High-Quality Compounder Hidden in a Commodity Business – Orion Engineered Carbons

Short article on an interesting situation. Orion Engineered Carbons (“Orion”) is valued as a commodity business, yet half of its earnings come from a specialty chemicals business with a secularly growing end market (electric vehicles). Don’t let the commodity portion of the business scare you off; the commodity segment seems to be at the beginning stages of an up-cycle with demand growing significantly faster than supply.

Overview:

Orion produces and sells carbon black products in two business segments.

Rubber Carbon Black is a line of commoditized products, that accounts for 75% of Orion’s production by volume and about half of the EBITDA. Orion is number 3 in the world in market share. That said, it is really a local market for commodity carbon black, as it does not transport well, which results in regional oligopolies. Carbon black is primarily used as a reinforcing filler in tires and other rubber products.

Specialty Carbon Black is a line of value-added products that account for 25% of Orion’s production by volume and the balance of EBITDA (at > 40% margins). Orion is the number 1 producer globally of specialty carbon black. Uses include being used as a color pigment in plastic, paints, and inks. The more premium the product, the easier to ship. About 60% of the uses are not formulaic. The balance is formulaic, engineered for specific client uses, which makes these products quite sticky. Orion is often the sole supplier for some high-end automotive coatings.

Investment Thesis

Orion should benefit from an up-cycle in its commodity business and a secular growing end market in its specialty business.

EBITDA and FCF should grow rapidly in the intermediate future.

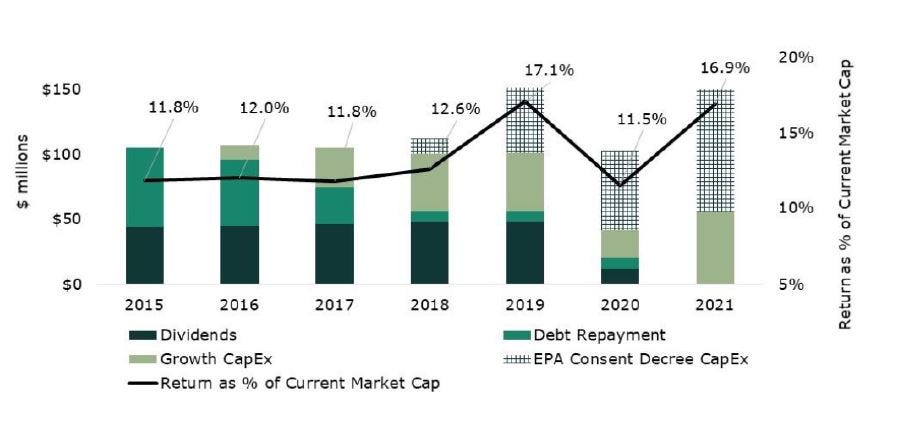

Orion just finished a round of growth capex spending, and is now poised to reap the benefits.

Furthermore, Orion is finishing up a massive capex outlay as part of on industry-wide consent decree with the EPA. This is soon behind them, and with no further spending on this issue likely, the FCF conversion should rocket up. Orion should generate between $700-$800M of discretionary free cash flow, that they can deploy into growth capex and share repurchases (note that the company views dividends as non-discretionary), as well as some dividend increases and further de-leveraging.

Speaking of share repurchases, the company has a $50 million authorization, and they expect to get through that authorization rather quickly . On their 11/4/22 earnings call, the CFO said “…our intent would be to get through the full buyback. First off, it is absolutely opportunistic, but we do — we put out that number not as a number we’re going to get — at some point or maybe partly, but our intention would be to fully execute that and really the timing of it, the speed of it wold be contingent on a couple of things, one of which will be continued positively on our cash flow, which we’re pretty strong. An then secondly, again, ……, but this is not a long window on that, that we’ll be sitting here in 18 months from now expecting not to have hit. We expect to hit much sooner than that.”

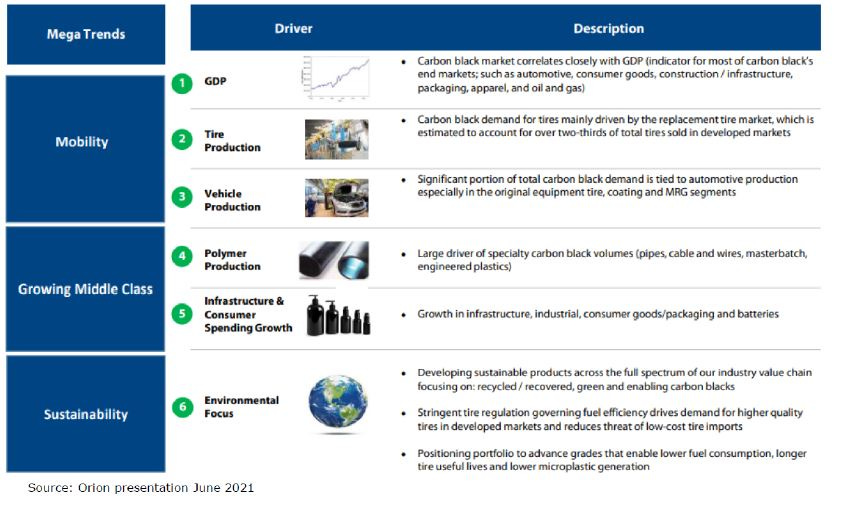

Carbon Black Demand Drivers

Carbon black has several demand divers working in its favor, some are listed below. However, let’s take a look at tires. Sixty percent of tires, and over two-thirds in developed markets, are for replacement tires, while only 15% goes to new cars. This gives the tire business some resilience in a recession. Additionally, EV production is a benefit for the carbon black industry, as EVs generate a massive amount of torque and are heavier than ICE vehicles. This means that tires for EVs require more reinforcement than tires for ICE vehicles and thus require more carbon black.

Why is It Cheap?

Perceived as a commodity business – but it has a large specialty chemical business

Commodity business has been in a downcycle (Chinese industrial weakness in 2018; European industrial weakness in 2019; COVID in 2020 and 2021; China’s Zero Covid policy; Ukraine invasion/War) – this seems to be changing.

Natural gas is a large input in the US and in Europe, and natural gas is well off its highs.

Worth noting that US new vehicle sales are still well below pre-COVID levels

Recently a Euro-centric company as it was listed in Germany, reported in Euros, with a former parent listed in Germay. Now it reports in US dollars and is listed on the NYSE.

EPA mandated capex limited free cash flow from 2018 – 2022

Valuation

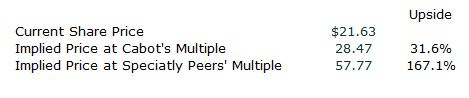

The company is priced as a significant discount to its closest competitor (Cabot), as well as to a basket of specialty chemical companies (FUL, PPG, RPM, AXTA, IOSP, AVNT).

Hope you enjoyed this. Thanks to Kyle from Grizzly Rock for the idea and allowing me to borrow a slide or two.

Disclaimer: Currently long. For entertainment purposes only. Not a solicitation to buy or sell any security. Do your own due diligence.

Thanks for sharing this idea! Nice work.

Thanks for sharing, worth to look further. Cheers.