eDreams: Q2 Update – A Multi-Bagger Still Hiding in Plain Sight

In August, I wrote an article “eDreams: A Multi-Bagger That is hiding in Plain Sight.” Given that they just reported their second quarter earnings, I thought it was worth an update given there was some incremental guidance given during the report. The quick summary is it’s still a multi-bagger hiding in plain sight. Now, let’s get to why.

High Quality Business with Ample Growth Opportunities

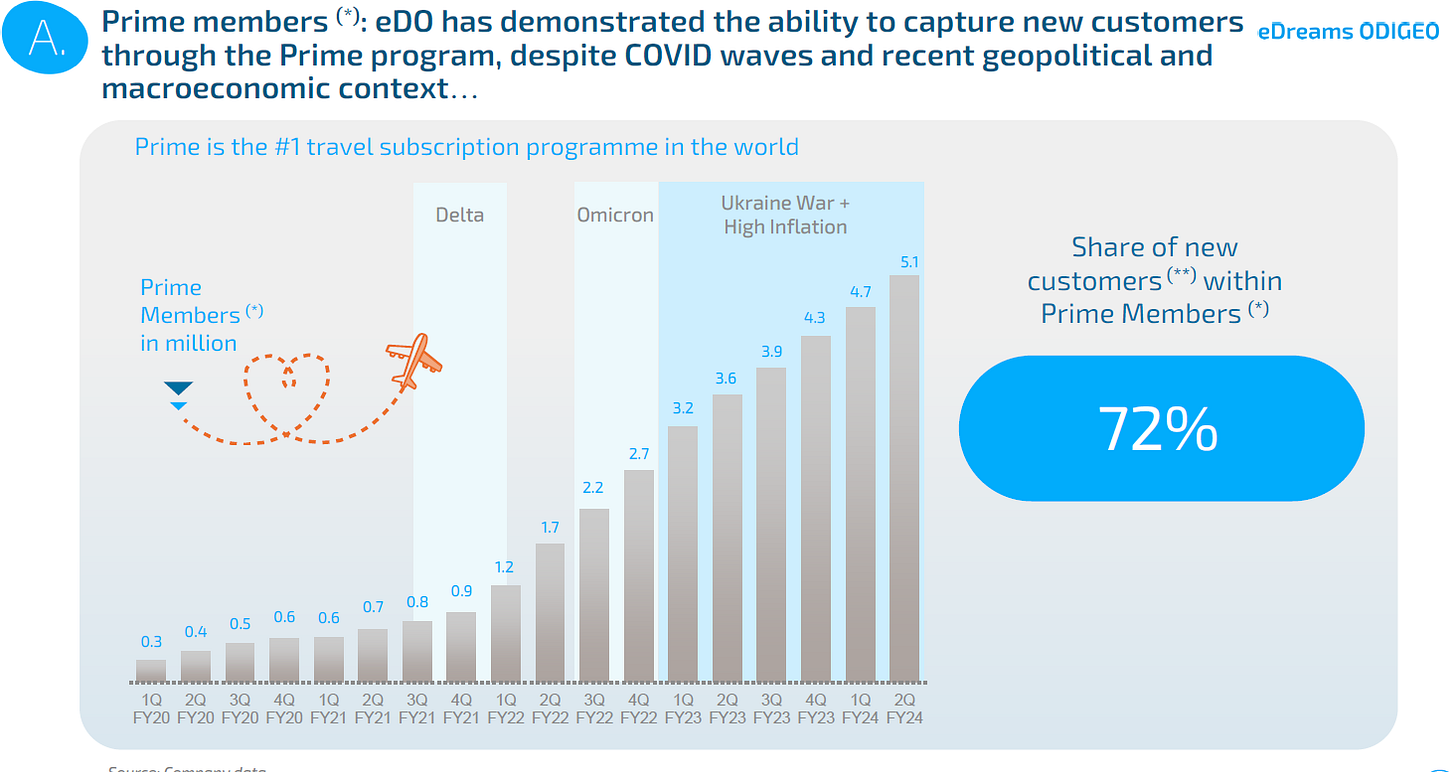

The growth of eDreams’ subscription program, Prime, continues on. Launched pre-COVID, Prime took off with the leisure traveler’s return to travel post-COVID. Impressively, it grew through the resurgence of COVID with both the Delta and Omicron variants, as well as the Ukraine War and period of high inflation.

Despite its success in growing Prime, predominantly in its European markets, there seems to be ample room for growth in its 10 existing Prime markets, as its best market it is still at a relatively low penetration level – 5.2%. Management notes that for subscription businesses such as Netflix and Costco, growth has been delivered in their programs for 20+ years. Additionally, management is keen to grow Prime beyond its initial 10 markets.

Estimates and Valuation

The company’s management doesn’t really do quarterly or annual estimates. What they did do, at the Analyst Day in November of 2021, was give estimates for the number of Prime subscribers (>7.25M), ARPU (~€80), and Cash EBITDA (>€180M) for the Fiscal Year ending in March of 2025. I don’t mind not having quarterly or annual guidance, as I believe there is wisdom in management concerning themselves with the long term and not worrying about any one quarter. Additionally, as this business transitioned to subscription model, it became easier for investors to model and get comfortable with the notion of them achieving their FY25 Cash EBITDA target – I think they will beat it. That said, one new metric was given this quarter and I am highly appreciative of that. They provided free cash flow guidance for FY25 and gave us a nice chart showing its history and its path to FY25. The chart shows what investors have long suspected, just as the EBITDA margins will increase in this business over time, so will the EBITDA to FCF Conversion rate.

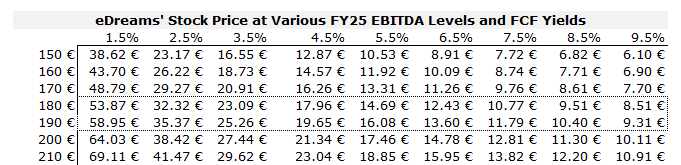

The free cash flow guidance makes it easier to see the intrinsic value of eDreams. eDreams (as of 11/16/23) trades at a 12.3% FY25E FCF Yield. What yield do you think it should trade at with its forecasted 59% EBITDA growth and ~142% FCF growth over the next year and a half? Personally, I think it should trade in the low-single digits. I think they will hit €190 of EBITDA in FY25. A FCF yield of 2.5% to 3.5% applied to that level of earnings implies an intrinsic value range of €25.26 to €35.37 per share. Don’t agree with my assumptions, use the below chart and apply your own FY25 EBITDA and FCF Yield assumptions. Whether or not you agree with my estimate, I would bet that your estimate for FCF Yield and FY25 EBITDA is nowhere near a 9.5% yield and €150M of EBITDA, which is the only combination that implies a price lower than today’s trading price (€6.54 as of 11/16/23). This company is egregiously undervalued.

Growth Past FY 2025

As discussed, there is ample room to grow within the existing Prime markets, but management is excited to take Prime into new markets. You can likely double the 7.25M FY25 Prime goal just getting their 10 existing markets up to the penetration level of France (its top market). I modeled out several years’ worth of projections, which contemplates just increasing the penetration rates in existing markets (see projections in addendum). These projections are likely conservative, as they will expand into new markets and do a hard push into hotels. That said, it shows their potential to compound earnings for a long time. Applying a 3.0% to 4.5% FCF Yield on FY29’s free cash flow and discounting that back to today implies an intrinsic value for eDreams of €41.51 to €61.14. That’s a current intrinsic value of 6.3x to 11.1x the current price.

Catalysts and Next Steps

There is a massive gap between the current trading price and its intrinsic value. To close the gap, some steps can be taken immediately, some in the coming months, and some a year or so out. Here is my list of steps management can take to help the company close the gap between the current trading price and its intrinsic value.

Operationally, keep doing what you are doing. Management has converted this business from a transaction-based business to a subscription-based business and is well on track to meet or exceed the FY25 guidance they established in November 2021. Management’s approach to focusing on the operations and letting the market figure out the valuation may work in the long run. Although, there are likely some ways for management to help the market in figuring it out quicker.

Add some new board members. It has been almost a year since two directors affiliated with Ardian (a private equity investor who was forced to sell their ~16% stake due to their fund winding down) left the board. Replace them with high-quality candidates. Given the concentration of US investors in eDreams, it would be nice to increase the US representation on the board (in addition to CEO Dana Dunne of course). I would privilege candidates with deep capital markets expertise and an ability to think creatively.

eDreams is in an inviable position to fund massive growth while generating excess free cash flow. Use that excess free cash flow to retire debt and repurchase shares – the company indicated a willingness to do this starting in the first quarter of calendar year 2024, so right around the corner. Ironically, repurchasing shares may also increase liquidity, as it gets the stock price closer to a price where Permira (long time private equity owner and current 25% shareholder) will begin to exit their stake.

Hold a capital markets day and introduce new long-term financial targets.

While the company is trading a substantial discount to its intrinsic value, with its clockwork-like progression towards their FY25 targets, the market should figure out the multi-bagger potential of eDreams, but there are some steps management can take to speed up this process.

Addendum

FY24 to FY 29 Projections

Disclaimer: Long eDreams. For entertainment purposes only. Due your own due diligence. Not solicitation to buy or sell any securities.

Any thoughts on this news: https://www.businesswire.com/news/home/20250226965734/en/eDreams-ODIGEO-and-PayPal-Join-Forces-to-Expand-Prime-Travel-Subscription-Benefits-Across-Europe

Can we access the investor day this week online?