eDreams: A Multi-Bagger Hiding in Plain Sight

Introduction:

eDreams, a frequent subject of my Substack articles, has executed a transformation from its original transaction-focused business model to a subscription-focused model. It grew Prime subscriptions from 0.3mm in Q1 2020 to 4.9mm as of August 22, 2023. What is most impressive about eDreams during this time, setting aside a year of COVID lock downs, is that it grew its subscription business in a profitable manner (using economic profits, but IFRS are catching up). eDreams’ stock price is up an impressive 66.1% YTD (as of 8/31/2023). Despite eDreams’ strong stock price performance this year, its current price is a fraction of my estimate of its intrinsic value.

Valuation:

Before diving into the valuation, let’s look at what drives it – earnings growth. I expect its Cash EBITDA(1) to grow at 59.7% CAGR between FY22 and FY25. The growth is slowing a bit, but I expect to be at a healthy 44.0% between FY24 and FY25. Despite the slowdown in Cash EBITDA growth, I expect free cash flow to grow at a rate well above that of Cash EBITDA. What FCF Yield would you assign to a business with an earnings growth rate north of 40%? The answer depends on if that high rate is sustainable or not. While management has not given us guidance beyond FY25, let’s look at the assumptions that underlie the FY25 guidance to gauge the likelihood of strong earnings growth past FY25.

FY25 Guidance: The company gives us three figures for its FY25 Targets. The first figure is the ending number of Prime subscribers - 7.25mm. The company is at 4.9mm presently, which means eDreams need +363k net adds per quarter to achieve 7.25mm by the end of FY25. This seems doable to me. The second and third figures are cash revenue of >$820mm and cash EBITDA of >$180mm.

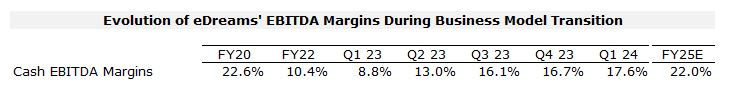

To assess if the FY25 guidance is achievable, as well as the growth prospects beyond FY25, let’s look at what initiatives are going into these numbers. The major component in achieving these numbers is the growth of Prime, which seems to be going well. Furthermore, Prime is still under-penetrated. In the top 6 Prime markets, it only has a 2.7% penetration rate. In its most penetrated market, France, it only has a 4.6% rate. One other indication of there being plenty of growth left for Prime in Europe is the company’s Cash EBITDA margins. I estimate that the steady-state EBITDA margins for the Prime business is north of 30%. The legacy non-Prime business is being used as a marketing tool to gather more Prime members. As Prime matures and overwhelms non-Prime revenue, eDreams Cash EBITDA margins should approach 30%. While the Cash EBITDA margins are trending up, as Prime is growing, they are far from 30%.

Beyond Prime penetration there are two upcoming initiatives that should drive part of the FY25 growth and a material amount of growth beyond that. The first initiative is hotels. eDreams can sell customers a hotel room now, however, their website is geared towards flights. There is some work that needs to be done on eDreams’ website to give them a stronger hotel offering. They are working on this. I expect the work to be completed near the end of calendar 2023 and enhanced capabilities on hotel bookings to be formally rolled out. Recall that the first money that is usually spent in travel goes toward flight tickets, so eDreams’ strength in flights will give them the first crack at a customer’s accommodations spend. I suspect that there is a little bit of earnings growth from their hotel initiative in their FY25 EBITDA, but not much. So, there should be plenty of growth, from hotels alone, post FY25.

eDreams’ has its IT staff focused on the hotel opportunity, as it should be, but this staff will become available for new initiatives once the hotel initiative is formally launched. After hotels, the next initiative is likely building a fully functional Prime program in the US. The US has a limited functional Prime program, but the company has long discussed expanding Prime outside of Europe and there have been public job postings for key leadership positions in the US. I don’t believe that the FY25 guidance has any material earnings in it for the US opportunity.

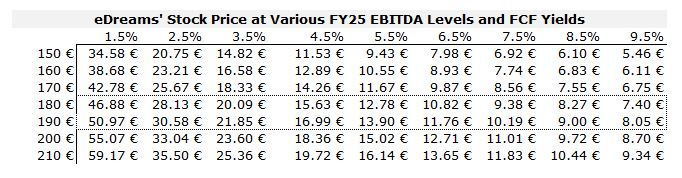

Given that there are plenty of growth opportunities post FY25, I ask again, what FCF Yield should this stock trade at? I would think it should trade between 1.5% and 4.5%. Below, you will find a chart with eDreams’ implied valuation(2) at various FY25 EBITDA and FCF Yield levels. Here are some initial observations. Even trading at a 9.5% FCF Yield, a ridiculously high yield for a fast-growing company, the current price of €6.56 is well below where it should trade if they deliver €180mm or more of EBITDA. Second, eDreams’ management likes to set conservative guidance and beat it. I wouldn’t be surprised if their FY25 EBITDA comes in above the €180mm guide.

Finally, using the €180mm guidance, and a FCF yield range of 1.5% to 9.5%, shows the intrinsic value 2.4x to 7.1x the current price.

Why is the current price a fraction of its estimated range?

Spanish investors (institutional) do not yet care enough about eDreams to take a close look at it. This could be in part due to its size. It could be in part due to its history. Years ago, eDreams stumbled shortly after going public, which may have left Spanish institutional investors feeling burned.

The IFRS numbers don’t yet reflect the business transformation. You need to peel the onion back, so to speak, to uncover the transformation. IFRS numbers are not yet prompting investors to do this.

The Madrid exchange, in general, may not be the best home for eDreams. There are other exchanges with deeper liquidity. Furthermore, it may not be home to investors who have an appetite for online travel agencies (OTAs) or companies with subscription business models.

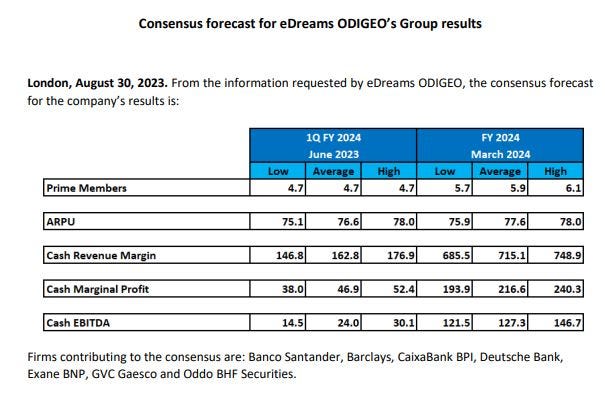

Sell-side analysts are not properly covering the company and its conversion to a subscription business model. Subscription business models stabilize the revenue and cash flow streams, which make each of them more predictable. Despite the increased predictability of the business there is a massive dispersion in the company’s cash EBITDA estimates by the sell-side analysts, as shown in the Consensus Cash EBITDA forecast below.

Watch Paint Dry or Bring Out a Hairdryer; How to Close the Valuation Gap?

Watching Paint Dry:

Time, or watching the paint dry, should fix the problem. As they say, in the long run the market is a weighing machine. Prime will continue to grow, eDreams will launch a major push into hotels, eDreams will launch a fully functional Prime program in the US and other non-European markets, and the IFRS financials will reflect the transformation of the business. All of this will lead to it gaining the attention of investors and the market will do its thing – close the valuation gap. This is beginning to happen, but too slowly in my opinion. In late May 2023, a famous Spanish investor, Antonio Lopez of March AM, presented eDreams at a value investment conference in Spain, noting that eDreams has “a very attractive valuation with revaluation potential of around 100%.”

Bring Out the Hairdryer:

This company survived the COVID 19 pandemic with flying colors and it grew its Prime subscribers by 1.7mm members and counting throughout the period of the Ukraine War and high inflation. Although, there are certainly some black swan events, the use of nuclear weapons in the Ukraine War for example, that could hurt it, the risk that I worry about the most is that investors get tired of waiting for the market to figure out the value of eDreams and push for a sale. A sale price of €12.50 to €15.00 would be 90.5% - 128.7% over the current price. While this would be a nice return on any investment, this price range comes nowhere near the intrinsic value of eDreams. The company may want to bring out the hairdryer and help the paint dry, so it can avoid its investors becoming impatient and pushing for a sale of the business. How could the company help the paint dry quicker?

First, there is a liquidity issue in the company’s stock. You have a handful of investors, some of whom own a substantial percentage of the company, who know the value of the company and will not sell at current prices. Share repurchases can fix this. It is counterintuitive that reducing a company’s share count will help its liquidity issue, but share repurchases will drive the stock price up, perhaps to a level where some of the large shareholders would begin to sell, which would help solve the company’s liquidity problem. Management, to its credit, is conservative. I don’t see them repurchasing shares until the end of the calendar fourth quarter (though one hopes to be surprised), as eDreams will have substantial working capital needs in the holiday travel season. That said, as that working capital unwinds, management should buyback as much stock as it can. In addition to reducing the share count, increasing its price and liquidity, a share repurchase would be positive news to the market, which may awaken investors to the opportunity. It would be akin to management yelling to the market “look here, and undervalued stock.”

Second, is to re-list the stock on the Nasdaq. Looking back to the list of reasons the stock may be undervalued, many of these reasons can be addressed by going to an exchange that has liquidity, investors who value OTAs, investors who understand subscription business models, and investors who will peel back the onion before business transformations are reflected in reported financials. Furthermore, while eDreams is headquartered in Barcelona, it has operations and generates revenue all over the globe – the global nature of eDreams will increase as it pushes deeper into the US market. The Nasdaq, with its deep liquidity and an investor base that understands subscription businesses, looks like a natural home to me. There are several businesses with significant foreign operations that have listed in the US and found success, including Atlassian, Ferguson, GDS Holdings, and Orion Engineered Carbons, so the high amount of non-US business of eDreams should not be a deterrent. A recent example, as shown in the August 29, 2023, Wall Street Journal excerpt below, is the German industrial stalwart Linde, which is moving from the Frankfurt to the NYSE to decrease burdensome financial regulations, increase liquidity, and be perceived as a global business and not just a German business. Aside from increasing liquidity and a gaining sophisticated shareholder base, re-listing to the US may also allow the company to pick up additional sell-side coverage.

Ultimately, a re-listing may not be necessary if a share repurchase, alone, closes the valuation gap. However, given the time and effort it takes to execute a re-listing, it may be wise to start working on it now. One last benefit of re-listing, the positive sentiment that AI related stocks are receiving on the Nasdaq is nearing the frenzy level. eDreams’ has been using AI since 2014 and is a recognized leader in its use among European companies – recognized in every way but the stock price. Imagine what would happen to the stock price of this low liquidity company if it caught a bit of AI induced fevered buying.

Lastly, there is always a sale of the business. eDreams is number one in flights in Europe and owns the largest and fastest growing paid subscription program in travel, therefore, it is a strategic asset. While an acquirer can easily pay 2x-4x the current price of the company and likely end up being highly successful with the acquisition, even 2x-4x the current price leaves a lot of money on the table for its current investors.

Conclusion:

eDreams is the owner of the most successful paid subscription program in travel. A program that it built and transitioned to while remaining profitable (setting COVID aside). Now it is reaping the benefits with expanding margins and stabilized streams of revenue and earnings. Despite the success of its transformation, there still seems to be plenty of growth ahead with increased penetration of its Prime program within existing markets, expansion of Prime into new markets, and a hard push into hotels. The ideal situation for its public investors is to be along for the ride for this future growth. To keep investors on board, the valuation gap between today’s price and its intrinsic value needs to close. The company’s management and board can help this process along by executing share repurchases and re-listing the company on the Nasdaq. Otherwise, the closing of the valuation gap may take too long, which would prompt investors to push for a sale.

Footnotes:

(1) Cash Revenue and Cash EBITDA recognize the revenue and earnings from new Prime subscriptions as they are booked, and the cash is received by eDreams.

(2) Companies are usually valued off 1-year forward levels. Given that FY25 ends on March 31, 2024, we are almost there. For simplicity’s sake, I am using FY25E FCF as the 1-Year forward numbers.

Disclaimer: Long eDreams. For entertainment purposes only. Due your own due diligence. Not solicitation to buy or sell any securities.

Thanks for the article. I am still learning about the business model and would like to learn more about the basics on why they are winning market share and the value proposition for customers. After listening to the latest conference call management is cagey about churn and doesn't offer much about the benefits of the business model except for platitudes about NPS and delighting customers.

Too be clear, I own shares and looking to increase my position. Looks very interesting at these levels and just exploring bear cases.

I found this comment from NOLA18 on VIC interesting. Curious if you have any thoughts on it?

"However, I really struggle to square a few things here. It seems very clear to me that the actual prime savings claimed by eDreams are not real. For example, the snapshots below are using a French IP address and looking at flights on the eDreams website from Paris to Barcelona. The “prime only” member rate they claim as a ~25% discount to the normal fare, is actually usually only 1-2 dollars/euros off of the widely available fare. From a high level view this makes sense, because even in markets like Europe where flights are highly fragmented, you are talking maybe 5-7% margins. eDreams would be taking massive losses on every transaction if they actually were offering the kind of discounts claimed. You can change your IP address to dozens of different countries across Europe and search hundreds of flight pairs, and the results I come up with are the same, a difference of a few euros at best.

So with that as the starting point, you have a management that is hesitant to discuss churn, and claims that the majority of prime growth is via word of mouth. However, it seems obvious that the real reason, or at least a major reason, why Prime is growing is actually because for any transaction that occurs on eDreams, you have to opt out in the checking process not to get signed up for a membership. I know online reviews skew negative, but there are literally thousands of reviews out there with people saying they don’t know why they are being charged 59 euros a month. So with a business that likely does 8-10m transactions a year, and given the structure in checkout of being opted into prime, maybe the current growth isn’t all that surprising?"

Great write up! Any idea if the big players like Expedia or Booking will get in the flight booking business in Europe and take away the niche market share eDreams built.