Last month I was having breakfast with a fellow investor who follows eDreams. He mentioned that his firm had recently studied Nomad’s Nick Sleep’s and Qais Zakaria’s analysis of Costco (an interesting exercise!). The attributes Nomad identified at Costco that widened Costco’s moat – a moat that has held up nearly twenty years after Nomad’s analysis was published and included the time period in which Amazon disrupted retail - he found to be similar to attributes of eDreams’ subscription program, Prime. The breakfast discussion was enjoyable, and it prompted me to go back and re-read Nomad’s letters. Apropos of that, I thought it would be interesting to apply Nomad’s analysis of Costco to eDreams. Excerpts from the Nomad letters are in quotations.

The Annual Fee:

Costco:

“Costco is a member-only wholesaler of consumer goods. Membership is available to the public at a price of U$45 per annum. The act of purchasing has the effect of raising the company’s share of mind with the customer in the same way that consumer goods companies hope to achieve with conventional advertising. At Costco, the consumer has chosen to commit to the retailer. In other words, people shop at Costco because it is Costco, not because Costco stocks Coke. And the reason they shop is that goods are priced at a fixed maximum 14% mark-up over cost. The fixed mark-up is referred to in the industry as “every-day-low-pricing” or EDLP, in order to differentiate it from normal industry practice of changing prices in an attempt to influence traffic, or so-called high-low pricing.” (1)

eDreams:

eDreams is an online travel agency (OTA) that is deep in the process of converting from a transaction-focused business model to a subscription-based business model. eDreams is the leading OTA for flights in Europe, although it also offers hotels, auto rentals, airport transportation, and other travel-related services. Historically, eDreams earned money by charging both an airline and their customer a booking fee. Under the Prime program, customers pay an annual membership fee of ~€55.00. For Prime members, eDreams gives back the booking fees in the form of lower prices, saving the Prime members money. As Prime members subscribe, Prime raises eDreams’ share of mind with the customer. This raised profile of eDreams in the customers’ minds has the following effects.

It saves the customer money, which delights the customer.

It increases the likelihood of customers making eDreams the first place they look for flights, thus cutting out expensive performance marketing costs (one of the largest cost items for competitors).

Note that mobile bookings (in app) were 26% of bookings in Q1 FY17 vs. 59% in Q2 FY24. The balance of the bookings are made on the desktop, which would either be directly with eDreams (let’s call this a “cheap channel”) or via a paid source (such as Google).

It’s worth noting that bookings via cheap channels for a Prime member is much higher than that for a non-Prime customer. I would not be surprised if the cheap channel rate of Prime members continues to go up over time as the program matures and more services are introduced.

Scale Economics Shared:

Costco:

“In the office we have a white board on which we have listed the (very few) investment models that work and that we can understand. Costco is the best example we can find of one of them: scale efficiencies shared. Most companies pursue scale efficiencies, but few share them. It’s the sharing that makes the model so powerful. But in the center of the model is a paradox: the company grows through giving more back. We often ask companies what they would do with windfall profits, and most spend it on something or the other, or return the cash to shareholders. Almost no one replies give it back to customers – how would that go down with Wall Street? That is why competing with Costco is so hard to do. The firm is not interested in today’s static assessment of performance. It is managing the business as if to raise the probability of long-term success.” (1)

“…..whilst Costco continues to recycle cost savings to the consumer, it is lowering the probability of failure.” (1)

eDreams:

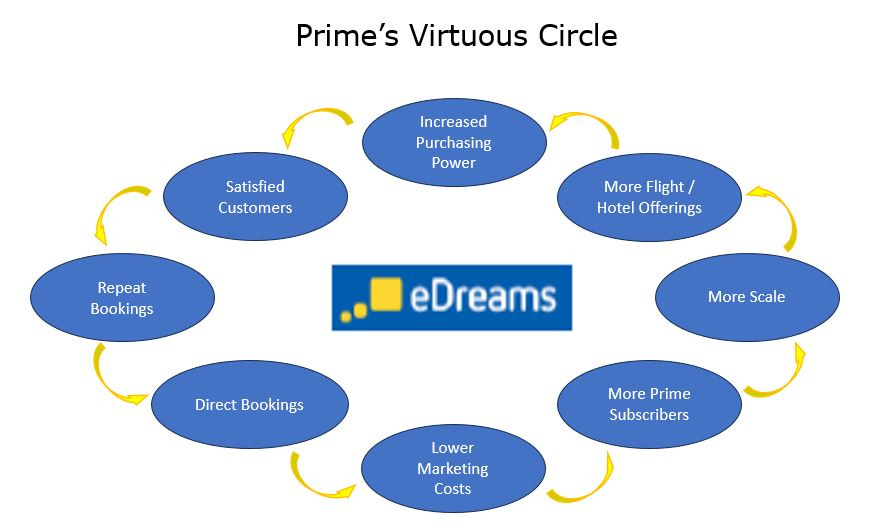

eDreams’ Prime model shares savings with customers which creates: (1) satisfied customers (see satisfaction chart at end of document); (2) ~3x the amount of repeat booking vs non-Prime customers (see repeat bookings chart); (3) a higher rate of direct bookings, which materially lowers marketing expenses and generates both a competitive advantage against competitors and a cost savings that can further be shared with customers; (4) purchasing power to use with hotels and airlines that can drive down wholesale prices, which can further be shared with customers; (5) new Prime subscribers; (6) more flight and hotel partners/offerings.

The virtuous circles inherent with scale economics shared are easy to articulate, but hard to build and maintain. As with most things, there is always nuance. Here are some of nuances of Prime. One of the main ways the Prime program generates savings that can be shared with a customer is by reducing or eliminating performance marketing fees – essentially, solving the Google problem. It does this as Prime members book directly with eDreams at a higher rate than non-Prime members. While Prime members book via cheap channels most of the time, they do not do it 100% of the time. As the Prime program matures, it would not surprise me if the rate of bookings via cheap channels increases. Furthermore, the legacy business of eDreams is flights. Their hotel offering is a newer business for them. One could see how they could expand their list of available hotels quickly if they took less of a take rate than their competitors. The combination of eliminating performance marketing spend (which competitors struggle to do) and giving back the reduced take rate should offer a hotel room price that is lower than competitors, while making the supplier happy that the room was booked via eDreams as opposed to another OTA. This raises the question that if there is so much to give back to the customer via a hotel booking, or better yet, a hotel plus a flight booking, why wouldn’t eDreams keep some of that margin for themselves? Hotels is a nascent business for eDreams, so it remains to be seen whether or not they fully share the scale benefits with customers and possibly suppliers. My gut feeling is they give all of the hotel margin back to customers (and maybe some to suppliers) in an effort to a) widen Prime’s moat b) extend the lifetime value of the customer and c) perhaps increase the number of hotelier relationships.

To illustrate the savings available to Prime customers, let’s compare the rate for a hotel room in New York City booked via eDreams Prime, Booking.com (genius level 3), and direclty with the Four Seasons. In this case, eDreams’ Prime rate is materially better than their OTA competitor as well as better than booking directly with the hotel. This is for a hotel in the United States. I would bet that the take rates for hotels in Europe is much higher given the fragmentation and the savings for Prime members are even higher.

What Would Be the Characteristics of The Most Valuable Company in the World?

“….What characteristics could one bestow on a company that would make it the most valuable in the world? What would it look like? Such a firm would have a huge marketplace (offering size), high barriers to entry (offering longevity), and very low levels of capital employed (offering free cash flow). Costco has some of these attributes. The range of products is as wide as any retailer, and by-passing savings back it is building a formidable moat…..” (1)

Nomad explained that Costco has a large addressable market, has a moat, and is more asset-light than its peers. Let’s apply these three characteristics to eDreams.

Offering Size: The online travel agency sector has huge addressable markets – just look at the market capitalizations of some of the leading companies in the sector. Looking at just Europe, if eDreams can reach a 10% penetration level for Prime, then the number of Prime subscribers could grow to around 30M from the current 5.2M, and that is without expanding into new markets.

Offering Longevity: The scale economics shared model of Prime is helping eDreams build a wide moat. Subscription businesses are not easy to build. The Innovator’s Dilemma also presents a problem as other OTAs would need to give up their precious take rate, destroying their margins during the transition process. eDreams’ moat in Europe, specifically, is especially wide given their leadership position in flights. eDreams can use flights (often the first money spent when a trip is booked) as a free customer acquisition source for their hotel business. Can competitors do this? Booking.com offers flights via a white-label program with eTraveli. It ultimately try to acquire eTraveli. That deal is not going through. If Booking.com was able to complete the acquisition, perhaps they could have used low cost flights as a feeder for hotel sales. Given their independent status, I doubt that eTraveli would allow Booking.com to sell flights via their platform with a zero take rate to serve as leads for Booking.com’s hotel business.

Low Levels of Capital Employed: eDreams’ business model is inherently capital light and operates with negative working capital. Looking at the tangible capital, eDreams often has negative net tangible capital employed. If you add goodwill to that (and I don’t know why you would given most of it was generated long ago, by a different management team, and they likely don’t need to do any more acquisitions), then it has about €500M of invested capital.

The Robustness Ratio:

“At the risk of mildly boring some readers, it may be worth completing the analysis of Costco by introducing the robustness ratio. (Avid readers will recognise the ratio was introduced in a Global Investment Review, contained in the appendix to this letter). The robustness ratio is a framework we use to help think about the size of a moat around a company. It is the amount of money a customer saves compared to the amount earned by shareholders. The ratio is more appropriate for some companies than others, the prime criteria being that the customer proposition is based on price, such as exists at Costco, as opposed to advertising-reinforced purchases such as Nike trainers. In the Berkshire Hathaway annual report this year, the Chairman tells us that Geico policyholders saved U$1bn as well. So that’s one dollar savings to the customers and one dollar retained for shareholders. At Costco we think the customer is saving around five dollars, compared to shopping at most supermarkets, for every dollar retained by the company.” (2)

So, Geico has a Robustness Ratio of 1 and Costco is around 5. What is the Robustness Ratio of eDreams’ Prime? First, let’s start with the following caveat. While Prime does save a substantial amount of money for customers, there is a large service component from eDreams. Their app and customer service phone lines often provide much better customer service than European airlines can do on their own. Furthermore, with multiple product offerings, their one-stop-shop ability makes using them convenient for booking multiple travel needs and managing your trip while traveling. Back to the ratio. Let us assume that the company retains the Prime fee of around €55 per subscriber (we will leave out overhead, taxes, etc.). The numerator depends on what and how often one books. I will use the above Four Seasons hotel as an example. The Robustness Ratio for Prime, if Booking.com is the comparison, is 16.9 [(4,802-3,870)/55]. If booking directly with the hotel is the comparison, then the Robustness Ratio is 1.3. Not too bad considering Prime customers often book multiple trips per year (and the denominator is likely much lower than 55!).

Position Sizing:

“To repeat: “what you are trying to do as an investor is exploit the fact that fewer things will happen than can happen”. That is exactly what we are trying to do. We spend considerable portion of our waking hours thinking about how company behaviour can make the future more predictable and lower the risk of investment. Costco’s obsession with sharing scale benefits with the customer makes that company’s future more predictable and less risky than the average business and that is why it is our largest holding. Our smaller holdings are less predictable but in certain circumstances could do much better as investments. We are just not sure that they will as their “cone of uncertainty” has a much greater radius that at Costco…..” (2)

Nomad made Costco their biggest position as they had a high degree of certainty with its growth potential. To determine how to size eDreams in a portfolio, one should try to determine how large it can become and how certain you can get with its growth. To do so, I find it easiest to work backwards. I start with how large I think the business can become. I don’t know the answer, but looking at just Europe, 10% Prime penetration seems reasonable, which gets us to ~30M Prime Subscribers. 30M subsrcibers, at the current rate of growth, is around 15 years of continued growth. Though, I think they can accerlerate the current rate and get to 30M sooner. If 30M subscribers, in Europe, is the target, what metrics should one track to monitor how the progression is going?

I would start with the following:

Net New Prime Subscribers. Prime offers a compelling value proposition to subscribers, and it is growing now only via performance marketing. They can likely accelerate the growth as the value proposition to subscribers grows when they expand their hotel offering and introduce new services. Furthermore, they can likely drive more subscriber growth with a referral program and targeted advertising.

Cash EBITDA Margins. Management has provided limited information on the life-time-value of a Prime subscriber, retention rates, and cheap channel booking rates. I trust that there are no issues in these areas. The way to validate this is by looking at the Cash EBITDA margins. A new Prime subscription provides very little margins in its first year, as that is the year the acquisition cost is made. As Prime subscriptions renew, the high rate of cheap channel bookings allows a mature Prime subscription to be highly profitable. As the percentage of mature Prime subscribers versus first-year subscribers grows, so should the cash EBITDA margins of the business.

Penetration rates within existing markets.

Expansion into new markets.

Pace of new offerings. Each offering increases the value of Prime to the subscriber.

IT employee headcount. This is an IT intensive business. The number of IT staff is likely a leading indicator of their growth.

Customer satifcation scores.

Enagement of Prime customers.

Since coming out of COVID in June of 2021, the company has averaged ~422K net new Prime subscribers per quarter. The steadiness of the Prime growth, and the fact that number of Prime bookings is somewhat immaterial to their earnings, makes this business highly predictable. I would be surprised come FY25 if they don’t slightly exceed their €180M target, a target that management implemented in November of 2021. This level of predictability gives me comfort in making it a large holding.

Conclusion:

I found re-reading the Nomad letters to be both informative and enjoyable. I find their analysis of Costco to be a nice blueprint on how to analyze eDreams now that it transitioned to being a subscription business. Looking at both Costco, with its large addressable markets, widened economic moats, shared scale economis, and free cash flow generation ability, gives me comfort that eDreams, with similar attributes, has a bright future ahead of it.

To read Nomad’s letters for yourself, you can find them at: https://igyfoundation.org.uk/wp-content/uploads/2021/03/Full_Collection_Nomad_Letters_.pdf

Footnotes:

From 2004 Annual Letter. Bold emphasis is mine.

From Interim Letter 2005.

From eDreams’ Q2 FY24 Earnings Presentation.

Disclaimer: For entertainment purposes only. Do your own due diligence. Not a solicitation or offer to buy or sell any secuirty.

Addendum:

Customer Satisfaction Chart (3):

Repeat Bookings Chart (3):

🎯

Opodo Prime is terrible at least in Germany. They trap people in the programe making it almost impossible to cancel. A whole flock of lawyers makes money by helping people to get their money back. It is one of the most unnecessary poducts I have come across.