Brookfield Corp. - Get a Buck for Fifty Cents

Trying to Make Sense of the Complicated Parts and Highlight its Value

I started this article earlier in the year. Finishing it has been a nice distraction from the Tariff Tantrum, which has given us an even more attractive price.

Brookfield Corp. (“Brookfield”) had a remarkable 2024. Its stock returned 56% in 2024. Despite this market beating performance, Brookfield’s stock price has lagged some of its peers. KKR and Apollo each returned ~78%, respectively. In the wake of the Trump Tariff fiasco, all the alternative asset managers (“alt. managers”) have significantly pulled back given fears that exits and fundraising may slow, and perhaps they’ll be impacted by a recession. Let’s table that and look at where the alt managers are trading, some differences among the larger alt. managers, and if there is a specific opportunity at Brookfield.

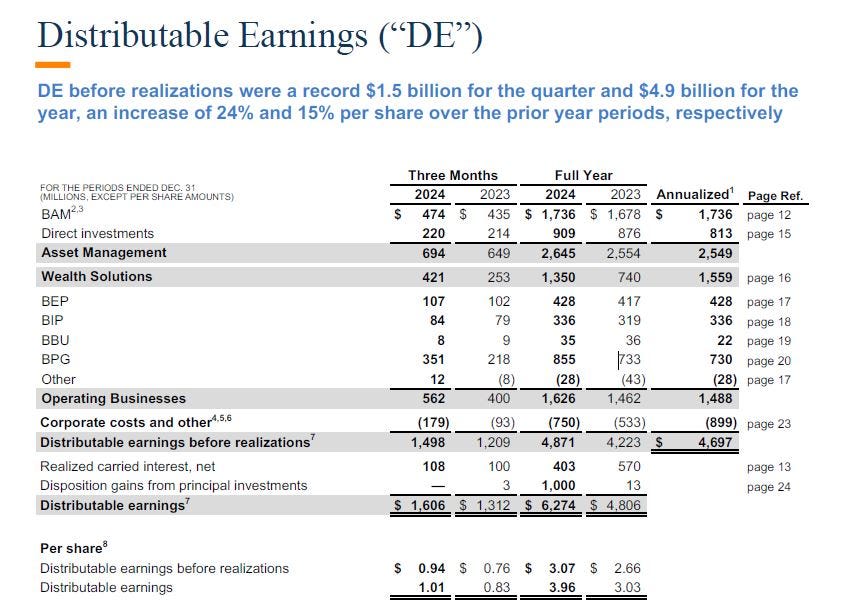

Brookfield’s management often shows Brookfield’s “Plan Value”, which is another way to say sum-of-the-parts valuation, when illustrating Brookfield’s intrinsic value. We will discuss later the benefits and drawbacks of using Plan Value as a valuation methodology for Brookfield, but in the meantime, let’s use the more industry standard valuation metric – Distributable Earnings (“DE”). On a ‘25E DE basis, Brookfield is trading at 13.2x, while Apollo Global is at 14.6x, Blackstone is at 24.3x, and KKR is at 20.1x (as of 4/10/2025). Brookfield, and even Apollo, are trading at a substantial discount to Blackstone and KKR. This discount is interesting given the similarities among the four alternative asset managers. Each has ample fee bearing capital (“FBC”) under management; Brookfield, Apollo, and KKR each have just over $500B in FBC, while Blackstone a bit higher. Each offers a wide diversity of alternative investment strategies and investment options. Each has perpetual capital, although with 88% of FBC in perpetual capital vehicles, Brookfield seems to have the highest amount of perpetual capital; Apollo is around 79% and Blackstone and KKR are both just over 50%. Each has exhibited strong historical growth and has compelling prospects for future growth. With all the similarities, why is there wide gap in valuation between Brookfield and its peers? I will present some possible reasons, but spend more time examining Brookfield, its business, and its prospects.

Why’d you have to go and make things so complicated?

The first reason that Brookfield is undervalued is because of complicated financials. The words complex and complicated are often used interchangeably, but I think they are distinct. Complex is like the weather or daily stock prices movements. You may have some inputs for a model that gives you an idea of what the weather will look like tomorrow, but it often turns out to be different, sometimes wildly different. Complicated is like a Rolex watch. There are a lot of moving parts, but with practice, you can learn to take it apart and put it back together and it will work the same way every time. Brookfield is like a Rolex (probably a Daytona), there are a lot of moving parts. In my opinion, the complicated parts that give investors the most unease would be the listed affiliates and/or Brookfield Property Group – more on this later. That said, if the financials of Apollo, Blackstone, and KKR are less complicated than Brookfield’s financials, it is not by much. While there have been several short reports criticizing Brookfield’s, and its various affiliates’ accounting, there is likely little to no nefarious intentions in Brookfield’s complicated accounting. Rather, complicated accounting is representative of who most of management is at their core – they are accountants. Jack Cockwell, Bruce Flatt, Brian Lawson, Nicholas Goodman, Samuel Pollock, and Sachin Shah all started out as accountants. Do accountants enjoy complicated financials for the sake of being complicated? Perhaps, but at the very least they prefer complicated structures as complicated structures can shield assets and be tax efficient. It is likely asset protection, tax efficiency, and a means of raising perpetual capital that is behind the complicated financials of Brookfield and not nefarious activities.

Valuation:

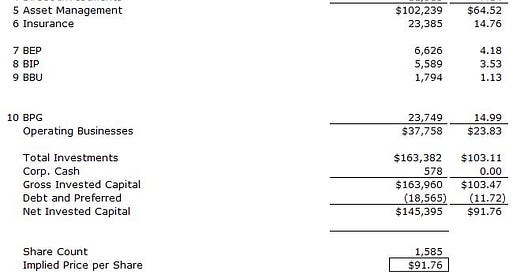

Plan Value – That’s Brookfield Speak for Sum of The Parts

Bookfield’s Plan Value is $91.76, about double the current trading price of $45.97. So, if the Plan Value is correct, you are picking up Brookfield for fifty cents on the dollar. So, let’s pick this apart.

The Publicly Traded Entities (Lines 1, 7, 8, and 9): 44% of Brookfield’s total investment value is comprised of Brookfield’s holdings in publicly traded entities – Brookfield Asset Management, Infrastructure Partners, Renewable Partners, and Business Partners. The significance of these entities being publicly traded is that we get a daily assessment of the market’s view of their values. It is worth noting that BIP has come under intense scrutiny by shorts. I am not going to re-litigate it, but @PrefShares on X did an excellent job refuting many of the shorts’ claims (https://x.com/PrefShares/status/1868061650462388286).

Carried Interest (Lines 2 and 3): Line 3 is carry that has been accumulated but unrealized. That figure should be money good; I have no problem with it. Brookfield has a long history of generating carried interest. Line 2 is their attempt to project and capitalize the amount of carry they expect to earn from their current funds that is in excess of Line 3. This is a bit aggressive…but they do have a long history of generating carried interest. I find it easiest just to sensitize this amount and look at it at various valuation levels. We will do this below.

Direct Investments (Line 4): Is the general partnership contribution to the funds that Brookfield raises. This is probably money good.

Insurance (Line 6): This is the value of Brookfield’s annuity/insurance business. It is valued at 15x DE, which seems reasonable.

Brookfield Property Group (Line 10). This is another controversial issue. This $24B represents the equity value of the real estate that Brookfield owns on balance sheet from their take private of Brookfield Property Partners. I wrote an article on BPG last summer, which you can read (https://310value.substack.com/p/brookfield-property-group). I tend to think that the $24B in equity book value is legitimate, but who knows. I do know for sure that their equity value is not zero – there may be some problems in the portfolio, but these are all individually financed assets. As of Q4 24, Brookfield has ceased payments on 4% of the debt on their properties, as they are negotiating with creditors. Once they stop making payments, the equity value for those properties are removed from the reported equity values.

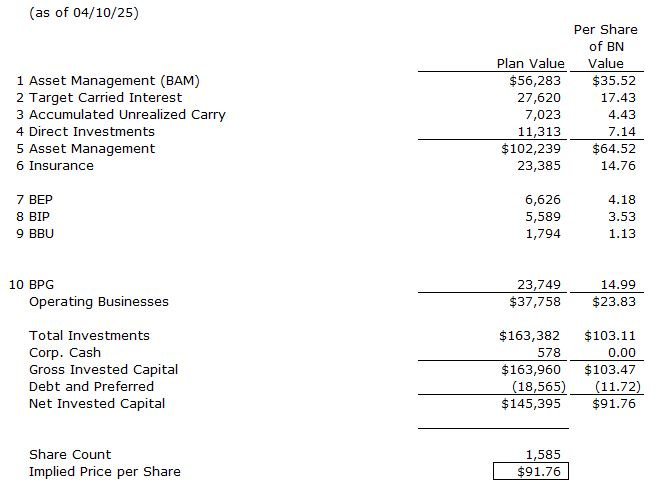

So, what are the benefits and drawbacks of Brookfield using Plan Value to illustrate its intrinsic value? I see two main benefits. First, it makes it easy to see the discount that Brookfield is trading at relative to its intrinsic value. Second, it makes it easy to sensitize some of the drivers of value. For example, the two most controversial components of the Plan Value are Target Carried Interest and the Equity Value of BPG. What does Plan Value look like at various Target Carry realizations or BPG Real Estate Book Values? If you take an extreme view that they will not realize any additional carried interest and that the equity value of their on balance sheet real estate is zero, then the SOTP is $59.34 – well above the current price.

Distributable Earnings:

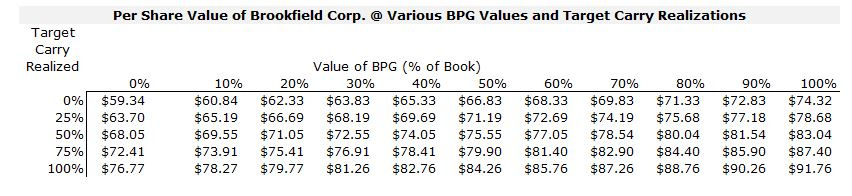

Let’s take a look at DE. To do so, it’s good to understand its various components.

BAM (representing ~36% of DE before realizations): The largest component of Brookfield’s DE is comprised of fee revenues earned by BAM less direct costs, cash taxes, and amounts owned by minority interests or other parties.

Direct Investments (19% of DE before realizations): This is the sum of the cash distributions it receives from its General Partner’s interest in its private funds. Think of this as dividends received by its ownership stake in the funds. One item to point out is that this metric likely understates the value of these positions as it does not capture the compounding of the value of the GP interests, nor the full amount of earnings that are supporting these distributions.

Wealth Solutions (28% of DE before realizations): This is the earnings from its annuities business. So, net invest income less cost of funds, interest and operating expenses. Apollo Global calls this Spread Related Earnings in their reporting. This is now 28% of DE, up from 18% last year. This should continue to grow as they get the full annual benefit from the AEL acquisition.

Listed Affiliates and Property Owned on Balance Sheet (33% of DE before realizations) – BEP, BIP, BBU BPG and Other: This is the cash distributions (think dividends) that Brookfield receives from its ownership stake in each of the listed affiliates and the property it owns on balance sheet. The DE noted for each of the affiliates ties directly to the cash distributions for each of the entities. As noted with my above comment on Direct Investments, DE does not account for any increased value in these positions, it only captures the distributions from them.

Realized Carried Interest: This is simple, it’s the realized carry received. There could be a huge wave of carry coming, more on this later, and DE would miss it, as it only captures what is realized in that period. Conversely, in periods with high amounts of carried interest, using a DE multiple would capitalize earnings that are less recurring in nature than that from standard management fees.

Dispositions on Gains from Private Investments: This is an interesting category, and it will likely become more significant over the next few years. First, the company sold some BPG real estate at a premium to book value. Second, the company sold some of its holdings of BBU units to Wealth Solutions. I’ll say more on this below in the catalysts section, but technically what is happening is that BBU units are being removed from the SOTP analysis (BBU price x units owned) and being transferred into Wealth Solutions. The value for these units are being captured in the SOTP to the extent that they increase Weather Solutions’ Spread Related Earnings. It’s worth point out that the Financial Times recently had an article that criticized some of Brookfield’s sales to Wealth Solutions. I don’t want to re-hash it all here, but I did address it in the following Twitter thread. https://x.com/310Value/status/1901674914559492386

Benefits of Using DE. For one, it is industry standard and highlights how cheap Brookfield is relative to its peers. Also, Brookfield’s DE should be ramping up.

If there is a shortcoming of using DE for Brookfield, it is that it understates Brookfield’s earnings. Recall, that for several of the components of DE – the listed affiliates, BPG, the direct investments – it does not represent the earnings of those entities, just the distributions received. This is akin to putting a PE multiple on the dividends a company produces as opposed to its actual earnings.

Catalysts

There are several upcoming catalysts that make Brookfield attractive and that is probably why the company has attracted some high-profile investors since Q3 last year.

Brookfield Wealth Solutions:

Brookfield Wealth Solutions is growing ~20% which will ramp up DE.

Brookfield Wealth Solutions’ portfolio could accommodate an ample amount of Brookfield Products and some of BPG’s high-quality real estate. As Brookfield products are transferred into the BWS portfolio, the fees that BAM gets paid will increase.

Brookfield Property Group

BPG will monetize an ample amount of its real estate portfolio, some of it to Wealth Solutions. As this happens, two things can occur. First, if the cash stays within the BPG portfolio, that portfolio will de-lever, which will cause management fees paid to BAM to increase, as they are paid by BPG on an equity value not total capital value. Second, cash could leave BPG and go to BN. So, an asset, real estate equity, that the Street is ascribing no value will be turned into cash. If the Street doesn’t value that cash appropriately, it can be used to repurchase shares. Third, the same-store NOI in their real estate portfolio is growing at 4%, so this may be an indication of a bottom. The more comfortable investors become with their real estate, the more willingness to begin to ascribe value to the portfolio.

Brookfield Asset Management

Brookfield Asset Management recently domiciled in the US, which makes it eligible for index inclusion.

New Sell-Side Coverage

Brookfield is under owned by large US asset managers. When BAM was spun out of Brookfield, every US sell side analyst (save JPM) dropped coverage. Recently, BN picked up coverage from Morgan Stanley. Brookfield pays banks a massive amount of fees, I wouldn’t be surprised if Brookfield is pressuring banks to pick up coverage.

Carried Interest

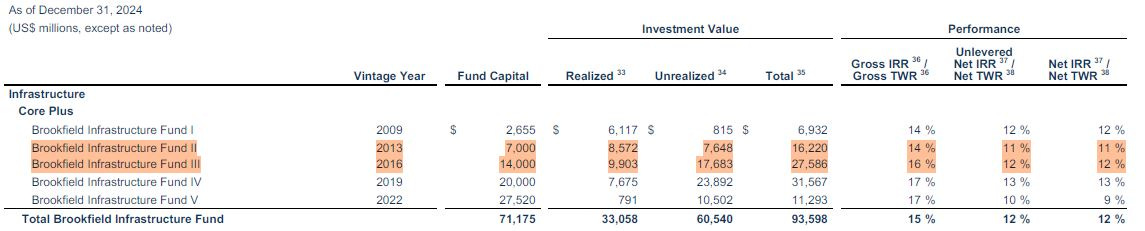

Brookfield has two large, well-seasoned, infrastructure funds that are ripe to be monetized. As they monetize these funds, there should be a large wave of carried interest hitting.

Another Bite the Apple / Pair Trade

When I first began writing this article, before the Tariff Tantrum (or as I prefer to call it Trump’s Folly), I thought that Brookfield would attract investors who feel that they missed 2024’s moves at Apollo, Blackstone, and KKR. Post Tantrum, alt. managers have become a popular short. Given Brookfield’s minimal exposure to tariffs, and its valuation relative to Blackstone and KKR, perhaps it attracts buyers who pair it with a short on the richly priced others.

Conclusion:

Brookfield seems to be trading at fifty cents on the dollar. While the macro environment is the most uncertain since COVID, their investments should hold up well. Additionally, there are multiple catalysts in its near future, which gives investors several ways to win.

Disclaimer: Not a soliciation or an offer to buy or sell any security. For entertainment/informational purposes only. Due your own due diligence.

Thank you for this. I appreciate your thoughts about the catalysts. I learned something new about Brookfield, as always from your posts/articles.

I do like this, my only problem is that since management began speaking about their plan value, it has always traded at a 40-50% discount, so a gap up in price would not be feasible. I do think it's a high quality stock, but it's not going to be booming any time soon, the accounting is still madly confusing.