Durable Earnings + Volatile Stocks + Share Repurchases = Shareholder Value Creation

Chemed, eDreams, GFL, and Secure - Four Companies with Durable Earnings and Strong Share Buyback Programs

Several of the companies that I wrote about in the past have durable earnings streams. This resilience is valuable in times such as these where the stock market is whipped around with headlines such as the weakening consumer, trade wars, Middle East War, artificial intelligence, DOGE, and uncertainty around US foreign policy (Trump attacking allies and cozying up with Putin). Companies with resilient earnings can take advantage of market volatility by implementing substantial buybacks. The below companies are such companies that have resilient earnings and are buying back ample stock.

Chemed

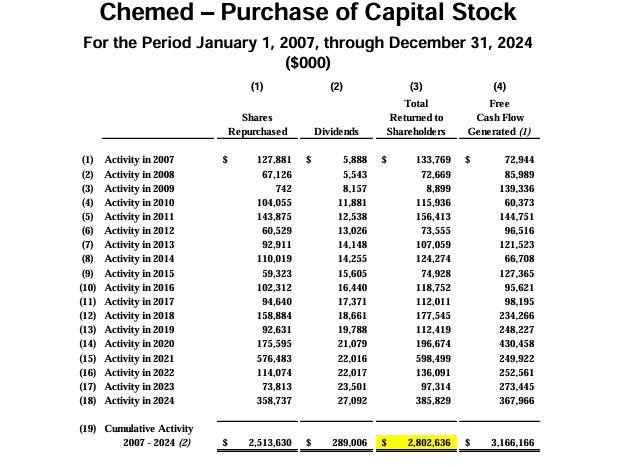

Chemed is a holding company which has two acyclical subsidiaries, Roto-Rooter (plumbing services) and Vitas (hospice care). While the earnings of both companies have compounded in the low teens over the last 21 years, each of the businesses can have temporary setbacks. Vitas did during COVID and Roto-Rooter is presently, as it digests a COVID induced demand pull forward and an inflation-squeezed consumer. Short-term disruptions can lead to temporarily lower stock prices, that management can take advantage of via share repurchase. As evidenced by the chart below, Chemed’s management has a long history of building cash, and executing large share repurchases when Chemed’s stock is attractively priced.

One fact to point out, is that of the $359M of share repurchases in 2024, 59.3% were executed in the fourth quarter. Despite this massive share repurchase, Chemed ended 2024 with $178M in cash and no debt. Should its stock price remain attractive, more repurchases should be on the horizon. What is an attractive price? One metric management looks at is Chemed’s FCF Yield vs. the interest rate it gets paid on balance sheet cash. Its 2025E FCF Yield is ~5.0%, well above the 4.25% Chemed gets paid, pre-tax, on balance sheet cash. I imagine management is buying every share they can buy without overly influencing the short-term price of the stock.

eDreams

Spanish online travel agency (OTA), eDreams, took the opportunity that COVID provided to remake its business model. It eschewed the traditional and more volatile transaction-focused business model and replaced it with a subscription-focused model. The new subscription model yields a stable revenue stream that is both growing and easy to forecast. One issue that eDreams faces is that its stock’s price is egregiously lower than its intrinsic value. This leads to low trading liquidity in the company’s stock, as investors who know the intrinsic value will not, or rarely, sell the company’s stock. To address this, the company implemented a share repurchase program in February of 2024, and is executing repurchases near the daily purchasing limit imposed on it by its exchange. Over time, the daily repurchasing of stock should clear out the sellers and work up the stock price towards its intrinsic value. Year-to-date, eDreams has repurchased ~1.2% of their shares outstanding on pace to repurchase 5.6% of their shares in the calendar year. The company has the werewithal to repurchase even more if not burdended by the daily limits. That said, should liquidity improve as the stock price is walked up, its daily limits will also increase.

GFL Environmental

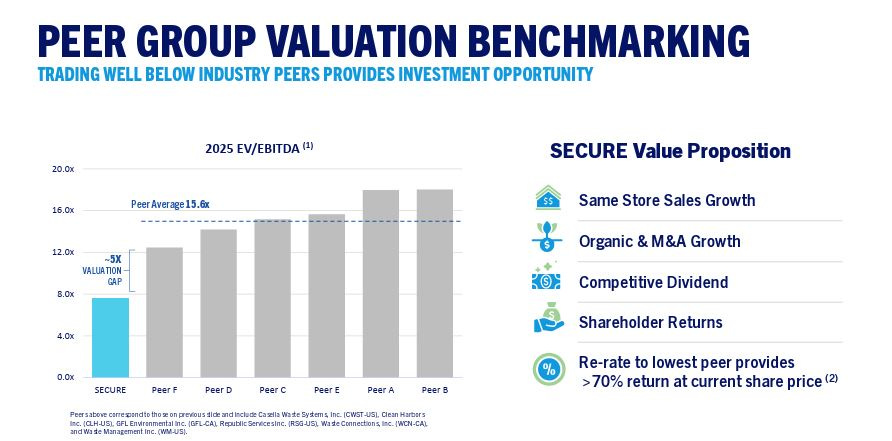

The waste industry, particularly municipal waste, has long proven itself to have resilient earnings. GFL, while benefiting from this industry dynamic, has trailed its peers in its valuation. In is no surprise that post the sale of their Environmental Services (ES) business, the flush with cash GFL will target two areas that may be partially responsible for its lower trading multiple. First, its leverage is higher than that of its peers. Second, it has some sponsor overhang to deal with. Via the cash from the ES sale, the leverage will be brought in line with its peers, while still leaving the company with ample cash. To deal with the sponsor overhang, GFL sought and received relief from the Ontario Securities Commission. The relief will allow a higher amount of the repurchased shares to come from GFL’s sponsors thus reducing or eliminating the overhang. Additionally, management believes the stock is too cheap and are taking actions via their Normal Course Issuer Bid (NCIB). The below excerpt is from GFL’s recent analsyt day.

Secure Waste Infrastructure Corp.

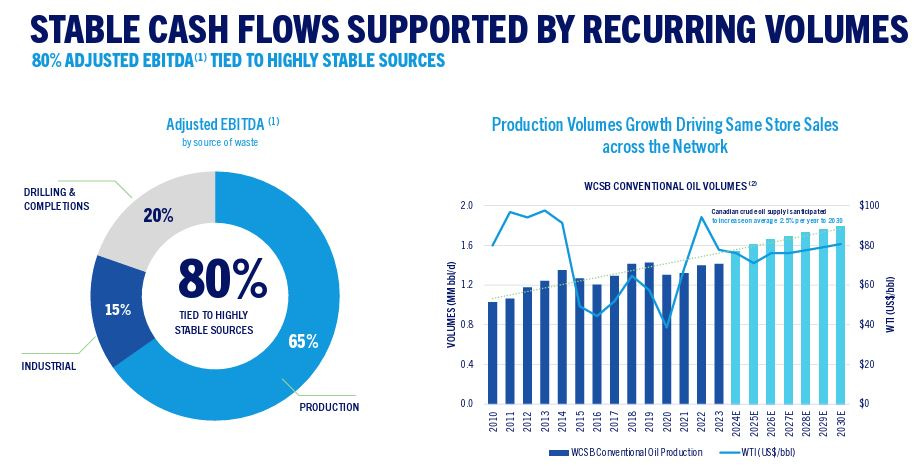

About a decade ago, Secure was highly exposed to drilling and completion activities. After living through the low oil prices of 2015, Secure focused on increasing its exposure to on-going production, which is more resilient during times of low oil prices.

2024 was a big year for share repurchases by Secure. It ended up buying back ~19% of its stock in 2024 through a combination of its NCIB and one tender offer. Additionally, management forecasts buying back 8% in 2025 through their NCIB. They are on pace to surpass it, as year-to-date through late February, Secure bought back 1.8% of its stock. It makes sense to do this given its valuation; it is cheap relative to its peers.

Secure is buying back every share that it can subject to its NCIB limitations. If its stock price persists in a state of undervaluation, does management execute another tender? They executed one last year. Their 1.1x leverage ratio is well under their 2.0x – 2.5x target ratio. Combining the $300M in expected free cash flow management expects to generate this year and Secure’s leverage capacity, it would not surprise me if another tender offer were announced.

Disclaimer: Not a recommendation or an offer to buy or sell any security. For entertaiment and informational purposes only. Do your own due diligence.

Why is Secure so cheap versus its peers? I don't get it