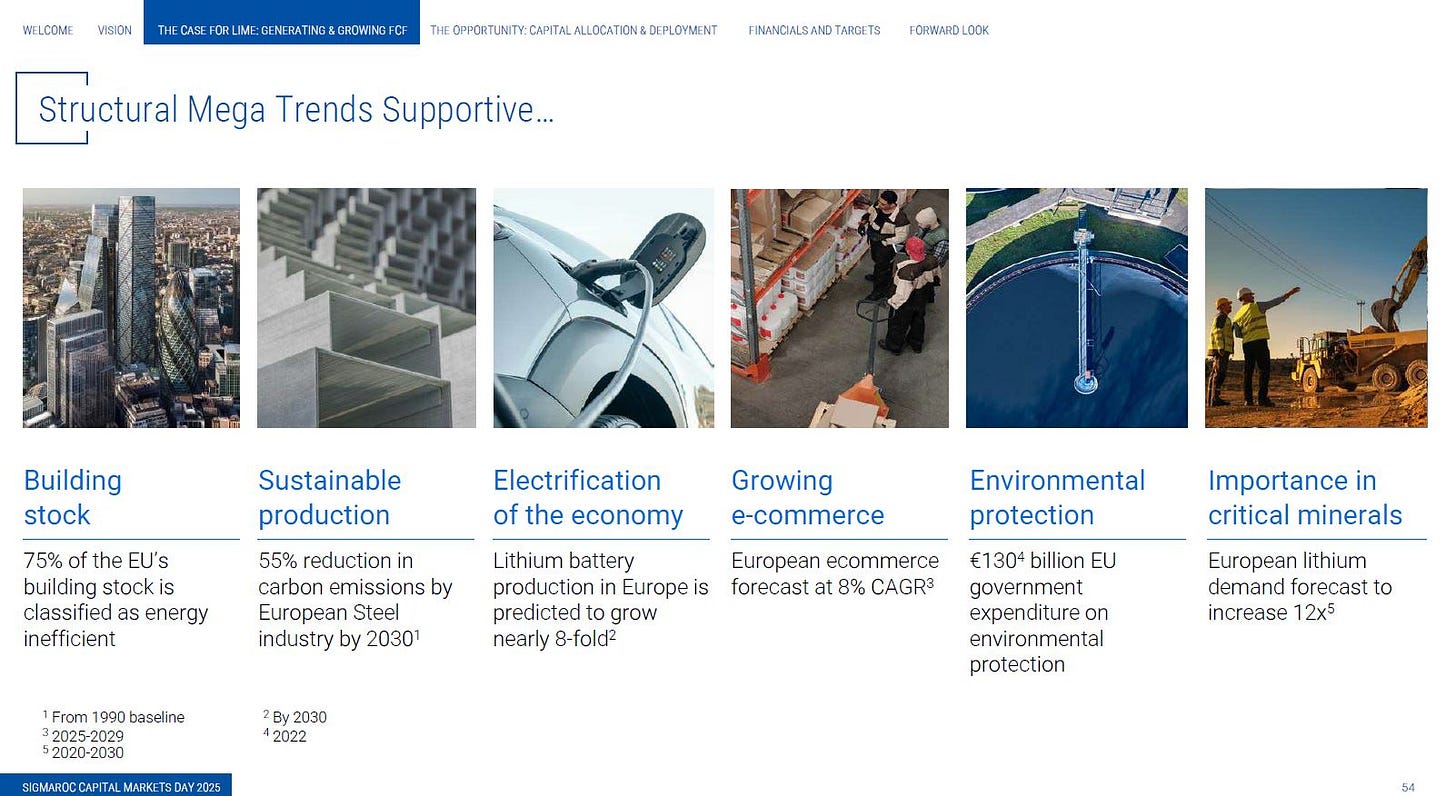

Trends to Support Volume Growth

There are several mega-trends that support the growth of SigmaRoc for the coming decade. Drilling down into just the steel industry (17% of SigmaRoc’s revenue), SigmaRoc not only benefits from economic recoveries of customers of the steel industry, but it also benefits from the transition to green steel. Green steel uses 2x the amount of lime in its production process.

There are some large, but hard-to-quantify, upcoming tailwinds, which include the re-building of Europe’s defense industry and Ukraine’s reconstruction.

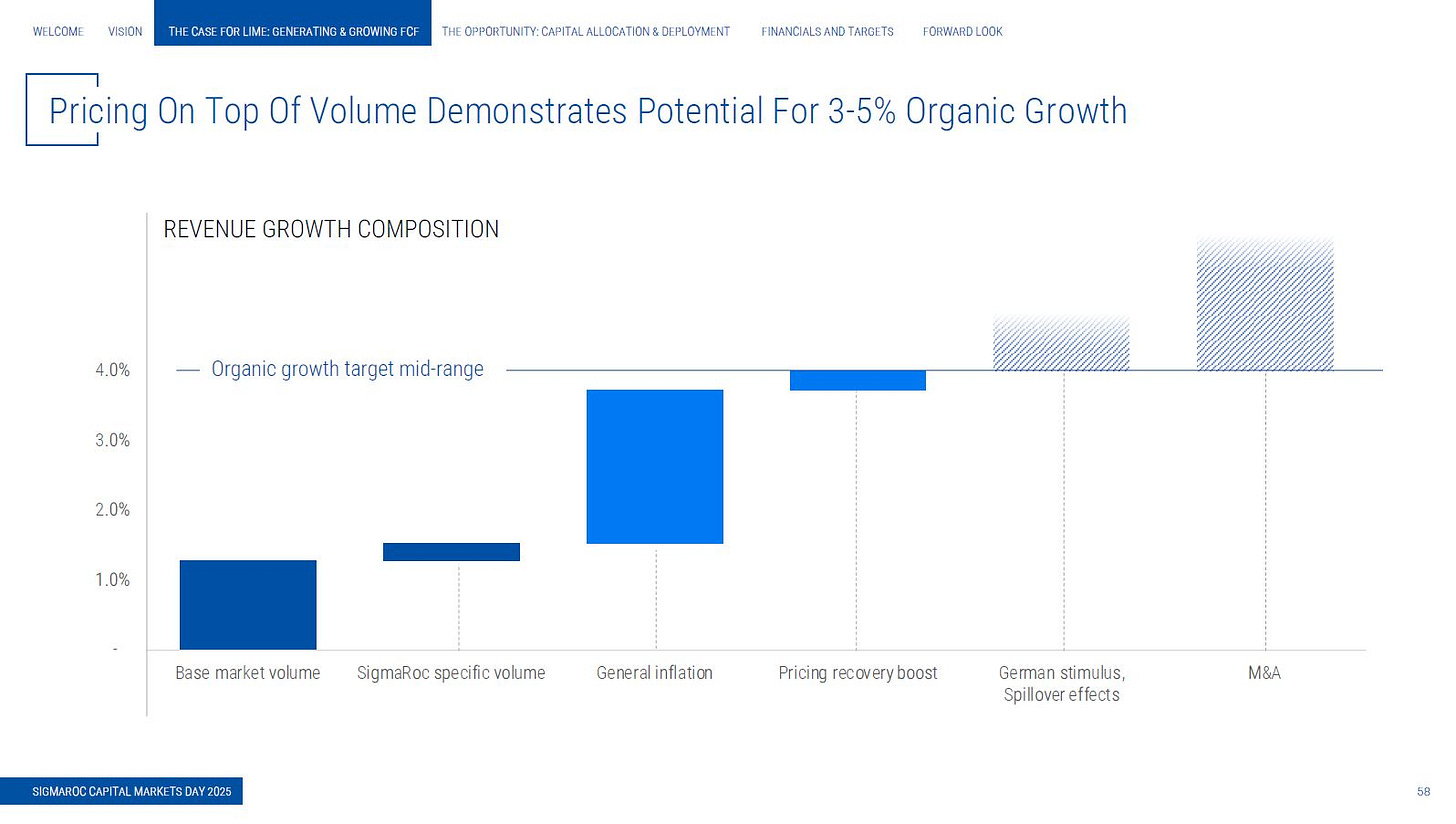

The trends lead to modest 3%-5% top-line growth estimates.

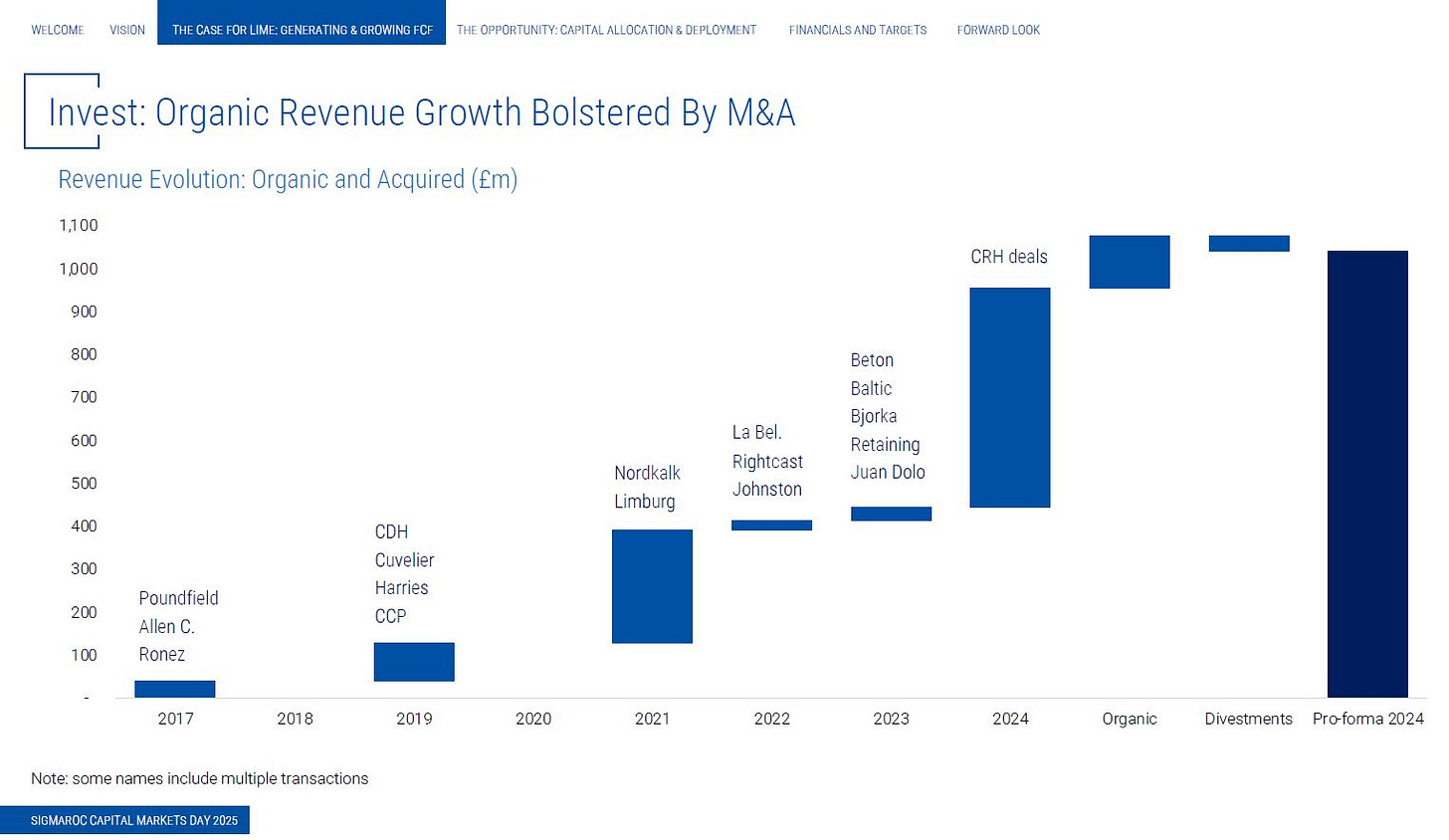

But don’t forget acquired growth - this management team knows how to do deals.

Not only does their M&A strategy grow the revenue, but via realized synergies, it also grows the earnings and buys down their purchase prices.

SigmaRoc’s acquisition history by purchase price, EBITDA contribution, and year.

Nordkalk - its second-largest deal after CRH - was a business with declining EBITDA before being acquired by SigmaRoc.

Post-Acquisition, SigmaRoc increased Nordkalk’s EBITDA by 38% over the course of 4 years.

Their early M&A activities laid a strong foundation for future growth.

M&A Isn’t the only high ROIC use of capital. Management also funded high ROIC growth capex initiatives.

Additional, and larger, growth opportunities are coming up!

Playbook Going Forward

SigmaRoc has been compared to specialty chemicals companies and aggregate companies. Its products having attributes that are irreplaceable to their customers yet are immaterial in a customers’ procurement bill are attributes it shares with several high-quality compounders. The game plan is quite simple. Own the quarries. Control costs and extract synergies. Maintain flexible costs base. Keep margins stable and working capital predictable. Supplement organic growth with M&A. Implement a capital return program once target leverage level is reached.

The below organic growth targets provide a base level of growth on which the company can enhance via tuck-in M&A and share repurchases.