Peter Lynch’s adage “buy what you know” compelled me to research and ultimately buy shares of First Watch. I first learned about it while at an old job – there was one next to my office. I found the food to be enjoyable. I ultimately left the job and didn’t think about it again. A couple years later, they built one near my house. In the meantime, the company had gone through a massive revamp. The food was still high-quality, using fresh ingredients to prepare dishes that was made to order, but the menu was enhanced and streamlined, and the look was revamped using an Urban Farm décor. Since then, my family has been going to the restaurant on an almost weekly basis (usually after church on Sundays).

Overview:

First Watch Restaurant Group (“First Watch”) is a daytime café that serves breakfast and lunch. It went public in September of 2021. It generates high AUVs, and cash-on-cash returns, despite only being open 7.5 hours per day (7:00am to 2:30pm), using as one shift, one menu approach. This approach of one shift with a streamlined menu has interesting operational dynamics, which we’ll get to later. The company has a strong focus on culture and employee development, which is key to driving their massive store count growth. First Watch has enjoyed both strong SSS and store-count growth, which is key to creating wealth in retail.

Thesis:

First Watch created their own niche in breakfast by sitting in between value focused concepts and special-event focused brunch restaurants. Being the only scaled player in the category helps to cement their leadership in this category in the minds of consumers.

Retail businesses with a combination of strong SSS, unit count growth, and high 4-wall ROICs can produce substantial shareholder wealth – First Watch appears to be such a business.

First Watch has a strong culture, resulting from its management training program, as well as its one-shift business model.

First Watch has ample opportunity to drive margin expansion without utilizing price to do it.

Should not require additional equity to fund growth, as it will soon hit a position of being cash-flow positive.

Despite being a luxury, I’d label it affordable luxury, it may prove to be economically resilient.

The Food:

First Watch’s food is high-quality and fresh. You will not find a microwave oven, a heat lamp, or a deep fryer anywhere in its kitchens. The menu is focused with around 60 menu items. It has several breakfast classics with some First Watch specialties mixed in. The menu also changes from season to season, with five seasonal menus throughout the year. My go to is avocado toast with Million Dollar bacon. Although, it was displaced this spring with the seasonal offering of Al Pastor hash (see you next spring!). The company has an innovative juice offering, juices are about 15% of sales, with drinks such as Purple Haze (lemon juice, cane sugar, butterfly pea flower and lavender tea), Kale Tonic, or my favorite, Morning Mediation (orange and lemon juices combined with beat juice, agave nectar and turmeric). While they don’t have a bar per se, they do have an innovative cocktail offering with specialty cocktails based on their juice offering. For breakfast cocktail purists, standard Mimosas and Bloody Marys are available. Cocktails are ~3.5% of sales for stores that have alcohol. I’ve seen some sellside opinions that this can approach 10%. If that happened, then great. I think the juices are more of a focus for them, and the alcohol offering is there to alleviate any consumer vetoes – some people really like their Bloodies on Sunday.

Affordable Luxury:

First Watch is priced above many restaurant concepts, especially the value players. Although, the upscale décor and fresh food deserves a premium over your standard IHOP offering. That said, the average ticket price per person is ~$15.00. This brings up a point around the company’s potential resilience in a recession. The company’s clients tend to be older and wealthier, or younger and health focused. If a recession hits, do you see these demographics cutting out their weekend brunch or going down market to an IHOP? I don’t. I see them keeping the $45 family of three weekly brunch and cutting out the $100 Thursday night sushi.

Culture and Management Training:

Culture in a company can often be tough to assess while being on the outside. Yet, you can sometimes get glimpses of it in they way management talks, in their actions, and often in a company’s results. First Watch co-Founder built the company with a few foundational principles in mind: put others before yourself, go above and beyond for the customer and for each other, and – most importantly – “just be kind”. Talk is cheap, let’s look at actions. During the COVID pandemic, the company suspended operations for a period of time. The company furloughed most of its employees. However, with support from their sponsor, Advent via a capital infusion, they invested in their employees by providing relief payments to their tenured hourly workers, and by paying the base salaries of their managers and corporate staff. These actions led to retention of 90% of general managers, 100% of directors of operations, and 75% of tenured hourly employees post COVID.

Speaking of employee retention, their one-shift model seems to make employees happy, as they have late afternoons and evengs to themselves, to be with family, to work another job, etc. First Watch’s historical turnover rate is 20% to 30%, in an industry where 50% retention is considered good. Anecdotally speaking, the servers at my local restaurants include many who have been there since the restaurant first opened.

Managers undergo 11 weeks of training which includes one week at the company’s Sarasota, Florida headquarters in the Farm program (First Watch Academy of Restaurant Management). After the Farm program, managers return to their restaurants drinking the company Kool-Aide, or in this case, Kale Tonic. Each store has one general manager responsible for the overall operations of the store. The general manager is supported by 2 operating managers (general managers in training). High performing general managers have the opportunity be promoted to opening new and perhaps bigger stores. This leaves an opening for one of the operating managers to move up and fill the void left by the general manager. This one general manager supported by two GMs in training is key to having the talent necessary to execute the company’s store-count growth plans. While this is anecdotal, I had a conversation with the manager of the restaurant that I frequent. I asked him if he participated in the FARM program. It caught him a bit off guard, but he lit up and said yes. Then he asked if I went through it. He later said that he worked at First Watch for 4 years, after 13 years at a competitor. I asked him about the differences between the two companies, and he said that First Watch’s management was “elite level.”

Talking about culture is cheap, but in the case of First Watch, their culture manifests itself in higher retention rates and a management pipeline that can support its growth.

Below are some pictures that I took in the main classroom of the FARM program.

Same-Store-Sales History, Unit Economics, and Store Count Growth

As noted earlier, First Watch went public in 2021, so we have limited data on its SSS performance. We do have overall SSS growth going back to 2018, and post-IPO SSS growth broken down into its traffic and volume components. Management has said that they have pricing power, but only utilize it to keep up with inflation. They prefer to use product mix and operating leverage to drive margin expansion. If that philosophy was true back in 2018 and 2019, then the traffic growth they are seeing is impressive. While the SSS comps in Q1 23 was +12.9% with 5.1% driven by traffic, if you compare that to Q1 19, SSS are up +42.0%, 11.7% was driven by traffic.

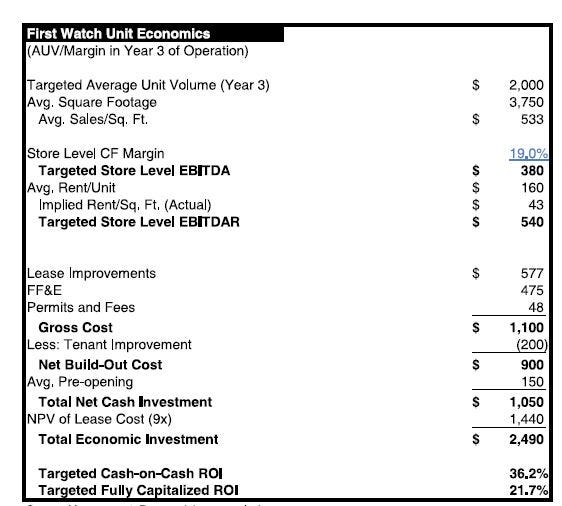

With the strong SSS level growth, it is no wonder that they want to expand their store count. I borrowed the below from Raymond James initiation report, which breaks down the unit economics and shows a 36.2% cash-on-cash return. These unit economics are from the time of the IPO. Currently, the company is opening larger format stores with a net build-out cost that is ~33% higher. While the larger format introduces an element of risk, if they work, the margins and cash-on-cash returns should move up.

The Future Growth Plan picture below is from their IPO materials. They currently operate in the same states in the picture, excluding the states in red. Interestingly, states in which they have the most stores, such as Florida, still have room to grow. Management believes that they are not at saturation in any of their existing markets. The below pciture shows a store count of 423. They are presently at 484 units (370 company-owned and 114 franchised) and the store count goal is ~2,200 units. It’s worth noting that at one point in their history, the company used franchises to grow. Given the high cash-on-cash returns of their units and their pipeline of new restaurant managers, I do not see them using franchises as a method of growth in the future. I wouldn’t be surprised if they bought back some of their franchises.

Margin Expansion:

The company has several levers to pull to expand margins. First, product mix can drive up margins – increased sales of juices and alcohol. Second, increasing the number of customers served per day will expand margins. The company has recently invested heavily in redesigning kitchens and launching an app, which should increase the number of customers served per day. The app, which has the ability for customers to order food to pick up, also gives them the ability to see the wait times at various locations as well as enter the wait list – this has been a game changer for my family. Third, as the company grows their store count, corporate expenses will be diluted.

Valuation, Headwinds, and Mitigants:

Given the current SSS performance and store-count growth, the company seems to be firing on all cylinders. Though, if you look at the 23E FCF Yield (ex-growth capex), it trades at a 6.3% yield (6/15/23). Why so cheap, for a company that can likely put up mid-single digit to low-double digit SSS comps and low-double digit store count growth for a long time? There are probably a few issues that are giving investors the opportunity to pick this company at a bargain price. First, there are some growth accounting issues, where the company screens expensive. Look at the operating free cash flow less the maintenance capex and compare that to the GAAP net income, and you’ll isolate the growth accounting issue. Second, this restaurant has been classified by some as a full-service restaurant, which is not the “hot” fast-casual category that inventors love. While there is a malaise among investors in full-service restaurants, First Watch is differentiated, and their results should speak for itself. Finally, their financial sponsor, Advent International, owns 63.2% of the company. While there is an overhang, as these shares will ultimately come to market, I would note that Advent is one of the most astute growth equity sponsors, and they know how to manage exiting a position. Furthermore, one of Advent’s partners who serves on First Watch’s board, was also an investor in Lululemon. I would say that she has excellent growth retail experience.

If the company can continue to perform, and I think they can, investors should realize several years of capital appreciation.

Disclaimer: Not investment advice. Do your own due diligence. For entertainment purposes only. Author is long FWRG.

See unit level economics chart by ray j. 36.2% cash on cash returns.

Mind explaining where u see or expect the “ high 4-wall ROICs”? Thank you.