Brookfield held the investor day for Brookfield Corp. (BN/BNRE) and Brookfield Asset Management (BAM) a couple of weeks ago. The management, led by Bruce Flatt, was optimistic, dare I say promotional, as usual. Though, they have a lot to be optimistic about and shareholders of Brookfield Corp. have several ways to win. I’ll go through some of them in this article.

Insurance:

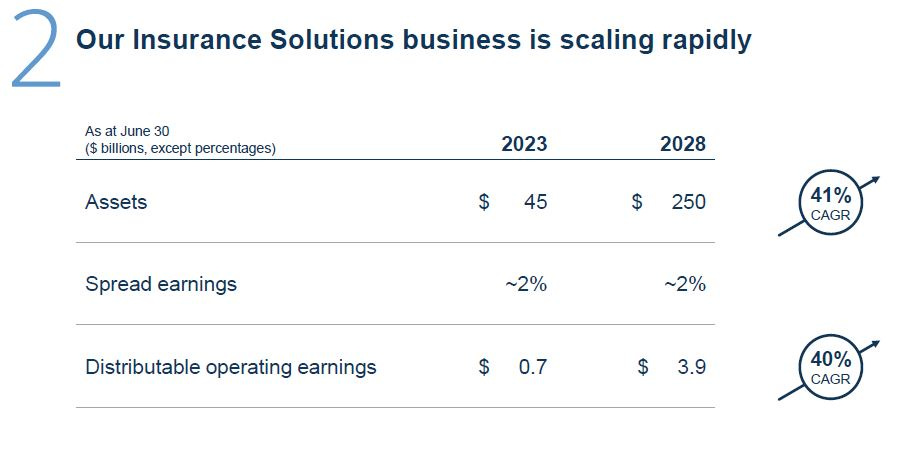

Brookfield is following Apollo’s lead in using fixed-rate annuities as a source of permanent investment capital. As of June 30, 2023, Brookfield’s insurance business (Insurance) had $45B in assets. Though, pro forma for the soon-to-be closed American Equity Investment Life (AEL) transaction, they will have $100B of assets within Insurance. They expect this business to have $250B in assets by 2028 and grow from the current $0.7B in Distributable Earnings (DE) to $3.9B in DE. Insurance CEO Sachin Shah believes that over the next 5 years, Insurance can write $10B to $20B in new policies per year. This means that from its current asset base of $100B, they predict Insurance to grow organically at a CAGR or 8.4% to 14.9%, with some in-organic growth thrown in there.

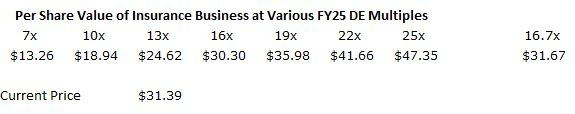

Let’s play a game. What would you pay for a high-ROIC company with an organic growth rate of 8.4% to 14.9%? If you take their 2028E DE and apply a range of multiples to it, and then discount that back at a 9% cost of equity, the implied value for their insurance business is stunning. At Brookfield’s current DE multiple of 7x, insurance is worth $13.26 per share. At 16x, it is almost worth the entire market capitalization of the company. Using a low-to-mid twenties multiple is not unreasonable if they can hit the upper end of the range of their organic growth targets, at which point the implied value dwarfs the current market capitalization. Another way to look at this is that at 16.7x 2028 Insurance DE, you get to the current share price, and you get all the rest of Brookfield Corp. for free.

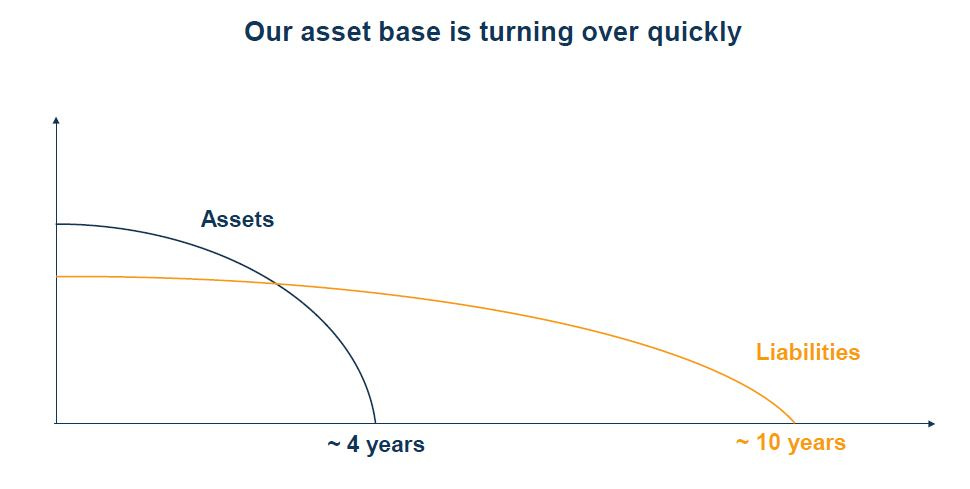

One last item to mention about Insurance is that they have liabilities with an average life of 10 years, but assets matched to them with an average life of four years. This means that there is upside embedded in the business, as they will be able to capture the higher rate environment in the assets, while the liabilities will remain set from a lower rate environment.

Carried Interest

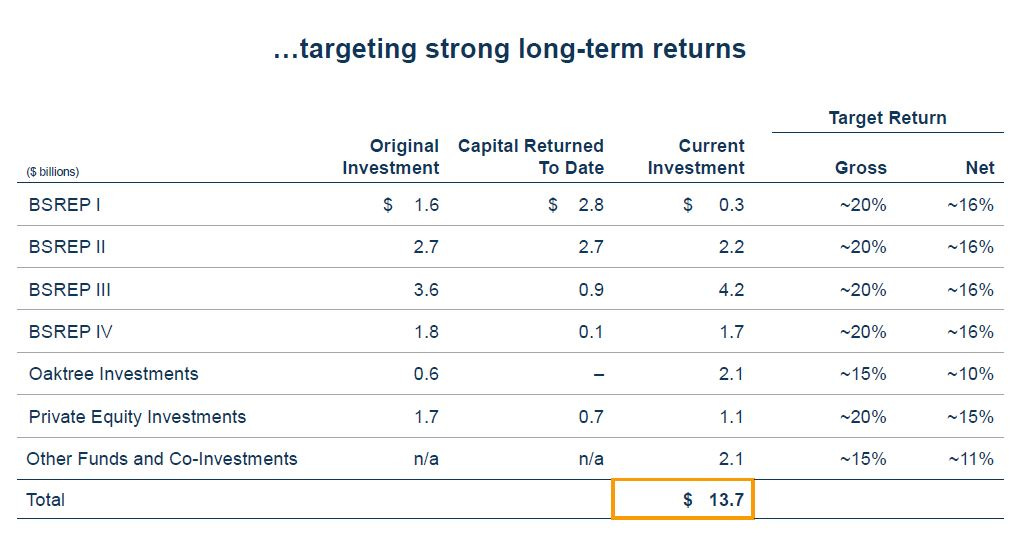

Carried Interest is one area where they are a bit aggressive. They value their carried interest as being worth $32B with $14B coming from carried to be realized from existing funds. While it is yet to be determined if they can generate sufficient returns to generate this level of carried interest, their historical returns, over a long period of time and multiple strategies, suggest they can. Additionally, if you zero out the value of the carried interest in the sum-of-the-parts valuation of Brookfield Corp., the implied valuation is materially above the current price – for more information see my August 23, 2023 article (https://310value.substack.com/p/brookfields-sotp-valuation).

Real Estate:

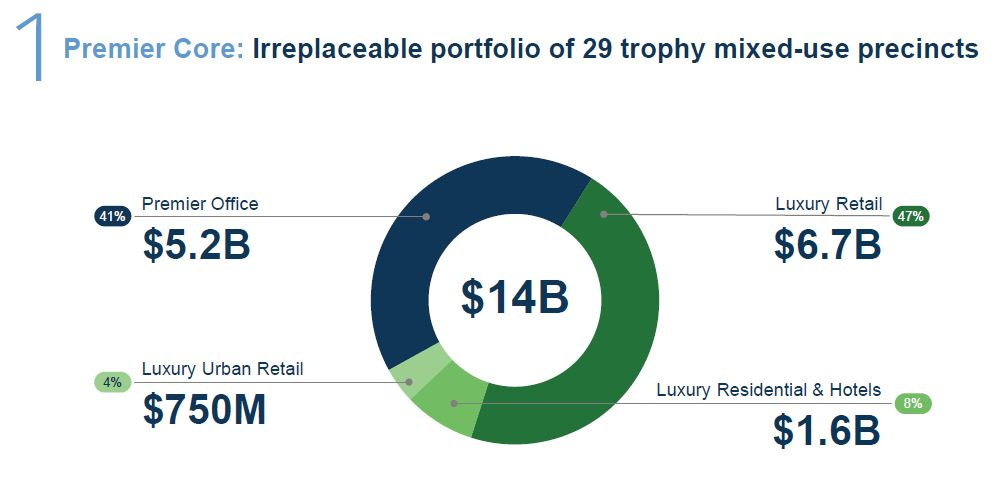

One of the likely more controversial aspects of this company is the value of real estate that they own on balance sheet - the former Brookfield Property Group (BPG or Property) portfolio. Brookfield has $24.3B in real estate on its balance sheet. $14.3B is in their Core portfolio, which consists of 29 trophy assets. The balance is $10.1B in their Transitional and Development portfolio. Each of the properties is individually financed and won’t contaminate the rest of the portfolio. I imagine that the Core portfolio is money good, with no problems. I expect that the Transitional portfolio likely has some problems in it. That said, I know two things. First, I don’t know the value of Brookfield’s Property assets, though I expect it to be at least as valuable as the Core portfolio. Second, the value is not zero, even though it looks like the market is ascribing that the property portfolio is worth less than zero. Going back to the August article, if you valued the property portfolio and carried interest at zero, the implied share price for Brookfield was $41.59 versus the then trading price of $32.69.

Share Repurchases

Share repurchases are interesting and introduce another way to win. Let me state that Brookfield has always (since I started following it in 2014) traded a lower multiple than it should given the earnings growth it delivers. However, it never repurchased many shares. This is changing, as they can now both fund growth and return capital – management anticipates $40B of excess cash being generated from 2024-2028. Additionally, share repurchases can be accelerated further should Brookfield decide to monetize some of their Property portfolio and use the cash generated from it to retire shares.

Summary:

I left out several ways to win from their movement into private credit and Oaktree to tapping the ultra-high net worth markets. The above are the areas that really jumped out to me at the Investor Day. Brookfield is in a position to perform admirably, there is a massive margin of safety at the current stock price, and the nascent share repurchase program is a catalyst to close the valuation gap.