eDreams Q4 Update - Who Likes Free Money?

Prime Subscription Program Fuels Compounding + an Arbitrage Opportunity

It has been a month since eDreams reported their FY24 fourth quarter results. Their Prime subscription program, which had 556,000 subscribers at the beginning of COVID, has 5,825,000 subscribers. Let’s dive into how the growth of the Prime subscription program has impacted the company’s financials and how the financials should look going forward. We will also look at what should drive the stock price in the coming years. But first, it is worth highlighting that the company announced a tender offer 4.5mm shares (more on this later) at a price of €6.90 per share, which is a 6.2% premium to its current price of €6.50 – seems like a nice risk-free return to me.

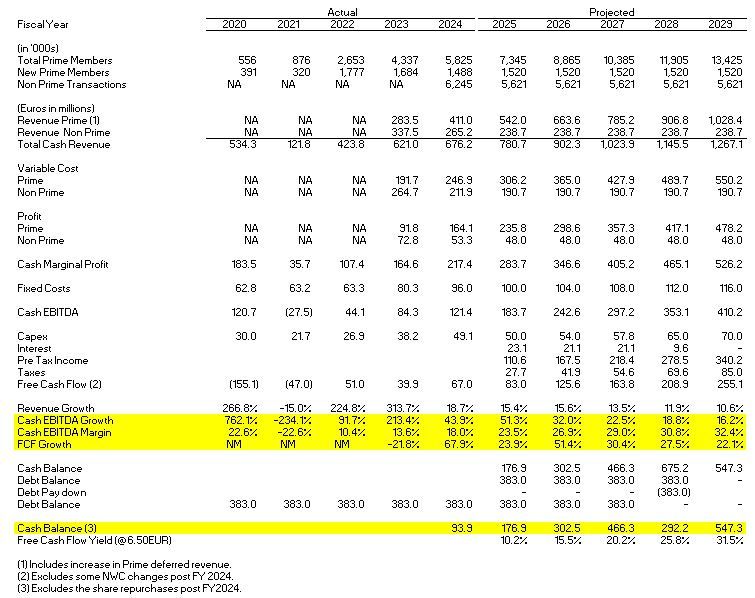

Historic and Projected Financials

This will be a granular look at the financial impact of Prime. For a qualitative look at Prime see the following: https://310value.substack.com/p/applying-nick-sleeps-and-qais-zakarias.

I start with the historical period at FY2020, which ended 3/31/2020. This was before Prime was large plus there were minimal revenue and earnings impacts from COVID, so revenue and EBITDA were still strong (the working capital unwind from COVID did hit FCF). Akin to a software company moving from a licensing model to a SaaS model, the growth of Prime runs mainly through the income statement, which optically depresses earnings. With that said, let’s go through the line items.

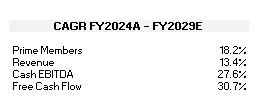

Prime Subscribers: Prime is still in the low to mid-single digit penetration rate in Europe, a market where ~40% of purchases are offline. They should be able to grow at a rate of 1.5mm per year for a long time (setting aside expanding outside of Europe)

Revenue: Non-Prime revenue is a lead generator for Prime. At some point, it becomes less relevant as a lead generator, but holding the number of transactions relatively constant seems reasonable. Prime revenue grows near the rate of new subs. This latter point could be overly conservative, as they could increase the price of a subscription and/or offer a premium Prime service (they recently went to market with this)

Variable Cost of Prime: This is a main part of where the company’s long-term investments are running through the income statement. This is driven by the customer acquisition cost of a new Prime customer. eDreams may acquire a new customer via a google search. eDreams pays to get introduced to a customer and then converts them to a Prime subscription. There is a cash outflow to the lead generator in year one, but minimal outflows thereafter. This cost should go down overtime as word of mouth and/or, possibly, a company implemented referral program drive the growth of new subscribers

Fixed Costs: Subscription programs take a massive IT investment to implement. This is reflected in the rising fixed cost spend and employee head count. The company’s IFRS earnings were overly penalized in the early days of Prime, as fixed costs as a percentage of cash revenue went from 11.8% in FY 2020 to 14.2% in FY 2024. I expect FY 2024 to be the peak year, with fixed costs continuing to rise on an absolute basis but falling as a percentage of revenue

Cash EBITDA: EBITDA margins were 22.6% pre-COVID, then fell during COVID and during the early stages of the Prime build out. As the number of tenured Prime subscribers relative to first-year subscribers grew, so did the margins. They went from 10.4% in FY2022 to 18.0% in FY2024. I expect this margin expansion to continue strongly this year, and then expand at a slower pace for the intermediate future

Capex: Capex is mostly software development expenses. Again, this heavily burdened cash flow in the early days of Prime but should become less burdensome as time goes on. It was 7.3% of revenue in FY 2024 but should go down ~200bps by FY 2029.

Free Cash Flow: FCF is starting to grow nicely and should continue to as Prime begins to mature and the company gets operating leverage over its fixed costs and capex. Additionally, eDreams should be able to generate sufficient cash to pay off all its current debt, fund its growth, and buy back stock. This is exhibited by my assumption that the company pays off its debt in FY 2028 and still has €547mm of balance sheet cash in FY 2029.

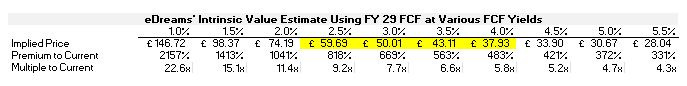

Valuation

If eDreams can hit the above projections, what does that mean to its valuation? Well let’s assume they hit the above. Fast forward to the end of FY 2028. Looking one year out from there, the company is expected to grow free cash flow ~22% and can buy back €547mm in stock. What kind of free cash flow yield should such a company trade at? 1.5%, 2.5%, 3.5%? I am more on the lower side given the strong FCF growth combined with the ability to repurchase shares, but let’s go with it trading at a 3.0% yield in 2028. Discount that back to today and you get a price of €50.01 per share. This implies that the stock is worth 7.7x what it is currently trading at. So, we have a multi-bagger, how do we realize that value.

Closing the Gap Between its Current Price and its Intrinsic Value

So, we have a company that we expect to grow FCF over the next five years at a 31% CAGR trading at a 10.2% FY25 FCF Yield. How does the stock price start to work? The main reason why eDreams trades well below its intrinsic value is its low liquidity. I have discussed various ways for the company to deal with this in other articles, but let’s look at what management is doing. To set up the solution, let’s look at part of the problem. Permira Advisors owns about a quarter of the company. They are a private equity fund, that owns eDreams in a continuation vehicle, so they can be very patient. They are not likely sellers of any shares in the single-digit Euro range. So, the share price needs to get to price where Permira will begin to unload their shares into the market. When this starts to happen, more active trading in the stock will take place and daily trading liquidity will increase. As an aside, I have heard that there are numerous institutional investors interested in eDreams, but there is not enough liquidity to easily get them the position size that they desire.

Back to management. Management launched a normal course share repurchase program in February of 2024. Between then and the Q4 earnings call at the end of May, they bought only 1.0mm shares. The lack of trading liquidity limited eDreams’ ability to implement its share repurchase program. Management dealt with this by announcing a tender offer for 4.5mm shares at a price of €6.90 per share. They have to apply for regulatory approval and go clear some other hurdles, but it sounds like that tender offer should be executed in the next month or two. This tender offer raises an interesting question. If the tender offer price is €6.90 and the intrinsic value is multiples higher, what happens if they do not get all of the 4.5mm shares? Well, let’s start with if they do get all the shares. In this case, the company just bought back its stock at a steal of a deal. If they don’t, it sounds like they can announce a new tender, whereby they will need to step up the offer price.

Looking at the cash flow projections of the company, eDreams will have more cash than it needs to grow. Furthermore, since implementing its Prime program and changing its business model, it is not likely to find attractive M&A targets; hence, continued share repurchases will likely continue to be in eDreams’ future. Management will likely have to implement multiple tender offers per year until trading liquidity materially improves. It is likely that they will keep stepping up the offer price of each tender offer and this will help to close the gap between its trading price and its intrinsic value. Hopefully, the stock price quickly gets to a price where Permira will begin to sell some stock and the company’s trading liquidity becomes a nonissue. I know several shareholders who have been frustrated with the valuation gap, but it seems with the tender offer approach, there is finally a clear and imminent catalyst to close the gap.

Given my view that this company is worth multiples of the current price, I will not likely be selling into the current tender offer. That said, it is tempting to arb the tender offer by buying more stock at today’s price.

Disclaimer: Long. For entertainment purposes only. Not an offer or solicitation to buy any security. For entertainment purposes only.

I doubt it. It’s not having much, or any, impact on their numbers. Liquidity is the issue, which they should solve with a series of tender offers.

Thanks for the article. Do you think the Ryanair commentary is another reason it is cheap? Any thoughts on the commentary in their latest earnings call (go here and search edreams and ota and read the relevant 2 sections, https://app.tikr.com/stock/transcript?cid=413817&tid=2644123&e=1878602970&ts=3134871&ref=1ydie7)?