Brief Thoughts on Brookfield's Investor Day

Brookfield is Cheap Compared to Plan Value

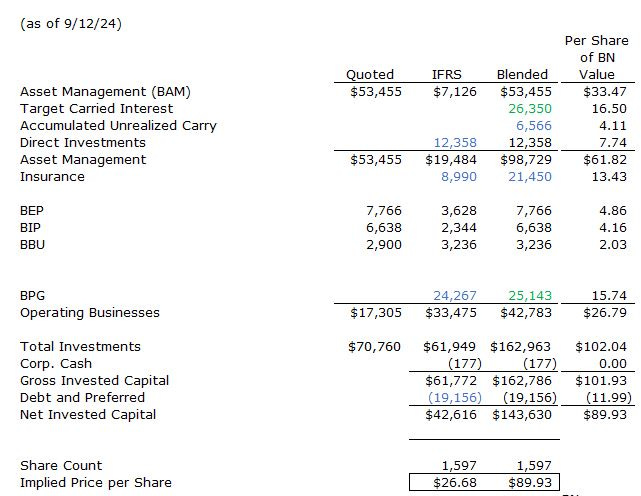

BN is trading around $50.00, with their plan value (basically a sum-of-the-parts valuation) at $84. I have it closer to $90 as of today. ~$52 per share can be attributed to the per share value of BN’s stakes in its four publicly traded affiliates. Then you have $4 in accumulated but unrealized carry, $17 in targeted carry, $13 in the annuity business, $16 in its real estate owned on balance sheet.

They Plan to Grow their Insurance (Annuity) Business in a Big Way

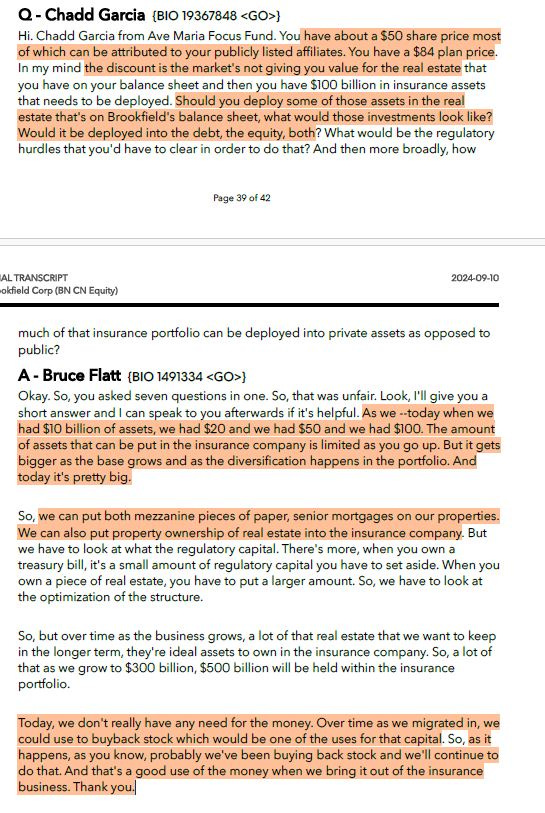

Insurance Portfolio Will Be Deployed into Funds and Core Real Estate

Cash From the Monetization of Core Real Estate Assets Can Be Used for Buybacks

One question got directly to how to use the insurance portfolio to close the gap between trading value and plan (intrinsic) value. Deploy part of the insurance balance sheet into their highest quality balance sheet real estate and use that freed cash to repurchase shares.

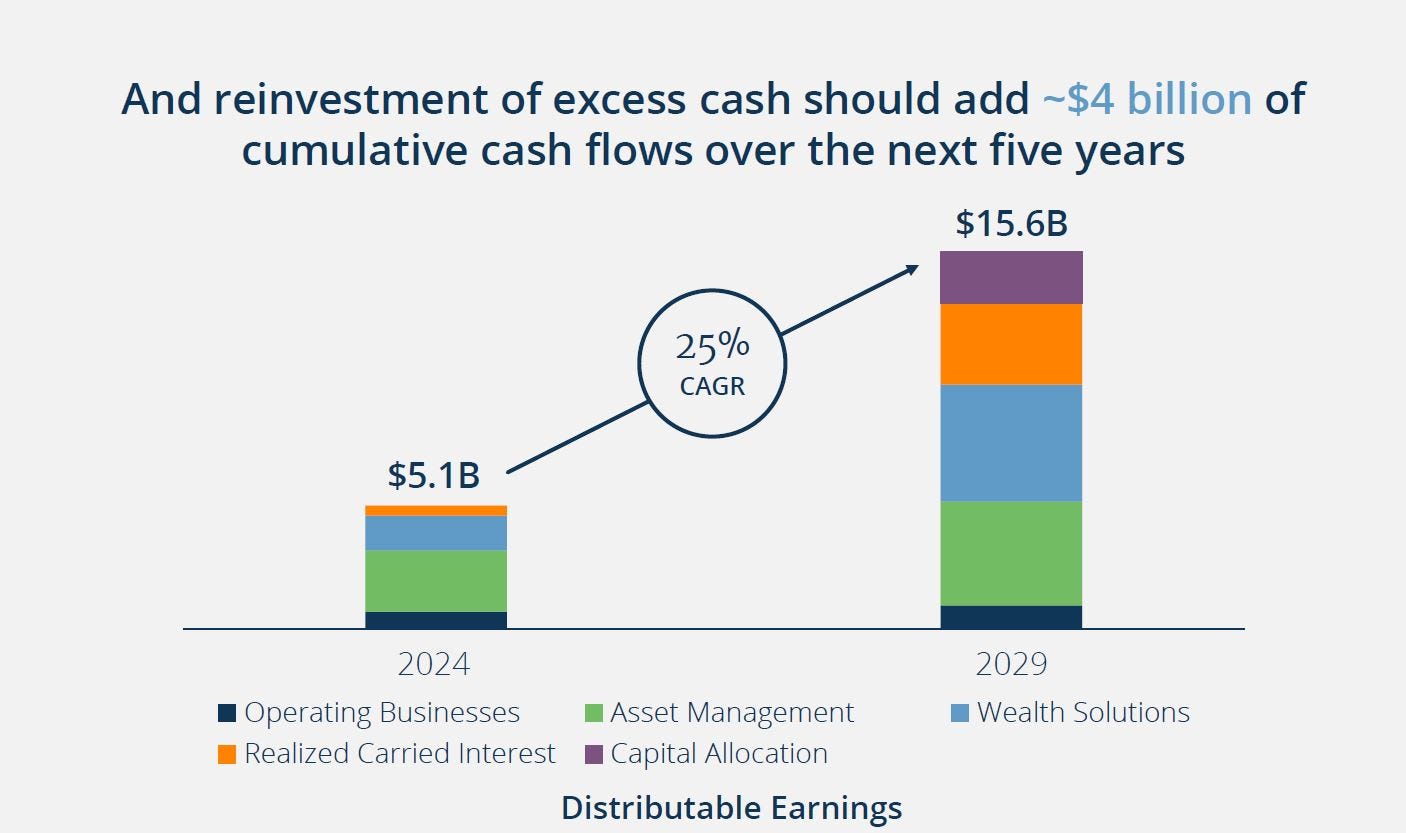

The point was touched on in their presentation as they covered the expected amount of balance sheet realizations between now and 2029.

Balance Sheet Real Estate (which is getting no value in the SOTP), will be Much Smaller In The Future

Balance sheet real estate, which is only a part of their “Operating Businesses” will be reduced as per the above slide. That said, Operating Businesses’ DE is projected to grow slightly between now and 2029, where DE as a whole is expected to CAGR at 25%.

Conclusion

Brookfield has many levers to pull to realize value. They can grow their asset management business via their several flagship strategies. Their nascent, but now $100B, insurance business should drive a material amount of growth. It should also help Brookfield turn real estate assets, which seem to be valued at zero by the street, into cash which will likely be deployed into share repurchases.