Acquisition Accounting and Financial Analysis

GAAP or IFRS accounting tries to accurately represent the economic earnings of a business. However, given the varying business models, it is difficult to come up with a common accounting regime that will accurately represent the earnings of all the businesses to which the regime is applied. Savvy analysts must often make adjustments to GAAP or IFRS earnings to get to the true economic earnings of a business. Setting aside varying business models, one type of corporate action can have a dramatic impact on the reported numbers, as well as give one insight into the intelligence and priorities of management. This event is a merger or acquisition.

Types of Acquisitions:

There are three basic types of acquisitions (in the US). There is a stock or equity purchase. In this transaction, the acquirer purchases the stock (or equity) of the seller. The acquirer steps into the position of the seller. Meaning, the acquirer accepts the liabilities of the business and steps into the tax basis or the seller. At the time the writing of this article (2022), this has real tax implications for the buyer. The Tax Cuts and Jobs Act of 2018 allowed 100% Bonus Depreciation. So, a business, with some limitations, could write off in the first year of service, 100% of the value of an asset that was purchased. This 100% write off goes from 2017 to 2023. After 2023, the Bonus Depreciation declines 20% per year, until it reaches 20% in 2027. So, if an acquirer buys a business, it is possible that they generate no tax depreciation for making that investment, even if the acquired business is rich in depreciating assets. Furthermore, any amount paid in excess of the target’s net worth is deemed to be “goodwill”, which is not tax deductible. This type of acquisition favors the sellers, as they receive all the cash agreed to and have no ongoing liabilities to worry about.

The second type of acquisition is an asset purchase. In an asset purchase, an acquirer buys the assets of a target. Liabilities, known or future ones, are left with the seller. Additionally, the assets of the business are written up to fair value (whatever this means, but consultants will tell you). A tax is paid by the seller on the difference between new, stepped-up value of the assets and their pre-deal tax basis. Additionally, there is a category called identified intangibles. These include copyrights, trademarks, trade, secrets, customer lists, brands, etc. A consultant comes in during the acquisition and assigns a value to these intangibles, and you get to write them off over 15 years and deduct them from your taxes. More on this later. Sellers like typically like this less, as the liabilities stays with the sellers, and they pay the taxes on the stepped-up assets.

The third type, and compromise, is a stock purchase with a 338 h 10 election. This is a stock purchase that is treated like an asset purchase for tax purposes. So, the buyer gets the tax benefits, and the seller gets free of known and potential liabilities. This is the best of both worlds. The seller must pay the taxes on the stepped-up assets, but this gets negotiated out in the overall purchase price.

Before getting into why it matters, let’s have a brief discussion on identified intangibles. I, for the most part, believe that this is just goodwill that a company gets the benefit of deducting for tax purposes. The exception to this would be a pharmaceutical patent, where upon expiration, the selling price of a drug will drop. This is a legitimate expense and should be treated as such. That said, customer lists, brands, technologies, etc., I believe, are replenished with cash expenses such as marketing, advertising, and research and development expenses, so it is silly to double count them through the amortization of intangibles (but, by all means, take the tax break!).

Why it Matters:

There are a couple of reasons why the above matters to financial analysis. First, and most importantly, the type of acquisition executed can have real impacts on a company’s cash flow, as a vanilla stock purchase may seriously limit the ability to use tax shields. Companies that do this are likely optimizing for GAAP/IFRS accretion analysis for the acquisition, and not optimizing for cash-on-cash returns, which is what I would like to see my portfolio companies focus on. I use this as an early test when analyzing acquisitive companies.

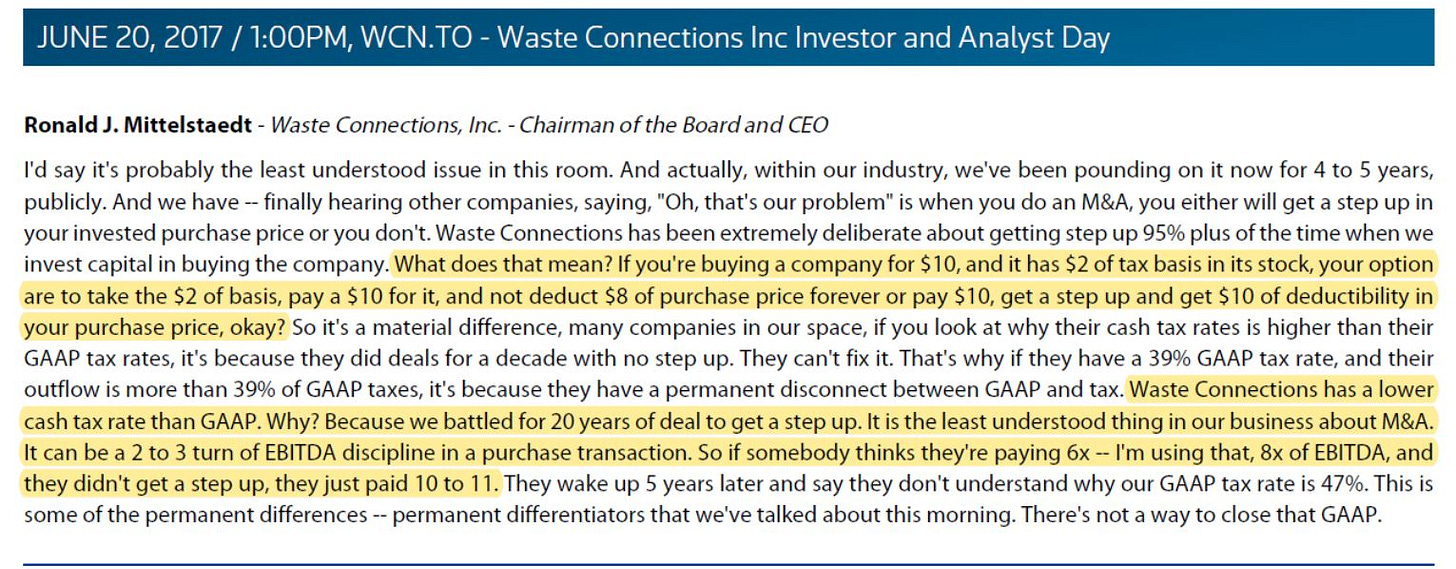

Waste Connections, a company with management I admire, gets it. See the below comment on this.

Second, it affects how a company screens from a valuation and ROIC perspective. Let’s start with earnings and valuation. Transactions where the asset values are stepped up can affect the earnings of a company post transaction in three ways. First, while it is possible, but not likely, that inventory values are increased, which would cause COGS to go up and earnings to go down. Second, the stepped-up fixed asset value increases depreciation, which reduces earnings. In some instances, this new depreciation expense may exceed that of maintenance capex. Third, the amortization of identified intangibles also reduces earnings, and as discussed, this is, most often, just goodwill that the government is allowing to be expensed and a tax shield generated.

Regarding ROIC, let’s start with the question why an investor looks at this. I do it for a few reasons. First, to rate how well management is at acquiring businesses (note, I have other ways to rate them on this, which rank higher, but this is one tool). For this rating, ROIC, with some adjustments, is the best metric to use. Second, to look at what type of returns on capital invested into the business generates (I take it one step further and look at the return on incremental capital, but this is for another article). Here, I look at returns invested into the business as it is, assuming no further acquisitions. The best way to do this is to look at returns on tangible capital. Finally, I look at it to get an indication of how the business will do in an inflationary environment; ROTC is good for this as well. Acquisitions can impact the ROIC, as the increased D&A lowers earnings, which reduces the numerator of the ROTC calculation, thus artificially lowering returns. The denominator is increased as fixed asset values are increased, as is goodwill and intangibles. In cases not as extreme as the Axalta case below, I tend to take the amortization of intangibles out of the income statement, and just keep them on balance sheet.

When assets are stepped up, the impact can dramatically impact how a company screens. The case study, that I believe, best illustrates these points is Axalta.

Axalta Case Study:

Axalta is a manufacturer of auto and industrial paints, which was owned by DuPont. In 2012, Carlyle acquired Axalta from DuPont and did so using a 338 h 10 election. It had the following effects:

Depreciation went up to accommodate for the higher values of the assets. Note that the depreciation far exceeded that of the prior two years capital expenditures. Yes, capital expenditures went up after the acquisition, but I would argue that there was probably a lot of growth capital in those numbers as Carlyle was eager to grow previous corporate orphan.

Amortization of intangibles increased from $26mm per year to around $80mm.

On the balance sheet, the assets ballooned, as fixed assets, goodwill, and intangibles all increased.

When I first looked at the business in 2016, the accounting impact of Carlyle’s acquisition caused the NTM P/E Ratio to be 21.4x, versus 11.6x if you back out the impacts from the acquisition.

Furthermore, the trailing Return on Invested Capital for the business was 23.8%, versus a Return on Tangible Capital (basically ROIC adjusted for the acquisition) was 32.1%.

I love the tax benefits that Axalta received; that said, why would anyone judge the valuation or ROIC with the impact of Carlyle acquisition in the numbers? If the answer is to judge how management does acquisition, recall that this was Carlyle buying the business and allocating capital, not the management of Axalta.

I hope this article helps your understanding of acquisition accounting is beneficial in your analysis of companies.

Disclaimer: For entertainment purposes only. Not a solicitation or an offer to buy any security. Views are opinions of the author.