Green Plains (GPRE): Transforming from a Commodity Producer into a High-Quality Compounder

Note: while not as an exciting opportunity as eDreams, the subject of my first article, GPRE is a compelling opportunity ant the article was enjoyable to write, as my first job after college was in a related industry.

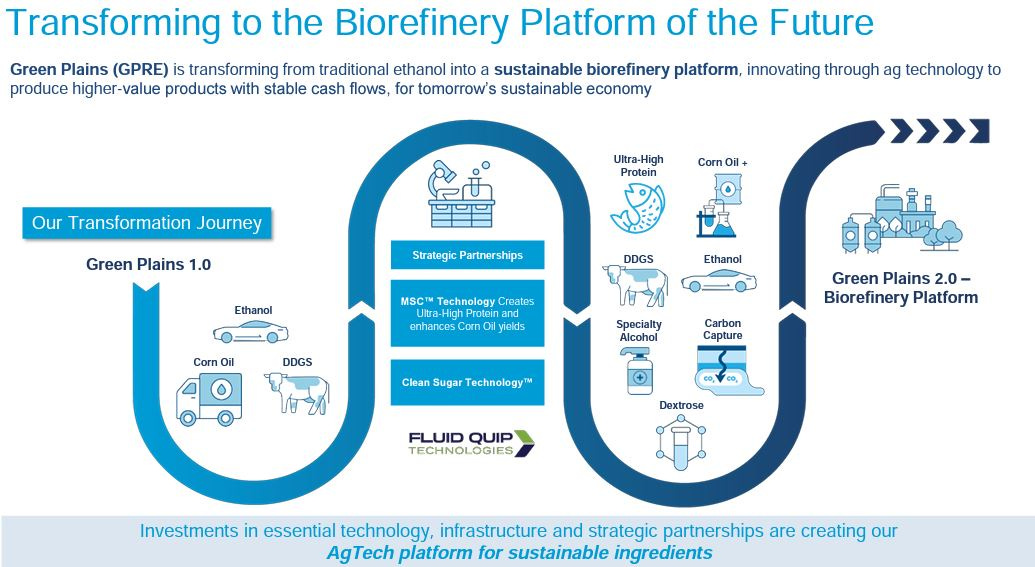

Mr. Market has yet to figure out GPRE’s transformation from its uninspiring legacy business, an ethanol producer, to an AgTech platform, which leads to an attractive valuation

The ethanol industry is known for shareholder value destruction, empty promises, and poor returns on capital

Ethanol companies are asset-intensive and cyclical – a bad mix for long-term investors

Consequently, many investors avoid the ethanol industry altogether, which may explain why Mr. Market is slow to catch on to the Green Plains’ story

To bolster this point, GPRE is trading at an 80% correlation with ethanol crush margins

GPRE’s proven technology is transforming its free cash flow

As the upgrades to its ethanol plants are completed, Green Plains should generate consistent free cash flow, which once recognized by the public markets, should cause the stock to re-rate

The combination of multiple expansion and growing earnings are the booster engines of a stock’s price

Green Plains is in control of their own destiny with the acquisition of Fluid Quip, which is the patent holder of the technology that is transforming their manufacturing process

The technology has been proven out not only at GPRE’s facilities, but also at outside facilities such as: Flint Hills Resources, Badger Ethanol, and United Wisconsin Grain Products

Investor Misperception

Some investors believe that GPRE’s Hi Pro Corn Meal is a niche ingredient

Global pet food and aquaculture markets are extremely large and growing 4% annually. GPRE should pick up commercial agricultural customers looking to transition diets to vegetarian diets or use ingredients that are lower cost than corn gluten meal. Green plains’ 60% product profile can support $750+ per ton in the current market giving massive updated to high protein EBITDA

Green Plains Overview

Green Plains produces, markets, and distributes ethanol, animal feed ingredients, corn, oil, specialty alcohols, clean sugars, and other products. GPRE owns 11-corn biorefineries in the US Midwest with two facilities producing specialty alcohol. GPRE also owns Fluid-Quip Technologies, a biorefinery engineering firm with multiple patented systems including high protein, corn oil, and clean sugar systems; an agribusiness involved in corn procurement, handling, storage, and marketing; and fifty one percent of Green Plains Partners (NYSE: GPP) a transportation and logistics MLP that owns 32 biofuels storage facilities and 7 fuel terminals.

Historically, Green Plains produced three products. Ethanol for use as an automobile fuel once it is blended with gasoline. Corn oil for use as an animal feed ingredient or a bio diesel. Finally, dried distillers’ grains (DDGs) for use as an animal feed ingredient.

Green Plains 2.0

Green Plains attained a new processing technology which allows for the production of the following:

Ultra-High Protein Corn Meal (HiPro): Traditional DDGs are useful in certain commercial animal feeds for a few reasons. Firstly, it is highly palatable – it tastes good to animals! It is often used in feeds to help mask the flavors of high protein ingredients such as: corn gluten meal, blood meal, feather meal, and fish meal. The smell of the later two will make you sick, trust me on this. The animal nutrition industry measures energy by using Total Digestible Nutrients (TDN). DDGs have highly digestible fiber and have a high TDN count. Lastly, it is around 25% protein, which is a middle protein compared to other animal feed ingredients.

When animal feed manufacturers formulate animal feed, it is done using linear programming, which optimizes for specific nutrient requirements of the feed. That is the science of feed manufacturing. The art comes into it when determining how a feed mixture will go through a plant, what the mixture will look like as a finished product, and how the feed will taste to an animal. The value of DDGs on an energy basis and palatability basis together overwhelms the value of the protein. Meaning, DDG manufacturers don’t really get paid for the protein in DDGs, they get paid for the other two attributes. Green Plain’s new manufacturing process separates the protein from DDGs. The result is ~60% HiPro and DDGs ex the protein, let’s call them Light DDG (LDDGs). The get paid the same amount for LDDGs as they do for DDGs. However, in addition to LDDGs, they now have HiPro, which has an immense value as a substitute for other high-protein ingredients. Additionally, unlike other high-protein ingredients, HiPro is a fermented product, which means that it is pre-digested, so it takes little to no energy for the animals to digest the protein.

Renewable Corn Oil: The new manufacturing process allows GPRE to increase the amount of corn oil extracted from the DDGs in the process by 50%. Corn oil has a high value (currently it is the highest value product in the complex), so the increased amount enhances the value of their crush. Furthermore, given that corn oil is a byproduct of their production process, this corn oil has a low carbon intensity, which makes it desirable to the renewable diesel industry.

Clean Sugar: This new product is exciting, and probably does not get enough coverage, but they can convert some of their alcohol production to sugar production. Sugar is traditionally made at large, expensive dry corn mills, which produce high-fructose corn syrup, corn gluten meal, and corn gluten feed. Green Plains’ wet-milled dextrose can be used in biochem, bioplastics, synthetic biology (as a feedstock for biotechnology), and as a food product.

In addition to the changes resulting from their new manufacturing processes, Green Plains can capture and sequester carbon released in the fermentation process. This carbon sequestration should allow them to generate federal 45Q tax credits. It will use the carbon capture platform of Summit Carbon Solutions. Summit will partner with 18 biorefineries in the Midwest for the first phase of their project. The project will cost $2B and will be funded by partnering plants and will generate a return via the tax credits. GPRE will also receive premium pricing for ethanol sold into states with Low Carbon Fuel Standards, which will pay for their portion of Summit and allow their tax credits to be incremental free cash flow to GPRE. Additionally, the carbon capture will lower the Carbon Intensity (CI) score for GPRE’s products.

Interestingly, in Green Plains 1.0 the primary product was ethanol, and the rest of the products, including the animal feed ingredients, were byproducts. Under Green Plains 2.0, the primary product becomes the animal feed ingredients, and ethanol becomes a byproduct. The financial impacts of each of the above changes can be seen on the 2024E EBITDA chart further below.

Evidence of the Transformation and Implications to the Quality of Their Revenue Stream

Green Plains has two facilities producing HiPro. Management believes that over 50% of their production will be converted by the end of 2022 and expect to be at 75% by 2024. Furthermore, they announced a joint venture with Riverence Farms LLC, the largest trout producer in the United States and possibly the world. Through the JV, both Riverence and Green Plains will own a feed mill. The feed mill will have an HiPro offtake agreement with Green Plains. The produced feed will be used by Riverence, as well as sold to outside parties.

Feed manufacturers can change in and out of ingredients in their feed formulations depending on the changing prices of raw materials. Feed companies have traders that actively look for arbitrage opportunities in the ingredient markets. Some animals are hardy enough to tolerate large changes in their rations. Some animals, like baby pigs, need to be eased into and out of different rations. Aquaculture can be different. Riverence also produces salmon. Aside from meat/feed conversion ratios, feed rations can also affect the taste and color of salmon meat. Discussions with Riverence began two years ago and required ample amounts of testing before Riverence was comfortable using it in its rations. Now that HiPro is formulated in, it is not likely to be displaced.

Pet foods typically run high in protein, so there is value in the high protein levels of HiPro. Additionally, pet food manufacturers are large purchasers of brewers’ yeast, which they add to their feeds to enhance the flavor of the ration. HiPro, because fermentation is used in its manufacturing process, is high in brewers’ yeast. So, HiPro in petfood rations displaces both other high-protein ingredients and brewers’ yeast. Another attribute that is important to pet food manufacturers is consistency. A bag of Walmart’s Old Roy in upstate New York, needs to have feed inside that looks and smells the same as that from a bag in California. Pet food manufacturers will be slow to change formulations, and they are likely to have similar formulations nationwide. So once HiPro gets into a petfood ration, it should stay there.

Commercial operations such as beef, poultry, swine, and dairy operations may use HiPro, where it will compete on price, adjusted for its nutritional value. This is the same with what historically happened with Green Plains DDG sales. However, the pet and aquaculture markets make less changes to their formulations, which are akin to a roach motel – once you check in, you don’t check out. This makes the revenue streams of HiPro higher quality than that of the historical DDG revenue streams.

What Does This Mean to The Bottom Line?

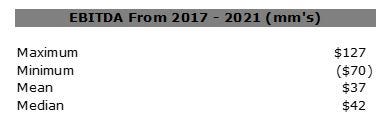

Green Plains’ EBITDA from 2017 averaged around $37 million per year, with a wide range of the low to the high. On a last-twelve-months basis, Green Plains generated $45.2M of EBITDA. Note that this dispersion is indicative of the commodity nature of ethanol. However, ethanol doesn’t really batter on a go forward basis.

The conversion to Green Plains 2.0 significantly increases the earnings potential of Green Plains, as shown in the below 2024E run-rate EBITDA (note that the conversion is not fully complete in 2024.

Note, taking the consensus EBITDA projections of $147 million in 2022 and growing it to $522 in 2025 will yield a valuation of ~$73.00 per share versus the current price, which is sub $30.00. This uses a 10.0x trailing EBITDA terminal multiple, which is likely conservative.

There is some execution risk. Green Plains needs to convert the remaining facilities. They need to acquire new customers. They should be able to acquire commercial agricultural customers quickly, and the prices received should be high given the value of proteins today. That said, higher quality pet and aquaculture may take time. Though the Riverence JV is nice evidence that there is something here. Riverence isn’t simply signing an offtake agreement, they are committing capital to build a feed mill. Investors are getting well paid for the execution risk, as if the consensus is reached (note that it is below management’s upside case), the value of the business is ~2.5x the current price. Overall, Green Plains should go from a company with a low and volatile level of EBITDA to a company with a high and stable level of EBITDA, and benefit from both multiple expansion and earnings growth.

Disclaimer: Not investment advice. For entertainment purposes only. Not a solicitation to buy or sell securities. Do your own due diligence.