Brookfield Corp. (“Brookfield”) and Brookfield Asset Management (“BAM”) were hit with a lawsuit on May 8, 2025 by a former employee who claimed that he was terminated for “(i) refusing to accept a bribe and agree to help them engage in wrongful illegal conduct towards their investors and (ii) as retaliation for filing a whistleblower complaint with the Securities and Exchange Commission disclosing that an investment fund affiliated with the Brookfield Defendants was making securities misrepresentations to investors.” These claims are serious and troubling, if true. As a shareholder in Brookfield, I naturally thought I should investigate. I came away comforted after reading the complaint, as I do not believe many of the plaintiff’s claims hold water. I will go through some of the claims below and some evidence (mostly from the legal document itself) that casts doubt on these claims. I think addressing the core claims is sufficient and it is not required to go through each individual one in the document. The following article on the situation has a link to the claim if you want to read it for yourself (https://www.axios.com/2025/05/11/brookfield-vc-lawsuit).

Main Claims:

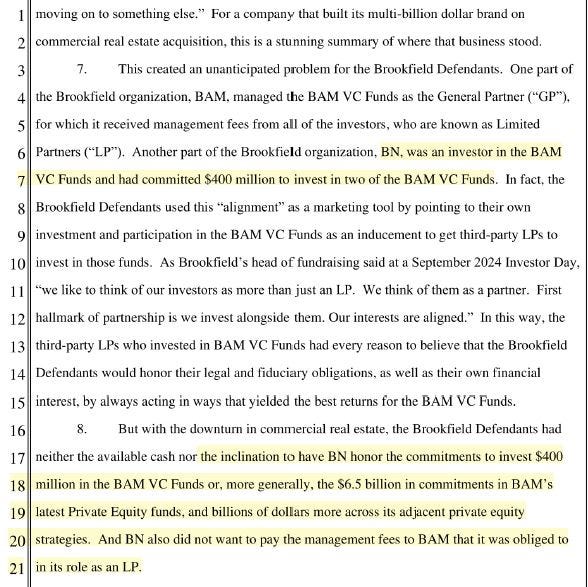

Brookfield raised two VC funds via third-party capital - Brookfield Technology Partners Funds II and III (“BTPF2 and BTPF3” or together “BPTFs”). (See exhibit 1)

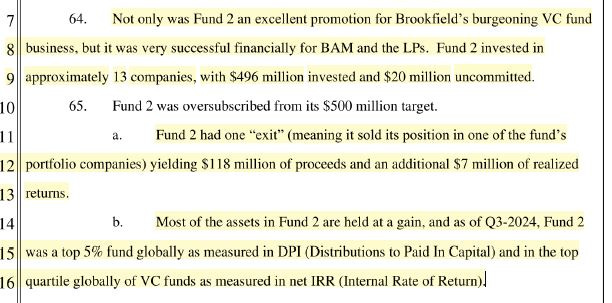

Performance wise, BPTFs were both doing well.

Brookfield had a cash crunch due to its real estate investments and did not want to fund future capital calls for the BTPFs.

Due to the above alleged cash crunch, Brookfield did not want to pay management fees to BAM.

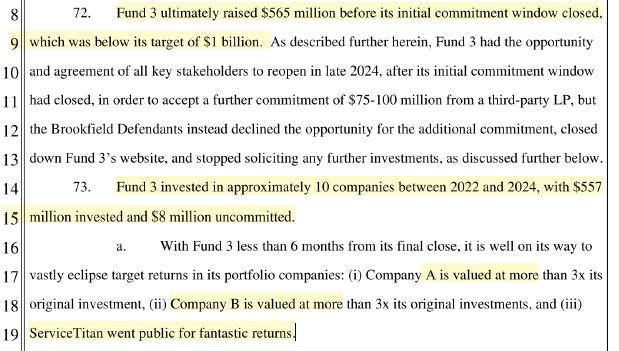

Brookfield had another venture entity that it bought out of Silicon Valley Bank called Pinegrove. It wanted to merge BTPFs into Pinegrove, which would put the BTPFs into rundown mode, as Pinegrove had agreements to not make direct investments into technology businesses and to only do so through other VC funds and secondaries. Hence, by limiting the BTPFs investment options, Brookfield was disadvantaging the limited partners of the BTPFs because those funds could not make any new direct investments, which could be attractive. (See exhibits 2 and 3)

As discussed, there were more claims than this, but I think this is sufficient to look at. To summarize, the plaintiff was a senior executive of Brookfield’s BPTFs. The funds were performing well, but Brookfield no longer wanted to fund capital calls or pay management fees as Brookfield had a cash crunch. Brookfield then wanted to merge BTPFs with Pinegrove, but that would disadvantage BTPFs’ limited partners.

Cash Crunch

As a shareholder of Brookfield, this is one of the more troubling claims. But I think we can quickly dispel it in a few different ways.

First, let’s use the language from the legal document itself. The document states that BTPF2 had $496M invested and $20M uncommitted. The capital was mostly called. Is the plaintiff saying that Brookfield didn’t have the cash for an additional $4M capital call? (See exhibit 4)

Continuing the same analysis on BTPF3, the claim states that BTPF3 had $557M invested and $8M uncommitted. If the remaining $8M capital were called, Brookfield’s call would be ~$4.2M. Again, are things so bad at Brookfield that they are sweating an additional $4M capital call? (See exhibit 5)

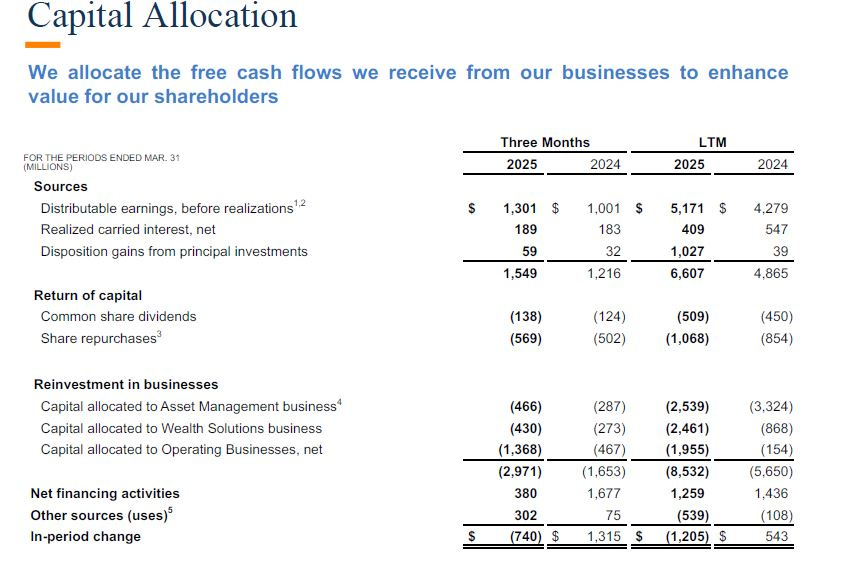

Second, if the above is correct, and Brookfield is sweating $8M in capital calls, that should impact how they are allocating firm capital. Looking at their Q1 2025 Supplement (see exhibit 6), Brookfield spent $569M in share repurchases in Q1 alone and $1.1B over the last twelve months – LTM the share repurchase are up 25.1% over the same period last year. Companies in a cash crunch don’t spend capital on completely discretionary uses such as share repurchases.

Third, let’s look at the claim that Brookfield did not want to pay fees to BAM. Brookfield owns north of 70% of BAM, so the majority of what BAM collects benefits Brookfield. BAM collecting management fees on BTPFs is cash flow positive for Brookfield not negative.

Based on the facts laid out in the claim and by Brookfield’s capital allocation actions, a cash crunch is not likely an issue nor the reason for Brookfield to want to merge BTPFs into Pinegrove.

Pinegrove

I don’t know the rationale of merging BTPFs into Pinegrove. Perhaps more on this will come out in the future. I can speculate, which I’ll do below. However, the Plaintiff makes the claim that merging BTPFs into Pinegrove would disadvantage the limited partners of BTPFs, as those funds would no longer be able to make direct investments. But those funds were likely at the end of the capital deployment periods (see exhibits 4 and 5). The capital that remained was likely held in reserve to support the existing portfolio companies.

Performance and Change of Strategy

BTPFs are relatively recent funds, so the performance is still to be determined. That said, it is not clear that the performance of the funds are as rosy as the plaintiff claims. BTPF2 had one exit (see exhibit 4). It was a large investment, which returned $118M in capital and generated a return of $7M – not a loss but not a stellar IRR. BTPF3 had one exit that went public for “fantastic returns” but no IRR or other information was given (see exhibit 5). Perhaps Brookfield wasn’t happy with the returns. Perhaps they just decided direct venture capital investing is not for them. Whatever the reason, it doesn’t seem likely that merging BTPFs with Pinegrove damages limited partners due to no longer being able to make direct investments. The funds seemed to be effectively done making new investments anyway.

Summary

As discussed, there were several more allegations in the claim. Feel free to read them on your own. I think I captured the major ones and alleviated any concerns that shareholders would have about them. I don’t think that Brookfield is in a “cash crunch”. They do not appear to be making decisions that disadvantage their limited partners. This seems like a normal course change of strategy that ended up in a disagreement within an employee.

Exhibits

Exhibit 1) Brookfield committed capital to two funds. Claims Brookfield does not want to fund capital calls into those funds nor pay fees to BAM.

Exhibit 2) Pinegrove

Exhibit 3) Pinegrove - Continued

Exibhit 4) BTPF2 Invested and Uncommited Capital and Peformance

Exibhit 5) BTPF3 Invested and Uncommited Capital and Peformance

Exhibit 6) Brookfield Capital Allocation