Revisiting eDreams Ahead of Q2 Earnings Call; Anniversary of 2021 Capital Markets’ Day

I think it is a good time to revisit eDreams given that they will soon have the anniversary of their 2021 Capital Markets’ Day, where the company formally laid out their plans to transition the business from a transaction-based business to a subscription-based business. Additionally, it is probably a good time given that there seems to be a massive chasm between the operational execution of eDreams and the stock price performance, which has been atrocious. Perhaps this article can assuage the concerns the market has regarding the company and its business model transformation.

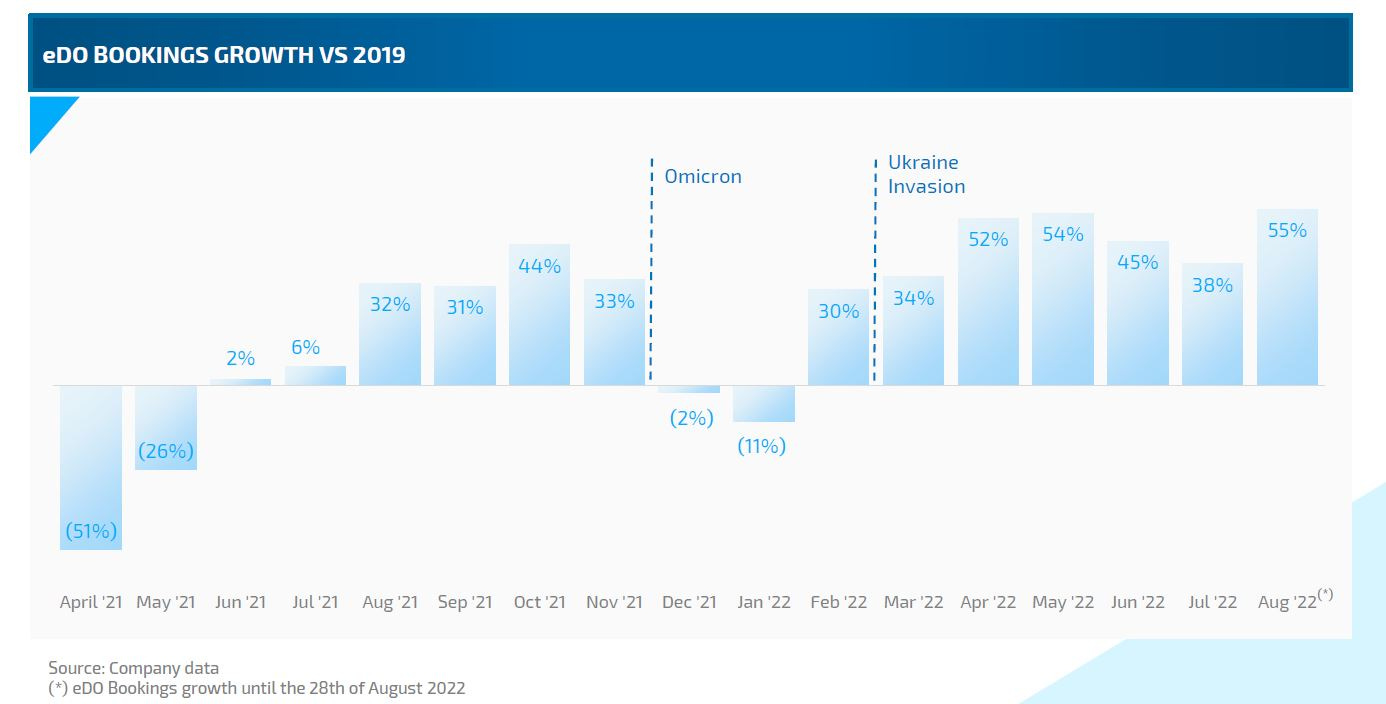

Looking at the below charts, it is hard to imagine that the stock price has poorly performed this year. Despite beginning the year undergoing a decline in leisure travel due to the Omicron variant of COVID, which was soon followed by Russia’s invasion of Ukraine, and the rampant inflation because of the invasion, the company’s bookings growth over pre-COVID levels has been remarkable. Furthermore, and more important than the growth of bookings, the company’s growth of its Prime Subscription program has been strong, ending August at around 3.5MM members, each paying ~€55.00 per year to be a member. Given these two indicators of the business’ health, what is the problem?

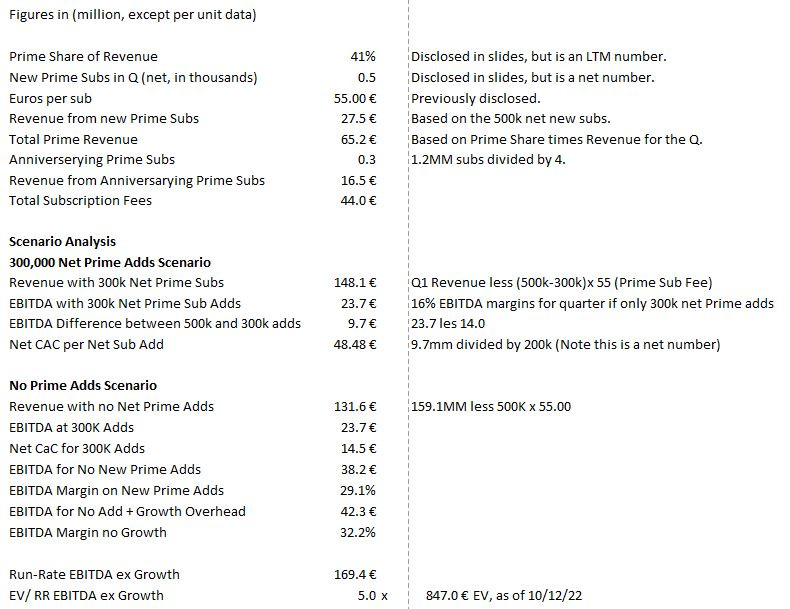

It is just a guess on my part, but I believe the main concerns investor have is with the Cash EBITDA Margin of 8.8% and Cash EBITDA value of €14.0MM last quarter. This low level of Cash EBITDA, and low margins vs. historical EBITDA margins may have spooked investors about the profitability of the new subscription model.

It is worth, peeling the onion back, to see if the concerns are valid, or if the profitability of the Prime business is being obscured, perhaps by growth expenses running through the income statement, as opposed to being capitalized. It has been discussed that the Cash EBITDA margins last quarter would have been 16% if the company had only grown its Prime Subs by 300,000 net new members, as opposed to the 500,000 net new members that it grew in the quarter. Using that information, we can estimate the Customer acquisition Cost, in terms of margins, of a net new Prime Sub. This information can be used to estimate the Cash EBITDA for last quarter in a scenario where no new net Prime Subs were acquired. Furthermore, it is well known that eDreams is adding employees in anticipation of future growth, as head count in the quarter grew 16% YoY. If you add back the change in fixed expenses YoY to the no-Sub Adds EBITDA, you likely get a fairly representative figure of what EBITDA is in a no growth scenario. I calculate that Cash EBITDA in the quarter would have been €42.3MM, generating a 32.2% Cash EBITDA margin.

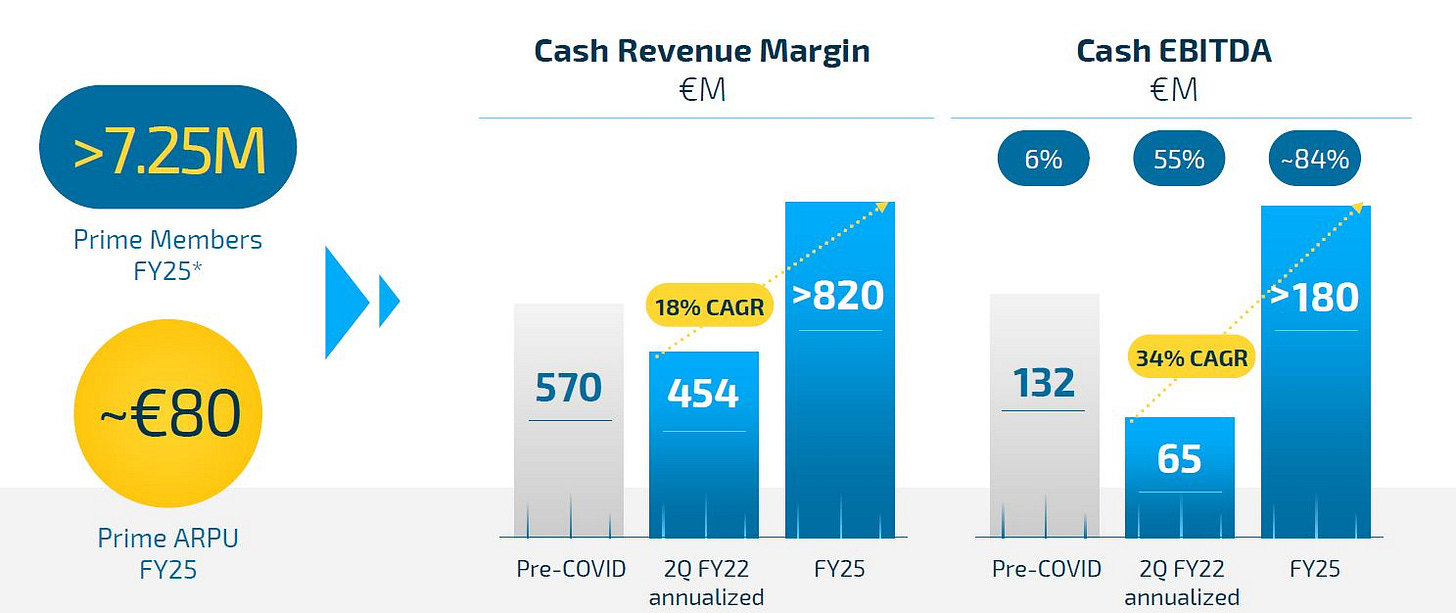

By no means do I wish for them to stop or slow down growth. However, the analysis does show 1) the Prime Subscription business model is highly profitable and 2) the profitability is being masked by growth expenses that are running through the income statement. What are the implications of this analysis? Firstly, it shows that eDreams is trading egregiously cheap. The company is trading 5.0x on an EV to run-rate Cash EBITDA basis. This, for a company that is growing rapidly. Secondly, it shows that the FY 25 goals, as shown below, are not an ending goal for the company, but still reflect growth of the Prime Program. The No Prime Adds Scenario show a cash EBITDA margin of 32.2%. The cash EBITDA margin of the FY 25 estimates show an EBITDA margin of 22.2%, meaning that there is still ample growth expenses running through the FY 25 figures.

What will it take to reverse the course of the stock? The first step is realizing the profitability of the Prime Program, which is currently being masked by the growth expenses. This article may help to get the word out, but if it doesn’t there are two events that could serve as a catalyst for the stock price. First, the margins will need to begin to work their way up. This should happen in the later half of this fiscal year. Yes, the company gained a massive number of new subscribers last year, but last year’s financial statements, as well as the first quarter of this year's, were burdened with large customer acquisition costs of new net Prime Subs. In the last half of the fiscal year, Prime Subs that were new last year will have anniversaries, and the cash flow from them will likely start to overwhelm the Customer Acquisition Costs that are being invested in those two quarters, which should lead to higher reported margins. The second step is for the company to expand the KPIs that they report and introduce KPIs that are more appropriate for a subscription-based business. Given that Q2 earnings date coincides with a one-year anniversary of their Capital Markets’ Day, the next earnings call would be a good time for management to introduce new KPIs.