eDreams Update: Long-Term Value Creation Thesis Intact, and some Short-Term Catalysts

I met with eDreams management on the second leg of the US roadshows. That meeting allowed me to adjust my model assumptions and get an update on the business. Here is what I learned and other takeaways.

Update:

First, the airline and airport strikes should not be a problem for eDreams and are, mostly, UK focused. Management expanded that UK airports have been an issue since Brexit as the airports lost a good number of foreign workers.

Second, a stronger entry to the US is in the works. There is outside validation for this, see the below job posting on LinkedIn.

Third, full push into European hotels coming. I would add that I imagine that the data they have on Prime customers, will be valuable to them and their hotelier customers. I anxious to hear about this as they push harder into hotels.

Fourth, they confirmed that of the Prime customers who make repeat bookings, 75% do so by coming directly to eDreams’ website or by using their app, which eliminates any customer-acquisition-costs. This makes me change my model, as I need to include customer acquisition costs for the remaining 25%. More on this later.

Fifth, along with the above, they confirmed the economics of Prime. When eDreams is introduced to a new customer, they have a good chance to convert that customer into a Prime subscriber (reminder the Prime fee is ~€55.00 per year). This means that they can share all their booking fee with the Prime subscriber in a form of a discount. Additionally, they can share their first-year Prime fee with google or a meta-search provider, as the Prime subscription typically lasts for several years. One can assume that they make no money on a new Prime sub their first year, and subsequently, they make the Prime fee each year. I think this assumption that they make no money is conservative, but it will make the point for the value of the company.

Below is how the cash flow works given my assumptions for a repeat client coming directly to eDreams via their app or website.

Sixth, at some point (back half of this year maybe?) you may begin to see the return of seasonality in bookings. The prospect of that may be a negative to some. However, the more important numbers to investor than bookings will soon be:

New Prime Subscriptions acquired in a fiscal year; and

Existing Prime Subscriptions, currently 3 million as of June 1, 2022.

Post first-year Prime subscribers will smooth out the earnings stream. So, we may be in a situation, where you see bookings start to move lower due to seasonality, and revenue and EBITDA crush it due to the presence of prime subs that are having anniversaries (renewals at €55.00).

Seventh, the feedback from their recent roadshows is that there is demand for large blocks of their stock; however, there is not much supply of large blocks.

Putting this all together, you have a company with the following characteristics:

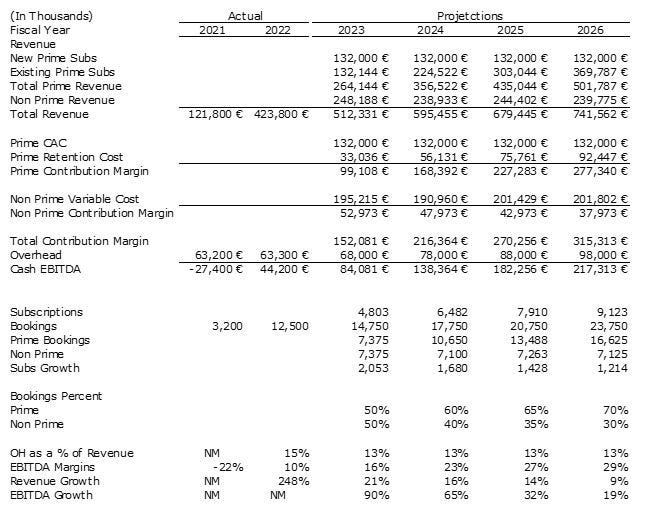

Cash EBITDA Should go from €44.2 million to €85.0 million plus this year (I’m thinking it’s either side of a hundred, but let’s go lower for conservatism),

Revenue should grow at a near ~20% CAGR over the next three to four years,

EBITDA CAGR should be 60% to 70%,

eDreams should enter the US with a unique business model – dynamic packages combined with subscriptions, and

Expansion into hotels, a business with a much higher margin than their core business of flights.

Why is the stock price low?

I think there are multiple reasons for recent stock trading performance. Namely, liquidity and lack of knowledge of the marginal seller. Let’s look at liquidity first.

Liquidity:

eDreams has a few different types of shareholders. First, it has the two private equity funds, Permira and Ardian, who control ~40% of the stock. They are not sellers (or haven’t yet) at current prices. Next, you have institutions who know the value of eDreams (I believe it’s worth at least €20.00; see the table below for more on this). They are not sellers either and interestingly are mostly made up of US based funds. The third type of investor is one who doesn’t know the value of the company and is likely made up of retail investors. Unfortunately, the marginal seller is likely made up of this type of shareholder.

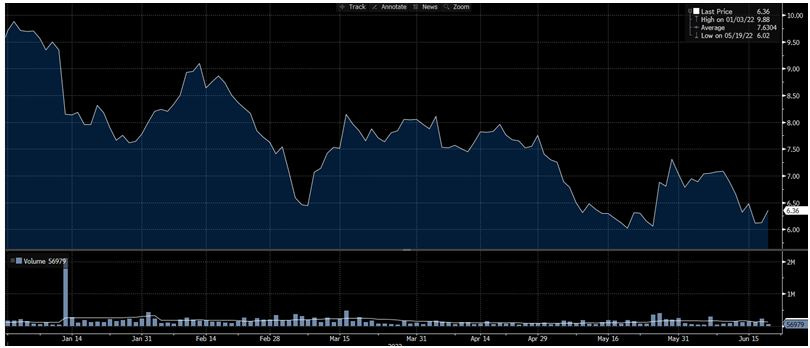

The below chart shows the volume doing well after the equity raise and up until the Ukraine invasion, where it dropped off substantially. To be fair, it did for the rest of the market.

So how does a company close the gap between trading value and intrinsic value? Usually, this is done through share repurchases; however, this avenue is closed for the time being given eDreams new debt covenants.

Investor Education: “They’ve had it easy. A long bull market and apps that will get them cars when they want to go somewhere and get them food when they are hungry. Is working hard their first instinct?” Un-named eDreams investor regarding current generation of investors.

Which leads us to investor education. The company, in the last month, has completed two road shows and two conferences, with one more conference on the horizon. Furthermore, there’s been plenty of good news with respect to European leisure travel. You have the Pret a Manger Heathrow coffee sales index is up over pre-COVID numbers, you have relaxing COVID regulations in Europe, even the US announced that tests are not required to travel to the US. However, the stock price performance has been horrible. While the company is getting the word out, they are not spoon feeding the sell side and buy side communities on how the economics of Prime works. Generally, the buy side is apt to dig into stories, but eDreams screens poorly and will continue to until the back half of this fiscal year. So, you need to give enough information out to get buy-side analysts interested enough to start peeling back the onion. Think about the current crop of investors for a bit in light of the above quote.

eDreams has been talking about Prime for a long time, it was the point on their investor day last November. They have delivered, ending the year with 2.75M subscribers. Yet they ended the year with only €44.2 million in cash EBITDA. The investor community is wondering why the increase in subscribers has not translated into higher Investor Education: “They’ve had it easy. A long bull market and apps that will get them cars when they want to go somewhere and get them food when they are hungry. Is working hard their first instinct?” Un-named eDreams investor regarding current generation of investors.

Which leads us to investor education. The company, in the last month, has completed two road shows and two conferences, with one more conference on the horizon. Furthermore, there’s been plenty of good news with respect to European leisure travel. You have the Pret a Manger Heathrow coffee sales index is up over pre-COVID numbers, you have relaxing COVID regulations in Europe, even the US announced that tests are not required to travel to the US. However, the stock price performance has been horrible. While the company is getting the word out, they are not spoon feeding the sell side and buy side communities on how the economics of Prime works. Generally, the buy side is apt to dig into stories, but eDreams screens poorly and will continue to until the back half of this fiscal year. So, you need to give enough information out to get buy-side analysts interested enough to start peeling back the onion. Think about the current crop of investors for a bit in light of the above quote.

eDreams has been talking about Prime for a long time, it was the point on their investor day last November. They have delivered, ending the year with 2.75M subscribers. Yet they ended the year with only €44.2 million in cash EBITDA and negative IFRS Net Income. The investor community is wondering why the increase in subscribers has not translated into stronger earnings. Well, I mentioned that it’s the second year where they begin to see the benefit. Explicitly explaining how the cash flow works would apprise the investment community why the Prime program has not yet translated into IFRS earnings and what investors can expect as we go throughout the year.

One would hope that investor education gets the stock back to double digits. At that point the private equity funds can begin to release some of their shares into the market, which would increase the liquidity. As the price continues to go up, the private equity funds may be willing to part with some large blocks, presumably to the large buyers that the company has been meeting on its road shows. The goal would be to get the price and liquidity to sufficient levels to be included in the Ibex 35, Spain’s main stock index.

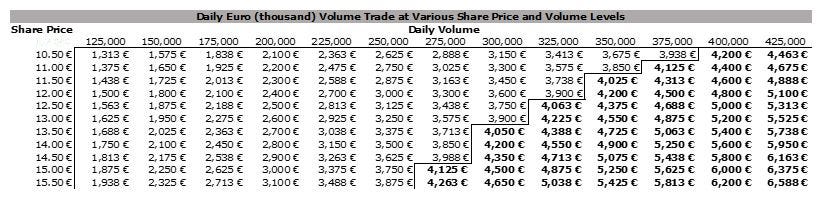

The market capitalization will need to be about 0.3% of the Ibex 35 market cap to be large enough to be considered for inclusion, which is ~€10.71 per share. They will also need around €4 million in average trading volume for 6 months. Below is a chart showing daily volume in euros at various share volumes and stock prices.earnings. Well, I mentioned that it’s the second year where they begin to see the benefit. Explicitly explaining how the cash flow works would apprise the investment community why the Prime program has not yet translated into IFRS earnings and what investors can expect as we go throughout the year.

One would hope that investor education gets the stock back to double digits. At that point the private equity funds can begin to release some of their shares into the market, which would increase the liquidity. As the price continues to go up, the private equity funds may be willing to part with some large blocks, presumably to the large buyers that the company has been meeting on its road shows. The goal would be to get the price and liquidity to sufficient levels to be included in the Ibex 35, Spain’s main stock index.

The market capitalization will need to be about 0.3% of the Ibex 35 market cap to be large enough to be considered for inclusion, which is ~€10.71 per share. They will also need around €4 million in average trading volume for 6 months. Below is a chart showing daily volume in euros at various share volumes and stock prices.

If education doesn’t work, what else can they do. Well one or both private equity firms could sell a block of shares at current prices. Getting a new, large investor a little bit pregnant with a block sale would give the new investor incentive to acquire more shares on the open market, which could drive up the price of eDreams to a more appropriate level.

In the worst case, and I don’t think we are there yet, the company could sell itself for well above the current price. Note, that the company ran a process in 2018 and likely had an offer materially above today’s price, at a time when the Prime program was less developed. Who would be a buyer? Private equity understands and likes online travel assets. From a strategic front, Airbnb could do with a flights option. Furthermore, AmEx Global Business Travel could easily diversify away from business travel and give Prime a nice name which begins with an “A”.

Financial Projections and Valuation:

So given the confirmation that 75% of Prime customer go direct for repeat bookings and 25% do not, I changed my model. I think that I am being highly conservative in my assumptions and my true base case for their financial performance is higher than this; however, the model still looks good even with the change. Though it is worth noting, that this doesn’t include the full-court press in hotels, US expansion, and expansion into other services that could make eDreams a one-stop-shop in travel.

The R Word – Recession:

What does FY23 look like if there is a recession later this year or the beginning of the next calendar year? Well, we don’t need to assume the growth of new Prime members as new Prime subs impact the next year’s numbers. Let’s be draconian and say that their non-Prime revenue is cut in half. In that case, they should have €27 million in non-Prime contribution margin plus €99 million in Prime contribution margin. So, €126 million in contribution margin less €68 million in overhead gives you EBITDA of €58 million, so it would be trading at 17.8x EBITDA in a draconian scenario. And if the projections hold, they will be trading at 12.3x and still growing topline at a double digit CAGR.

Summary:

The long-term case for wealth creation is here, with Prime growth, international expansion, the push into hotels, other products, and ultimately becoming a one-stop-shop for travel. Management is working on their biggest weakness, which is trading liquidity. They have plenty of options to choose from to tackle the issue, and I am sure they will take the most appropriate step(s). Aside from working on the liquidity issues, what are some other short-term catalysts?

Short term catalysts that get the stock moving could be:

Continued investor education with conferences.

Bringing new investors into the stock via road shows.

A favorable rating agency change.

Barclays initiating coverage on the company – they did Barclays conference; one would think an initiation of coverage is forthcoming.

Reporting Q1 and Q2 (hopefully more Q1).

Management clearly and plainly articulating the economics of Prime.

DISCLAIMER: For entertainment purposes only. Opinions are solely opinions of the author. Due your own due diligence. Not for investment purposes. Not a solicitation.