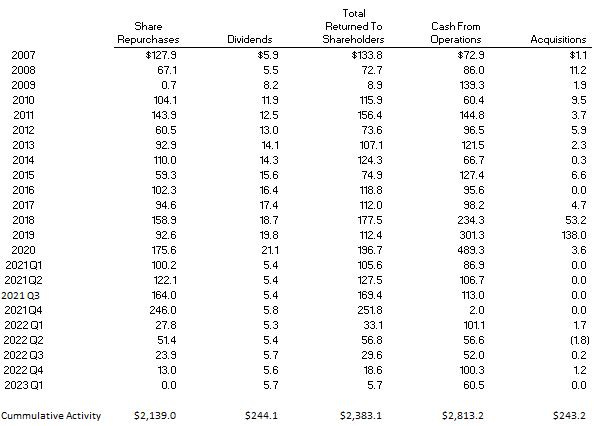

Chemed (CHE) is a holding company which is currently the home to two businesses, Roto-Rooter (plumbing services) and Vitas (hospice care). Its capital allocation is second to none. They have a history of engaging in large, transformative transactions, when it is in the best interest of shareholders. Since 2003, they’ve settled into growing Roto-Rooter (via organic growth and acquisitions) and Vitas (mostly via green fielding new locations); paying a de minimus, but growing, dividend (to check two buckets for shareholders who care about such things); and repurchasing large amounts of shares via lumpy transactions and only when the price is reasonable. The below chart shows, since 2007, Chemed generated $2.8B in cash, returning $2.4B to shareholders (mostly via share repurchases) while spending $243M on acquisitions (mostly small ones).

History:

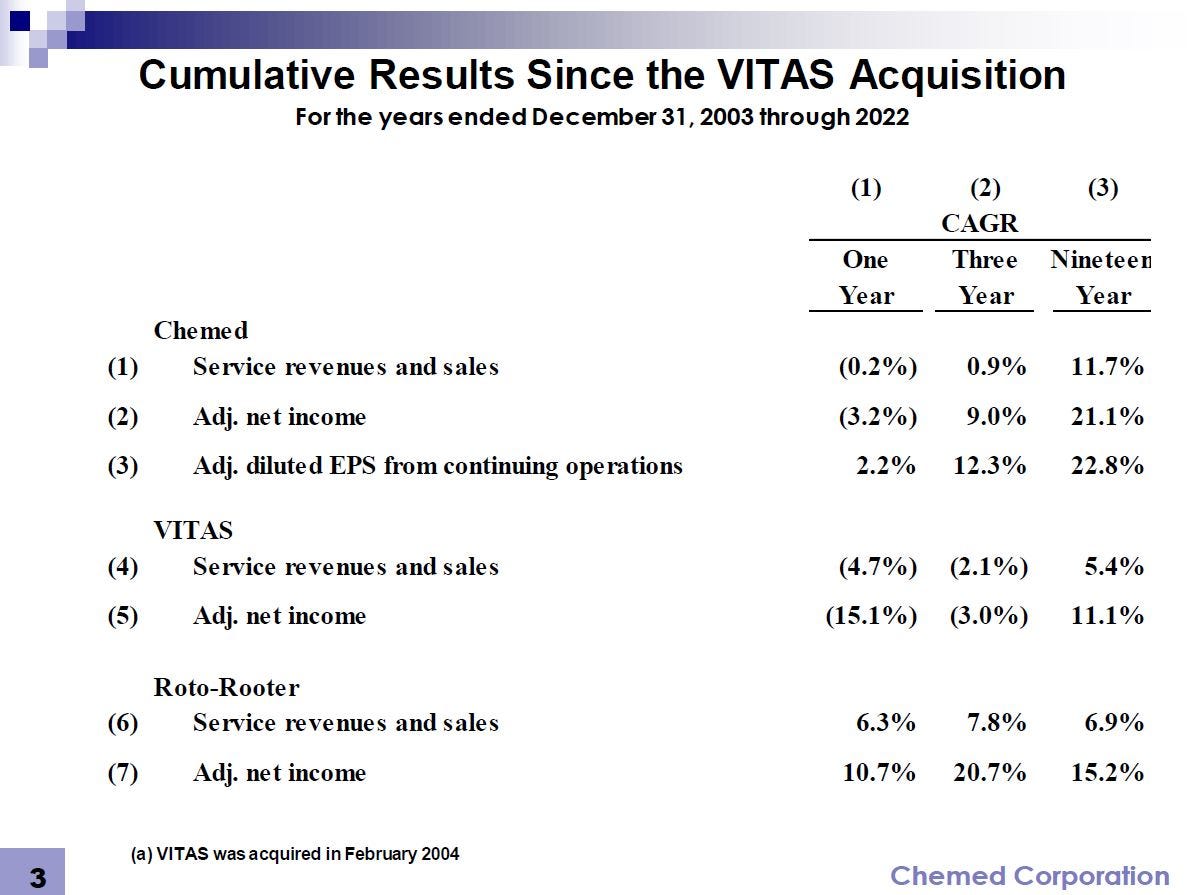

It is fitting that Chemed began its public-company life via a value creating transaction. It was spun out of WR Grace in the 1970s, and at the time, their flagship business was a specialty chemicals business. They also owned the healthcare business Omnicare. In 1980, they acquired Roto-Rooter, and in 1981 they spun off Omnicare. The 1990s were busy for them, beginning with selling off their flagship chemicals business, when presented with a price that was too good to pass up. In 1993, they helped finance the private equity purchase of Vitas via a convert worth about 20% of the company, this grew over time to represent 37% of the company. A decade later, the private equity sponsors informed Chemed that they were going to sell Vitas. When told about the selling price, Chemed informed the sponsors that they were not sellers at that price, they were buyers, so they ended up buying the remaining 63% of Vitas for $431M. At this point, they were left with Roto-Rooter and Vitas, and they focused on growing each. Below is a slide with some long-term performance metrics for Roto-Rooter, Vitas, and Chemed as a whole.

The strong performance of both Roto-Rooter and Vitas has led to strong stock price performance. Note, if you want to get rich, find a company that can compound its share price 22.8% per year for 19 years.

Business Segments:

Roto-Rooter (“RR”):

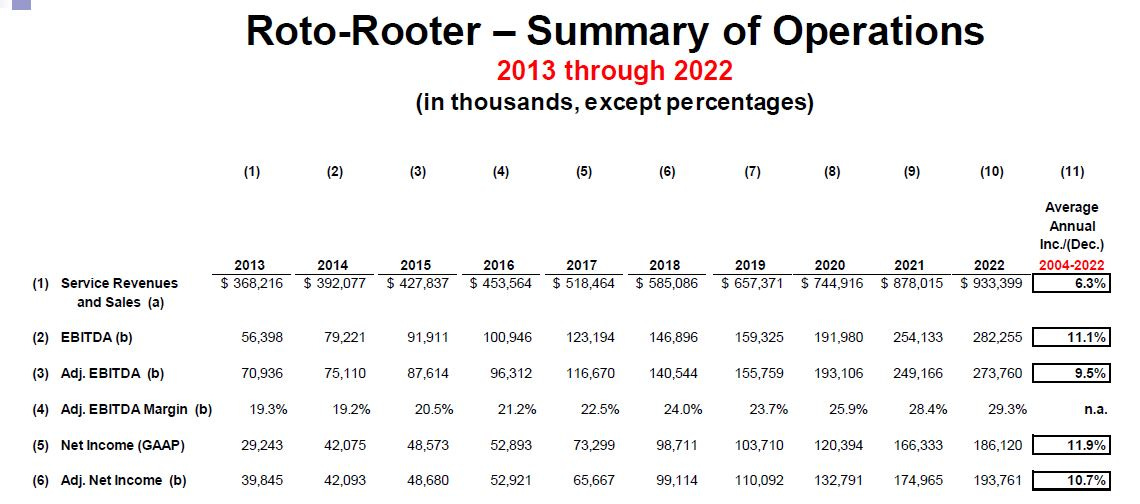

RR is in the plumbing and water remediation business - remediation is a $168M revenue business that they started from zero in 2015. It operates through three segments: 1) company-owned stores 2) franchised stores and 3) independent contractors. They have an estimated 15% of the drain cleaning market and 2% - 3% share of the same-day service market.

Roto-Rooter was founded in 1935, when Sam Blanc created a machine by attaching a cable with blades to a Maytag washing machine motor. This machine enabled the cleaning of sewer pipes, without having to dig up and replace the pipe, as was the previous practice. To set up a channel to sell his drain cleaning machine, Sam Blanc created Roto-Rooter franchises, which gave franchisees the right to operate in a given territory, for which they paid an annual fee based on the population of the territory. There are 369 franchises currently in place. The franchisees receive minimal support from corporate; essentially, they pay a royalty to operate in a given territory using the Roto-Rooter brand. Typically, franchisees are a husband-and-wife team, where the husband is a master plumber while the wife operates the call center and back-office functions. They benefit from the Roto-Rooter brand.

When Chemed bought RR, they began to buy back their franchises and operate company-owned territories. There is often a material difference between the financial performance of a company-owned and operated territory and a franchise, as company-owned stores are better at some critical functions of the business such as e-marketing and search engine optimization. The discrepancy in the performance between the two makes franchises attractive acquisition targets given the opportunity to enhance their performance post-acquisition.

If a territory is too small to be corporate owned and operated, then Chemed will set up Independent Contractors in a company-owned territory. Independent contractors receive more support from RR corporate than franchises and look more like a traditional franchise (paying Chemed 28% of their revenue as a franchise fee). A typical independent contractor operates in a rural market. It is run by a husband-and-wife team, where the husband is a master plumber, and the wife operates the call center and other back-office functions. It may have around 15 employees. It’s worth noting that independent contractors have the opportunity to become quite wealthy and can sell their business (but not the territory) when they want to retire. If they do not do a good job, Chemed can terminate the relationship.

For most of the last two decades RR spent in the single-digit range in millions of dollars per year to acquire small franchises. They spent $53M and $138M in 2018 and 2019 to acquire two larger franchises. I don’t think there will be opportunities to buy franchises of this size going forward.

RR’s services are non-discretionary. These aren’t plumbers installing a new shower. These are plumbers that you call when you are having an emergency and need a pipe unclogged, a toilet fixed, and the repair and remediation of a major leak. You call them when you need immediate service, and you don’t haggle for the price. Their reputation for quality and delivering quick service gives them pricing power. The equity in the brand also eliminates the need for referral services such as Angie’s List or American Home Shield. While they use some forms of advertising such as billboard, yellow pages (believe it or not), google is by far their most effective source of advertising. RR’s acyclical nature is evident in their performance; they grew during the Great Financial Crises and crushed it during COVID. Their commercial business suffered during COVID, but their residential business more than made up the difference.

Going forward, I model in 4% - 6% organic growth for Roto-Rooter, though its performance in COVID/Post-COVID periods were typically much higher. This estimated earnings growth is predicated on a 2.5% to 3.0% inflation environment. If inflation is higher, so should organic growth, as they have pricing power, and will use it. Earnings growth should advance faster as they expand margins as they grow, such are the benefits of scale. EBITDA margins a decade ago were ~15%, about half as much as they are today.

Vitas:

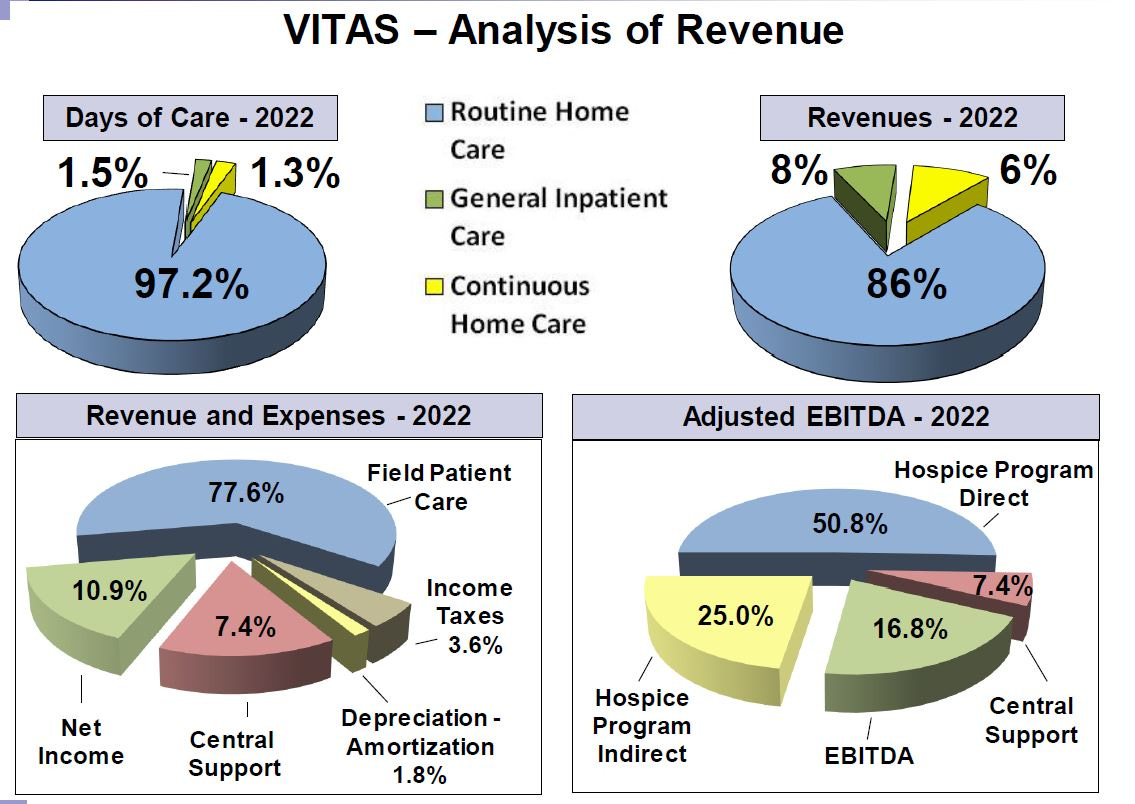

Vitas is the largest provider of hospice and palliative services for patients with severe, life-limiting illnesses. Vitas has ~10% market share in the US. It operates 48 hospice programs in 14 states and the District of Columbia. Revenue is 94% paid by Medicare, 3% paid by Medicaid, and 3% paid by private. In 2022, 86% of the revenue was for routine home care, 8% for general inpatient care, and 6% for continuous home care.

Hospice providers care for patients near the end of their lives. When choosing hospice care, a patient discontinues curative medical services, procedures, and medicines and switches to medical services, procedures, and medicines that focus on providing comfort and reducing pain. Payments for hospice services are for the most part socialized, as most of the patients are on Medicare. While having a large percentage of revenue coming from the government presents a risk, note that the hospice program saves the government money as palliative care is less expensive than curative care (which has limited efficacy towards the end of life and may do more harm than good). Note that 30% of every dollar spent by Medicare is spent within the last year of a patient’ life, with most of this spent in the last six weeks. A vast majority of that money is spent on curative care that does not cure or emergency room visits following an episodic event. Palliative care pulls people out of ineffective curative care and minimizes unnecessary visits to the ER. To begin palliative care three signatures are required. 1) The patient’s attending physician who certifies that the patient is terminally ill (i.e. a prognosis of six months or less); 2) the hospice physician; and 3) the patient or their proxy. Hospice systems must review if a patient is still terminal after two ninety-day periods, then every sixty days.

Hospice services are provided by a variety of different for profit and nonprofit entities. Hospital systems, assisted living facilities, and nursing homes all may have captive hospices. Each has some issues with respect to billing that Vitas helps to solve. Note that Medicare has two overarching rules with respect to paying for palliative care. 1) They limit inpatient care to 20% of the total days in hospice (Vitas runs in the low-single digits) and 2) they limit cap the annual spend per person at $32,487. The annual spend cap is not on an individual basis, but on the average of a hospice’s population. So, back to the challenges of hospitals, assisted living facilities, and nursing homes. Patients going to hospice directly from hospitals spend the least amount of time in a hospice. Often the revenue received from hospital patients is not enough to cover their setup expenses (paperwork, ordering medical equipment, and medication). Patients coming from assisted living facilities typically last the longest in a hospice program, followed by patients coming from nursing homes. Captives of these facilities often bump up against their annual Medicare cap, at which point, they provide their overflow patients to Vitas. Vitas has a large population of patients from a variety of sources, so they can manage the limitations of Medicare.

The Government:

The Government is a large risk factor, and frankly, I usually refrain from making healthcare investments because of this risk factor. That said, I am comfortable with government risk surrounding Vitas for two reasons. First, is its scale, a point I will talk about later. Second, Vitas saves the government money. Recall, that curative care towards the end of life has limited efficacy and is expensive. Palliative care is less expensive and relieves some pressure in the government funded healthcare systems. This feature will become even more important in coming years as the Federal Government deals with ballooning budget deficits while the baby boomers enter the later stages of their lives.

That said, the government can act quite irrationally in the short term. In 2017, Vitas settled a False Claim Act with the government for $75M. It’s worth noting that the company admitted to no blame in the settlement, and they fought the government for several years; ultimately, they paid less than 1% of the revenue from the covered period to make the issue go away. The government alleged that between 2002 and 2013, Vitas put people into their hospice program who did not qualify and treated and billed Medicare for unnecessary episodic treatments. The following is the management’s response. Regarding admitting non-terminal patients, the government, with 20/20 hindsight, cherry-picked cases whose lives exceeded the average expectancy. Vitas has no ability to know before hand, how long someone will live. Furthermore, the three required signatures at the entry into the program will negate there being a systemic plan to defraud the government. Regarding episodic treatments, these occur when there is a medical event for a patient in the program. Vitas’ billings for episodic events exceeded the industry’s average. This was the evidence the government used to claim that there was fraud. However, the company claims that the government could not point to one example of where the company did something inappropriate. In a well-run program, when an episodic event occurs, a nurse is called and the nurse stabilizes the patient, calms the patient’s family, and often teaches the family on how to deal with a recurrence of the event. In a poorly run program, no nurse is dispatched to a patient experiencing a medical episode. The family of a patient either takes the patient to the emergency room or calls an ambulance. A very expensive hospital stabilizes the patient, and then sends the patient back to the hospice, as they are terminal. It’s management’s claim that their higher level of episodic billing was due to their higher level of service that, in fact, saved the Medicare system money by eliminating the use of an expensive hospital service. They further say that proof of this is that shortly after the settlement with Vitas, Medicare raised the reimbursement rate for episodic services, which Vitas believes is a tacit admission that Medicare was under funding this vital service.

There is a recent example of the government acting irrationally. This one may end up benefiting Vitas. The Centers for Medicare and Medicaid Services (CMS) sets the payment rates for hospices, and it typically adjusts for inflation on a lagging basis. Given the recent inflation, particularly within wages, the CMS’s reimbursement increases have not kept up with the true wage inflation. Vitas has scale and consequently has 15% to 20% EBITDA margins. Smaller players have 5% - 9% margins. Wage inflation has both crushed competitors’ margins and limited their ability to pay market wages to their licensed healthcare professionals. This should work itself out in one of two ways. First, the CMS could increase reimbursements to an appropriate level. Obviously, this would benefit Vitas as its revenue would go up and its margins would expand. Second, the CMS could refrain from increasing reimbursements up to an appropriate level. This would put pressure on smaller operators and provide Vitas with an opportunity to both take market share directly from competitors and/or buy some competitors to use as platforms for further growth. We are already seeing Vitas capitalizing on this opportunity. Vitas has invested ~$40M in retention bonuses. About $37M of that was to stabilize their current work force. The balance of the investment was used to recruit new licensed healthcare staff – they gained 475 professionals through this investment. The earnings they should gain from having these 475 professionals is worth about $80M to Vitas, yielding a nice return on a $3M to $4M investment and giving them an opportunity to accelerate growth above their already impressive long-term growth rates.

Return on Invested Capital:

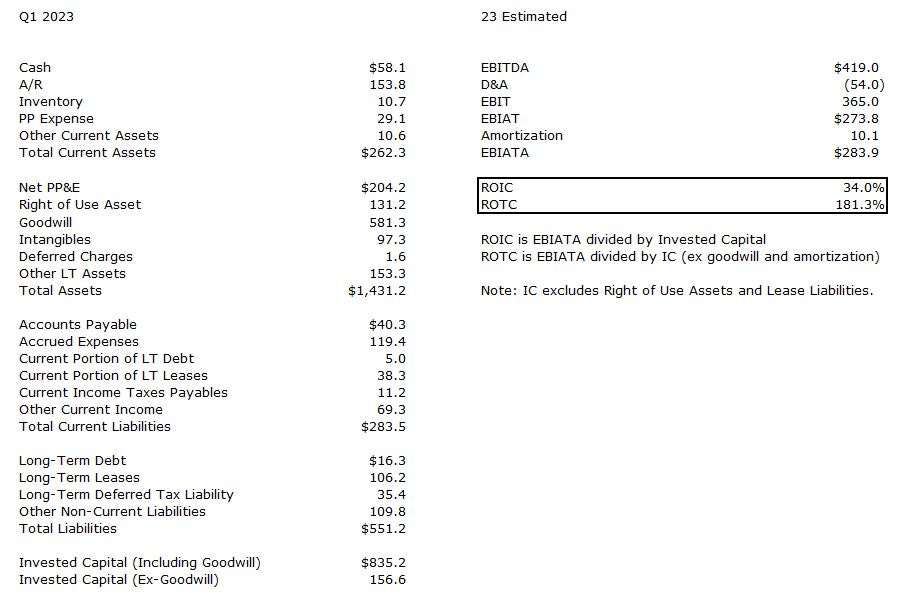

I view ROIC calculations with two main goals. First, to determine the returns on incremental capital deployed into the business if the business were to only grow organically. For this metric, I’ll use returns on tangible capital (ROTC), as ROTC removes the goodwill and amortization (for the most part, a fancy word for goodwill that receives a tax beneift from the US government) from the denominator in the ROTC calculation. Second, I’ll use it as one of the tools to access management’s prowess in executing M&A. For this calculation, I’ll keep the goodwill and amortization in the denominator of the ROIC calculation and only keep the tax attribute of amortization in the numerator (the government gives this to you, so take it). Additionally, I will usually remove the cash from invested capital if it is not a permanent fixture on the balance sheet.

I estimate that Chemed is generating an 34.0% ROIC and a 181.3% ROTC. While both are impressive, I think that the ROTC is more representative of the business than ROIC, given the small size of their acquisitions ($243M since 2007).

HoldCo Discount and Capital Allocation Considerations:

Having a plumbing company and a hospice provider in a HoldCo makes as much sense as putting bagpipes in a rock song; but like AC-DC’s “It’s a Long Way to the Top (IF You Wanna Rock ‘n’ Roll)”, in this case, it works. Why is there no HoldCo discount? I think there is not for three reasons. First, they clearly disclose the KPIs for each business. Second, they are willing to undergo a large, transformative transaction if a HoldCo discount persists – they tell you they will do it in each quarterly slide deck! Third, they buy back ample amounts of stock. The company doesn’t usually run with much debt. Given the market disruptions of 2022, and the availability of cheap debt, they did take some debt down and accelerated their share repurchases. As the cost of debt went up, they quickly retired their it. See the charts below on their capital allocation plans for each of the businesses.

Since Chemed brought up a willingness to divest either of the assets, then it is worth taking a moment to consider what the company would do if one of the businesses was sold (note that a spinoff would be one way for management to attempt to realize value, but that would come with less cash than an outright sale). If Vitas was sold, then there may be an opportunity to pick up a business that would compliment Roto-Rooter, such as American Leak Detection. However, the first time I spoke with management, I was told that the purpose of the two businesses is to generate a growing stream of per-share free cash flow. If they are going to buy another business, I would assume that they would find one that generates ample returns on invested capital, has the ability grow, for which they would pay only a reasonable price. If they cannot find one, you would likely see a large share repurchase.

Valuation:

Instead of providing its current multiples and thoughts on its current attractiveness, I’ll just leave you with this. This management team is one of the most astute buyers of their own shares, and the highest average quarterly price they paid for a their own shares was $519 in Q1 2023.

Disclaimer: For entertainment purposes only. Not a solicitation to buy or sell a security. Due your own due diligence.

Hey! Great writeup. One of my top positions is Water Intelligence (Roto Rooter's competitors from American Leak Detection). Any thoughts on them?

I leave you my writeup here just in case you're interested: https://oscar100.substack.com/p/water-intelligence-plc-watr

P.S: Do you have Twitter do that I can follow you?