In the last couple of months, several issues have come to light regarding Ammo Inc. (“Ammo”) including: a possible undisclosed related-party transaction, employing a senior executives under sanction by the SEC, employing a senior executive that may have been recently disbarred, and a whole host of allegations from a former board member, as detailed in Edwin Dorsey’s substack article. What is shocking, is that the more one digs, the more troubling information one can find.

While reading Ammo’s 10Q filed in August of 2022, I noticed the below mention of the settlement of the lawsuit. I downloaded the lawsuit from Pacer (leave an email address in the comment section if you would like me to email a copy to you) and found a lengthy set of allegations and history of events. The document is obviously a one-sided account. That said, the company did settle the suit. Why settle if there is not merit? Prior to the lawsuit, the Plaintiff, Kathleen Hanrahan (“Hanrahan”), a former senior executive and board member of Ammo, filed a complaint with OSHA, which lead to a finding in her favor, where OSHA acknowledged that a SOX violation occurred. Furthermore, the lawsuit references several parties who can validate or discredit Hanrahan’s claims - I’m looking at you Ammo Board of Directors. Lastly, it seems that the allegations in the lawsuit are the activities that led to the resignation of independent director Dan O’Connor, as discussed in Edwin Dorsey’s article.

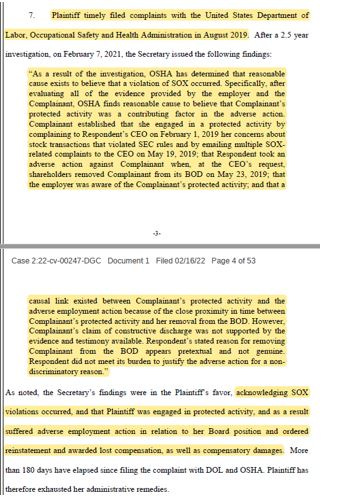

Below is an excerpt showing OSHA’s Findings.

I’ll list several, but not all (too many!), of the allegations, as well as where they can be found in the document.

The Allegations:

SOX violation occurred as Hanrahan took part in protective activity and suffered from adverse employment actions. (Pages: 3-4)

Founders voted shares that they did not own or control at the time the ballots were cast. (Pages: 6-7)

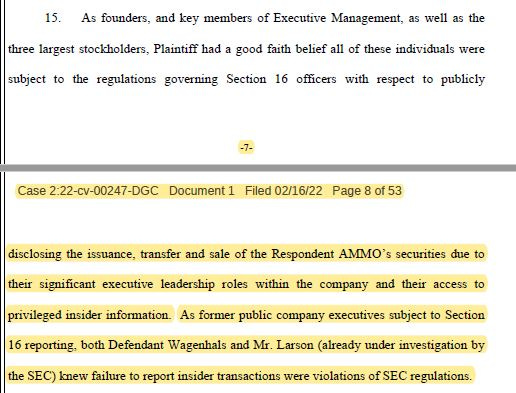

Failure to report insider stock transactions. (Pages: 7,9-15, 50-51)

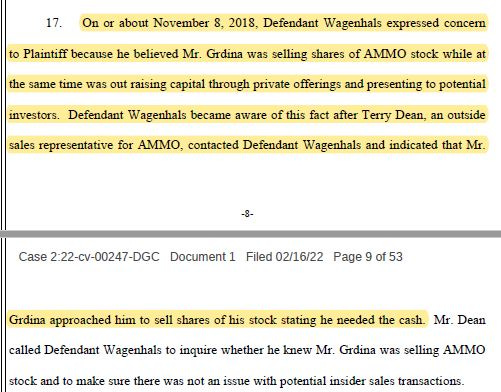

Selling stock while raising capital through private offerings. (Pages: 8)

Selling shares before the Registration Statement became effective. (Page: 11)

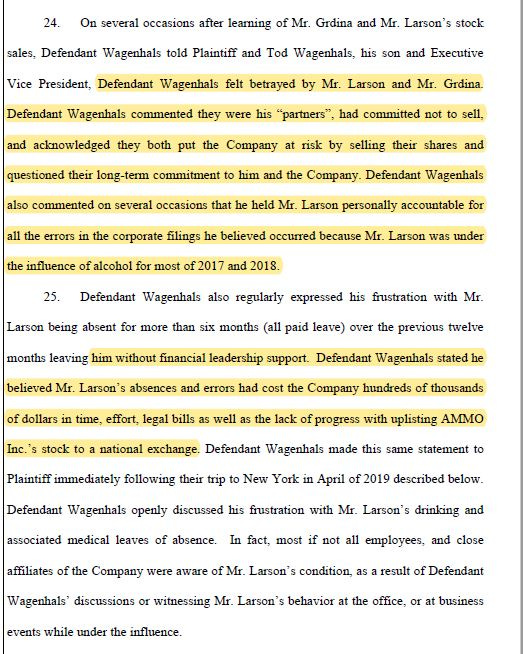

Senior executive under the influence of alcohol for most of two years. (Page: 12)

Senior executive was in the office or at business events while under the influence. (Page 12)

Painting the tape. (Page 14)

Selling stock during blackout periods and with timing around specific events and press releases. (Page 15)

Mr. Larson acted as the de facto CFO. Mr. Wiley was appointed CFO to help keep Larson under the radar of the SEC given Larson’s ongoing SEC investigation. (Page 15, 18-19, 27)

Ammo falsely communicated the status of the impending stock exchange uplift to investors. (Page 16)

Providing false information to the NYSE. (Page 18, 20)

Encumbering the company without requisite board approval. (Page 31)

Audit committee member stonewalled. (Page 32)

Plan to lie to a government customer. (Page 35)

Violence in the workplace. (Page 40)

Improperly conducted shareholder vote. (Page 47)

Violation of SEC rules and regulations. (Page 50, 51)

Below I’ll post excerpts from the document regarding the above allegations.

Voting Shares Not Owned:

Failure to Report Insider Transactions:

ure To Report Insider Transactions / Trading During Blackout Periods / Trading Around Events

Selling Stock While Raising Capital

Senior Executive Under the Influence of Alchohol

Painting the Tape

Senior Executive Acting as de facto CFO While Under SEC Investigation

In this instance, it was also alledged that financials the CFO was directed to delivery to the NYSE were incorrect.

NYSE learns the alledged de facto CFO was not the CFO

Allegation That the CFO Sent Knowlingly False Information to the NYSE

CFO alledgedly concerned about VP of Finance becoming angry if learned about disclosures to Audit Committe Chair.

Providing False Information to NYSE

Encumberance of the Company Without Requesite Board Approval

Audit Committe Stonewalled

Plan to Lie to Government Customer

Violence in the Workplace

Improperly Conducted Shareholder Vote

Violation of SEC Rules and Regulations

These allegations, if true, reveal a company with attrocious governance and a history of retaliation towards whistleblowers. Additionally, if these allegations are true, it shows that the lack of proper governance may be putting the company at risk of SEC investigations and possibly investigations by other regulators, that could have a negative impact on shareholders.

The above allegations raises the following questions?

Does the Board know the details of the lawsuit that led to a settlement?

If so, has the Board investigated the allegations? Note that the company annonced an investigation into board member Steve Urvan, a retailatory action in my opinion. Where is the announcement of a boards investigation into these alledged actions?

Why is Mr. Larson still employed by the Company?

Is Mr. Larson still acting as de facto CFO, despite being under sanction by the SEC?

Why is Mr. Flynn still employed by the Company?

Have internal controls covering employee stock trading been corrected?

If Mrs. Hanrahan’s allegations are true, I sympathize with what she went through. That said, given her settlement, she may have received justice. Where is the justice for shareholders?

Disclaimer: Not a solicitation to buy or sell any security. For informational purposes only. Due your own due diligence. Long.

I'm very interested in the lawsuit. Can you please email me a copy at peterbriansanchez@gmail.com

Thanks in advance