Archaea Energy: An Early-Stage Compounder and the Implications of Landfill Gas for Waste Haulers

Archaea Energy is one of the more interesting companies in the renewable energy space. Before getting into why this is the case, let us start with a brief primer on regulations impacting the space.

Renewable Energy Regulations

Renewable Fuel Standard and RINs

The Renewable Fuel Standard (RFS) program was created under the Energy Policy Act of 2005. The RFS is a program in a national policy that requires a certain volume of renewable fuel to replace or reduce the quantity of petroleum-based transportation fuel, heating oil or jet fuel. The four renewable fuel categories under the RFS are: Biomass-based diesel, cellulosic biofuel (what Archaea produces), advanced biofuel, and total renewable fuel. The EPA adjusts the required levels of cellulosic, advances, and total volumes annually. Note that the required levels have never decreased, and in 2022 were 16.0 billion gallons for cellulosic. Obligated parties under the program are refiners or importers of gasoline or diesel fuel. Compliance is achieved by blending renewable fuels into transportation or by obtaining credits (called Renewable Identification Numbers or “RINs”) to meet the annual EPA-specified volume requirements. Each fuel type is assigned a “D-code”. Cellulosic biofuel is assigned the code D3 or D7 in the case of biodiesel. RINs are generated when a producer makes a gallon of renewable fuel. RINs can be transferred on the open market or attached to a gallon of renewable fuel. RIN prices can be volatile as the number of gallons required annually is subject to change.

Low Carbon Fuel Standards (LCFS)

LCFS program was first adopted by California, but was subsequently adopted by Oregon, British Columbia, the UK, and the EU. The LCFS program requires oil refiners and distributors (obligated parties) to ensure that the mix of fuel they sell in the covered market meets the established declining targets for greenhouse gas (GHG) emissions measured in CO2 equivalent grams per unit of fuel per unit of energy sold for transportation purposes. Alternative fuels are measured with respect to their carbon intensity (CI) and given a CI score. The lower the CI score, the higher the LCFS credit. While Obligated parties are compelled to participate in the LCFS program, there are several non-Obligated parties that chose to participate in the program to lower the carbon footprint of their organizations. Non-Obligated parties include: University of California system, energir, NW Natural, Southwest Gas, and PG&E.

Carbon Sequestration 45Q Tax Credit

45Q is a tax credit for carbon sequestration, which is generated through the capture of carbon and storing it underground in a geologic or saline formation or with it in oil and natural gas recovery.

Inflation Reduction Act (IRA)

IRA has many impacts on Archaea, including: increases the value of the 45Q Credits to $85 per metric ton captured and stored; allows for the direct pay of 45Q Credits, lowers the qualifying threshold in annual volume for sequestration projects to qualify for 45Q Credits; provides investment tax credit for clean hydrogen projects worth up to $0.60 per kilogram of clean hydrogen produced; and provides additional investment tax credits for clean energy projects.

Renewable Portfolio Standards (RPS)

RPS are state (or province) laws that require a certain percentage of a state’s electricity consumption to be generated by renewable resources. Renewable Energy Credits (RECs) are generated when a renewable energy source generates one megawatt-hour (MWh) of electricity and delivers it to the grid. The other credits are nice to have, but RPS is what drives the demand for landfill gas. Presumably, all the credits could go away, and there still would be an insatiable demand for Renewable Natural Gas.

What is Landfill Gas?

When organic material decomposes in anaerobic conditions, a gas is produced, which is often referred to as biogas. Landfill biogas is composed of the following (approximately): 50% CH4 (Methane), 35% CO2, 15% O2, N2, and other volatile organic compounds (VOCs). Landfills produce predictable gas flows, with increasing production through landfill closure, and relatively constant production rates and composition for 30-years post closure. If the landfill gas (LFG) is not captured, it will be released into the atmosphere. Note that methane is the second most abundant GHG after carbon dioxide; however, it is 25 times as potent as carbon dioxide in trapping heat in the atmosphere. When methane is burned, it turns into carbon dioxide and water. Capturing emissions from LFG is environmentally the equivalent to electrifying ~75% of US passenger vehicles. Aside from being a potent GHG, methane smells bad. Alleviating the smell is likely a bigger reason than methane being a GHG, as to the importance of collecting LFG.

Landfill Gas Uses

LFG has various uses. The first, and simplest use is to flare it. This solves the issue of methane entering the atmosphere and alleviating the smell of methane but provides no revenue. To generate revenue, LFG can be burned on-site to generate electricity which could be used at the landfill or sold to the local power grid, in which case RECs are generated. LFG can be further processed to increase the concentration of methane and sold has renewable natural gas (RNG). RNG is eligible for D3 RINs and LCFS credits.

Additionally, RNG can be turned into Green Hydrogen (these projects are a couple of years away). The carbon in LFG can be separated from it and be used. Carbon can be sold for industrial uses, used in fracking, or sequestered; the latter two uses generate 45Q Tax Credits. Removing carbon from LFG and using renewable electricity sources in RNG/hydrogen processing through solar, wind, etc. will lower the RNG’s or Green Hydrogen’s CI score. Recall, the lower the CI score, the higher the LCFS credit.

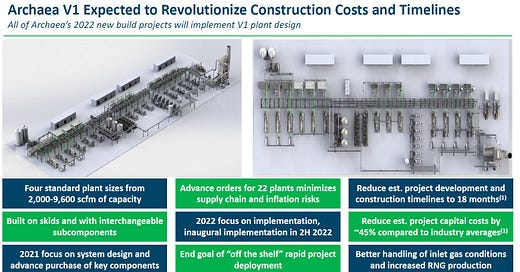

Archaea Energy

Archaea Energy (“Archaea”) was brought public via the Rice Acquisition Corp. SPAC and combined two companies, Archaea Energy and Aria Energy (formerly owned by Ares Management). Archaea is now run by the management team of legacy Archaea. What makes Archaea special? First, their plant design lowers RNG development costs by 45% compared to the industry average. Second, their business model contracts ~70% of the RNG production in long-term agreements with credit worthy counter parties. These long-term contracts lower the risks of Archaea and makes their projects easily financed.

Backlog Composition

Archaea has a substantial backlog of project. In fact, their current projects have enough earnings potential to get them to their intermediate term goal of generating $600 million of EBITDA through the completion of all 88 projects in the backlog. The backlogs can be classified into three categories. The first category is new builds, where Archaea installs a new project on a landfill. The second category is an optimization, where Archaea upgrades existing facilities. The legacy Aria assets provided opportunities to upgrade existing equipment and add new equipment to expand the capacity where needed. These optimizations are being completed in 2022 and should add $100 million in annual EBITDA. The third category is one I call held by production, to borrow a term from the oil and gas industry. In April of 2022, Archaea acquired the INGENCO asset platform which included 14 operating landfill gas-to-electric (“GTE”) plants on sites with a combined gas flow of 7 million MMBtu. They paid 6x pro forma EBITDA for these assets. One may wonder, why Archaea would buy operating GTE plants if GTE economics are one step above flaring gas. Well, the INGENCO GTE assets are ones that can be upgraded to RNG facilities whenever Archaea chooses to do so, in the meantime they produce GTE, an are “held by production”.

Project Economics – Infinite IRRs

Archaea RNG projects have upfront capital requirements, then de minimis maintenance capex going forward. To build a project, it costs four times the annual EBITDA, which equates to an ~25% un-levered IRR per project. As noted, the long-term contracts with credit worthy parties makes these projects easy to finance. Let’s assume Archaea capitalizes its projects with 70% debt and 30% equity. Their return on equity is massive given the high un-levered IRR combined with the debt financing. But wait, there’s more. The Inflation Reduction Act provides investment tax credits of up to 30% of the qualified cost of a project in tax credits. These credits are likely transferable meaning JV partners (who are taxpayers) can take advantage of them and pay for the privilege of using them. The value of these tax credits, therefore, can cover the requisite equity investment for projects post the IRA. Essentially, these projects will have an infinite IRR. See Archaea’s CFO, Brian McCarthy’s, comments during the Q2 2022 earnings call below.

Carbon Sequestration

The company is working hard on carbon sequestration and has a team dedicated to it. They may even beat Shell in having the first carbon sequestration project up and running in the state of Pennsylvania. Their Assai Project, with its estimated 4.0 million MMBtu in annual gas production, should be able to generate $13.1 million dollars annually of EBITDA from the 45Q program assuming the 45Q credits are $85.00 per ton. This equals $3.17 of value from carbon per MMBtu of landfill gas. For illustrative purposes, let’s apply that $3.17 to the midpoint of their 22E production estimate of 10.9 million MBtu and longer-term production goals of 50 million MBtu. That would yield ~$35 and ~$159 million in annual EBITDA, respectively. Additionally, this ignores the value to the lower CI score that carbon sequestration brings to their RNG. While the estimates may be on the aggressive side, given that I am assuming that all of it is captured and sequestered, as opposed to being used in fracking, I am not putting any of this in my valuation below. I am treating it as a very valuable, free option.

Major Project/ Customer Wins

Republic Services: Archaea entered a joint venture with Republic Services (“Republic”) to develop 39 RNG projects on Republic’s landfills. This is the largest announced RNG project to date and should generate more than 12.5 million MMBtu of RNG annually. Archaea will contribute $800 million to the JV while Republic will contribute $300 million. Note that the $800 million contribution from Archaea is a bit misleading, as the JV will purchase equipment from Archaea from which Archaea will make money. Additionally, the JV will allow Archaea to displace competitors who are operating Republic’s existing LFG assets once various agreements expire (there are 20-30 more projects outside of the JV with Republic, that could be added to the JV).

UGI Utilities: Archaea announced the sale of 332 thousand MMBtu of RNG annually for five years to UGI, a Pennsylvania-based utility.

energir LP: Archaea announced the sale of 2 million MMBtu of RNG annually for twenty years to energir, a Quebec-based utility.

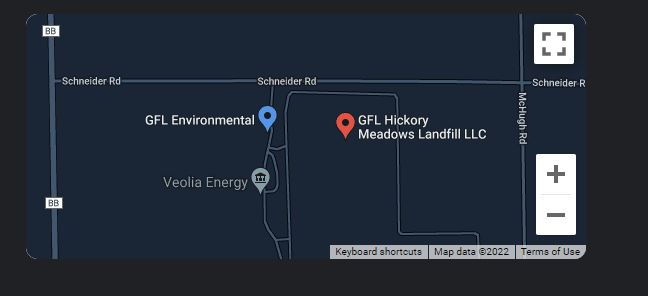

GFL (most likely): Archaea entered a joint venture with an unnamed, “large waste management company”. This is a small joint venture, but likely the harbinger of more business to come. Why is the party unnamed? Likely to not mess up the signing of the Republic joint venture, as it predates the Republic JV by four months. However, now that the Republic deal is signed, it will be interesting to see what comes from the Saturn Renewables joint venture. See below the note in Archaea’s ’21 10K and a google search of Hickory Meadows.

Projections and Valuation:

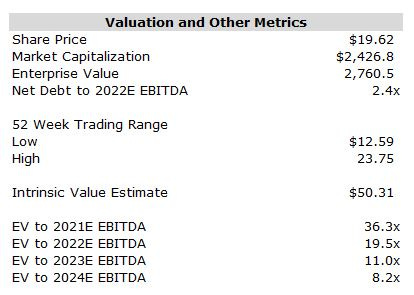

Below is a chart of Archaea’s projected revenue and EBITDA through 2025, which is mostly based on the sell side consensus estimates. Note that I think they will get to $600 million of EBITDA in the next four or five years. Additionally, I think that they should be able to get to one billion dollars of EBITDA in the next decade. It’s worth noting that given the capital raised to date, their ability to generate free cash flow in the future, and the IRA tax credits for investments, they should not need to raise additional equity to fund this growth.

While I think they can reach one billion dollars of EBITDA, assuming they get to only $600 million of EBITDA, and then grow at a 2.5% per year terminal rate, the company is worth approximately $50.00 per share – you would literally be buying a dollar’s worth of value for less than fifty cents if you bought today.

Note that above projections and the valuation exclude any value from carbon sequestration, which is even further upside.

How real are the projections? Of the $475 million of EBITDA that I am projecting for 2025, I expect the following. $160 million of that EBITDA will come from RNG upgrade and conversion projects from legacy Aria assets. These assets produced $50 million in EBITDA in 2021, so that is an incremental $110 million. $50 million will come from Archaea’s Assai project, which produced no EBITDA in 2021 and should produce $37 million this year. $212 million will come from new RNG development projects. A good amount of these projects is “in the bag”, so to speak. Archaea simply needs to execute. That said, what happens if they don’t hit $600 million in EBITDA by 2025. Well given the price difference between my estimate of intrinsic value and the current market price, there is ample room for error if they miss my 2025 estimate.

Implications for Waste Haulers

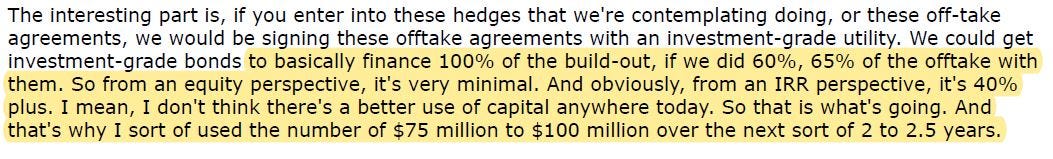

All the major waste haulers are working on RNG projects. Let’s stick with the waste hauler that I know best, GFL Environmental (“GFL”). The below is from the second quarter of 2021 earnings call for GFL. The CEO, Patrick Dovigi, said that the IRRs for GFL are 40%+ and that RNG projects are the best use of cash in his business. In the below transcripts, GFL discussed the goal for the RNG program is to generate between $75 million and $100 million of free cash flow annually. Subsequently, they revised that up to $105 million to $150 million.

GFL management gave us some real gems at their analyst day in May of 2022. At it, they confirmed internal goal for the RNG program is between $175 million and $200 million of annual free cash flow from the program. They also noted that the projects would require 25% to 30% in equity financing, and that the ROIC would be “really high”. It’s worth noting a couple of facts. First, the annual free cash flow estimates do not include any 45Q credits from carbon sequestration, and I confirmed with the company that they are working on carbon sequestration. Second, the analyst day predates the Inflation Reduction Act. Presumably, these projects would be eligible for investment tax credits, which would likely cover GFL’s equity requirements and make these infinite IRR projects.

There is another gem in the analyst day transcripts. GFL mentioned that they are partnered with the smartest people in the industry. Well, I assume they mean Archaea, given that Saturn Renewables LLC is the only partnership in the LFG space that I know that they have.

What is this business worth to GFL? Well, GFL, wisely, setup their RNG program in a separate legal entity. GFL can separate out the RNG program, should that be the best route for the creation of shareholder value. If the IPO market is hot for “green” energy companies, then what is a business that is cash flowing $200 million CAD per year worth? 20x? Remember this excludes the value of the 45Q credits, but let’s just go with this. Twenty times $200 million CAD is $4 billion CAD or $10.84 CAD per share. That is 31.6% of GFL’s market capitalization as of August 30, 2022. I think GFL is cheap based on the waste hauling fundamentals alone but having over $10 CAD per share of hidden value provides a nice margin of safety and upside potential.

Regarding the rest of the waste hauling industry, Stifel’s waste analyst, in his September 4, 2022 update, opined that GFL, RSG, and WCN each should see at least $150 million in annual EBITDA from RNG and that WM should see an incremental $400 million by 2026.

Summary

Turning landfill gas into RNG satisfies two of societies needs. First, it dramatically reduces the release of GHG into the atmosphere and it removes the smell from landfills. There are a couple of ways to invest in the space. You can invest directly into the space through owning Archaea. This may have more risk given the newness of the technology and the fact that it is a newer venture. Furthermore, if the political environment changed, and renewable energy was not mandated to be used in the production of electricity or transportation fuels, then the value of Archaea would be seriously impaired. That said, assuming the status quo, Archaea looks like a potential multi-bagger – recall that they expect to generate $600 million per year in EBITDA from just their current backlog and no carbon sequestration. That said, a safer way to invest in it would be indirectly through buying a waste hauler such as GFL.